1977 Volkswagen Type 2 Campmobile on 2040-cars

Claremont, New Hampshire, United States

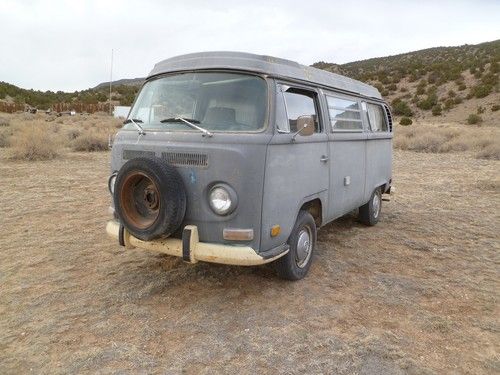

Body Type:Van

Vehicle Title:Clear

Engine:4 Cylinder

Fuel Type:Unleaded

For Sale By:Private Seller

Number of Cylinders: 4

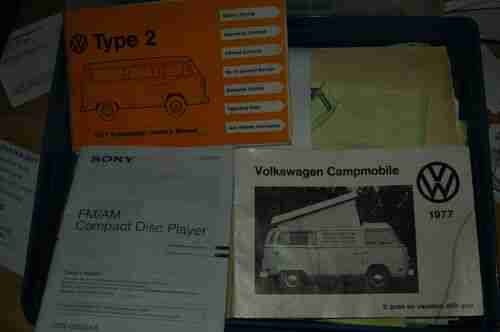

Make: Volkswagen

Model: Bus/Vanagon

Trim: Camper

Options: CD Player

Drive Type: Manual

Mileage: 3,156

Exterior Color: Green

Number of Doors: 3

Interior Color: Green

Warranty: None

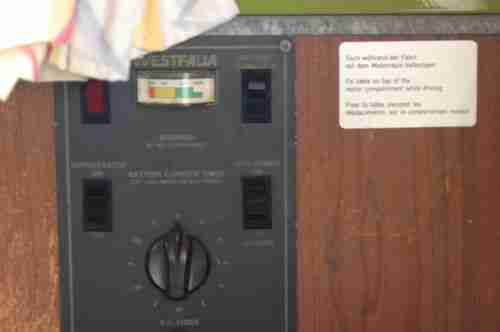

For sale a 1977 VW campmobile with a manual transmission.

Volkswagen Bus/Vanagon for Sale

Volkswagen vw bus/camper top condition-split window-1965 must have!!!

Volkswagen vw bus/camper top condition-split window-1965 must have!!! 1982 volkswagen vanagon camper (rare: powered by 1.6l diesel)

1982 volkswagen vanagon camper (rare: powered by 1.6l diesel) 4 speed fuel injected(US $2,500.00)

4 speed fuel injected(US $2,500.00) 1975 vw volkswagen westfalia camping machine with 2110cc and matching trailer!(US $25,000.00)

1975 vw volkswagen westfalia camping machine with 2110cc and matching trailer!(US $25,000.00) 1971 vw westfalia pop-top camper

1971 vw westfalia pop-top camper 1982 volkswagen vanagon l no engine good body

1982 volkswagen vanagon l no engine good body

Auto Services in New Hampshire

Vigeant`s Auto Sales ★★★★★

Tom`s Automotive ★★★★★

Tim`s Auto Repair ★★★★★

Pro Auto Ctr ★★★★★

New England Parts Warehouse ★★★★★

Mts-Associates ★★★★★

Auto blog

Volkswagen e-Co-Motion concept poised for delivery to Geneva

Sat, 02 Mar 2013With Nissan getting ready to launch the e-NV200, it appears Volkswagen is looking to go after the same zero-emission commercial vehicle market with the all-electric 2013 e-Co-Motion Concept. Debuting next week at the Geneva Motor Show, the e-Co-Motion Concept might be small in size, but VW says it has cargo and payload capacities that should be perfect for small businesses.

Measuring 179 inches long, 75 inches wide and 77 inches tall, the e-Co-Motion Concept has about the same footprint as the current Golf, and it has a cargo capacity of 162 cubic feet and a maximum payload of more than 1,700 pounds. There isn't too much information on the e-Co-Motion just yet - such as what electric components and platform are used - but the press release posted below states while the concept is shown as a cargo van, future body styles could include a passenger wagon or a refrigerated box van.

Import pickup truck-killing Chicken Tax to be repealed?

Tue, Jun 30 2015After over 50 years, the so-called Chicken Tax may finally be going the way of the dodo. Two pending trade deals with countries in the Pacific Rim and Europe potentially could open the US auto market up to imported trucks, if the measures pass. Although, it still might be a while before you can own that Volkswagen Amarok or Toyota Hilux, if ever. The 25-percent import tariff that the Chicken Tax imposes on foreign trucks essentially makes the things all but impossible to sell one profitably in the US, which lends a distinct advantage to domestic pickups. Both the Trans-Pacific Partnership with 12 counties and Transatlantic Trade and Investment Partnership with the European Union would finally end the charge. According to Automotive News though, don't expect new pickups to flood the market, at least not immediately. These deals might roll back the tariff gradually over time, and in the case of Japan, it could be as long as 25 years before fully free trade. Furthermore, Thailand, a major truck builder in Asia, isn't currently part of the deal, and any new models here would still need to meet safety and emissions rules, as well. Automotive News gauged the very early intentions of several automakers with foreign-built trucks, and they weren't necessarily champing at the bit to start imports. Toyota thinks the Hilux sits between the Tundra and Tacoma, and Mazda doesn't think the BT-50 fits its image here. Also, VW doesn't necessarily want to bring the Amarok over from Hannover. There is previous precedent for companies at least considering bringing in pickup trucks after the Chicken Tax's demise, though. The Pacific free trade deal could be done as soon as this fall, while the EU one is likely further out, according to Automotive News. Given enough time, the more accessible ports could allow some new trucks to enter the market.

VW's Winterkorn tells 20,000 staffers of big cost-cutting plans

Thu, 24 Jul 2014During a gathering of 20,000 Volkswagen Group employees at company headquarters in Wolfsburg, Germany on Wednesday, CEO Martin Winterkorn dropped a bombshell. The boss stated that the automaker isn't operating efficiently enough and admitted the company needs to radically start cutting back to raise its profit margins. To right the ship, Winterkorn has proposed killing off less profitable models and spending less on research and development.

According to Reuters, Winterkorn wants to raise the VW brand's profit margin from about 2.9 percent in 2013 to a target of 6 percent. To make that possible, his plan amounts to increasing cost cutting until Volkswagen reaches about 5 billion euros ($6.7 billion) per year to get things back in order. "Over the short-term, we urgently need more efficiency and higher profit," the CEO said during his speech, according to Reuters.

However, Winterkorn can't make these decisions unilaterally. Volkswagen's works council also has a seat on the supervisory board to represent laborers, and it isn't likely to take the proposed cuts sitting down.