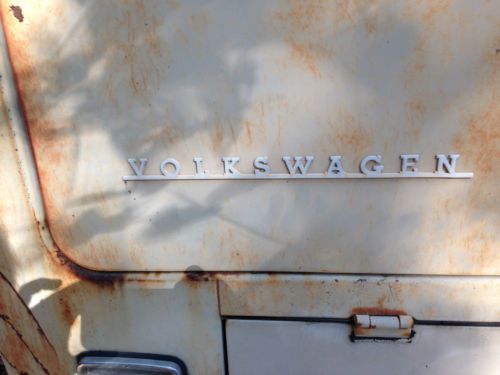

1970 Vw Volkswagen Sw Bus Van 'low Miles' on 2040-cars

San Marcos, Texas, United States

Body Type:Van

Engine:VW

Vehicle Title:Clear

Fuel Type:Gasoline

Used

Make: Volkswagen

Mileage: 45,833

Model: Bus/Vanagon

Exterior Color: White

Year: 1970

Trim: SW

Drive Type: VW

|

It was running when it was parked it 3 years ago. 45,833 miles showing on the odometer. The windows are all intact with no noticeable damage. This is a rare VW vehicle. Not many of them still out there. The title is clear and ready to transfer. Call me to make an Ebay sanctioned buy it now deal. 830 481 0003 Deposits are NOT refundable |

Volkswagen Bus/Vanagon for Sale

1971 volkswagen bus/vanagon deluxe

1971 volkswagen bus/vanagon deluxe 1978 vw bus transporter van(US $16,000.00)

1978 vw bus transporter van(US $16,000.00) 1965 volkswagen transporter - double door panel w/ pop top(US $22,500.00)

1965 volkswagen transporter - double door panel w/ pop top(US $22,500.00) 1980 volkswagen vanagon camper van adventurewagen westfalia hightop(US $15,000.00)

1980 volkswagen vanagon camper van adventurewagen westfalia hightop(US $15,000.00) 1966 split bus

1966 split bus 1967 volkswagen 13 window camper "split-window" in baja california, mexico.

1967 volkswagen 13 window camper "split-window" in baja california, mexico.

Auto Services in Texas

Zepco ★★★★★

Z Max Auto ★★★★★

Young`s Trailer Sales ★★★★★

Woodys Auto Repair ★★★★★

Window Magic ★★★★★

Wichita Alignment & Brake ★★★★★

Auto blog

Small 3-row crossover SUVs specifications compared on paper

Thu, May 10 2018There's no shortage of three-row vehicles on the market for carrying seven or more people and their stuff wherever they all need to go. Just about every car company has at least one large crossover or traditional SUV with three rows of seats, and there are still plenty of minivans to pick from. But most of these vehicles are large, pricey, and frequently thirsty. Fortunately, there are still a handful of smaller crossovers that deliver 7-passenger capability in a smaller, cheaper package. We've gathered four of the small three-row set here to compare them based on space, power, fuel economy, pricing, and more. They include the very old Dodge Journey, the slightly less old Mitsubishi Outlander and Kia Sorento, and the relatively new Volkswagen Tiguan. You can see the raw numbers in the chart below, followed by a more detailed breakdown and some notes on how we like each of these vehicles. For in-depth opinions on the vehicles, be sure to check out our full reviews, and if you want to compare these with other vehicles, try out our comparison tools. Engines, transmissions and performance Interestingly, three of the four crossovers here utilize similar engines for their four-cylinder offerings. The Dodge, Kia and Mitsubishi all feature naturally aspirated 2.4-liter four-cylinder engines. Only the Volkswagen Tiguan chooses turbocharging and a smaller 2.0-liter displacement. But because of its turbocharger, the Tiguan's four-cylinder is easily the most potent, making a healthy 221 pound-feet of torque, which is more than 40 more than the Sorento, the crossover with the next most torque. The VW is also second-most powerful, just one horse behind the Sorento. The Outlander is the least powerful in the four-cylinder class. The Journey is only barely better, but it will probably feel as slow or worse thanks to its ancient 4-speed automatic. The four-cylinder Sorento and Outlander each have 6-speed automatic transmissions, and the VW has an 8-speed. The Sorento with a V6 has an 8-speed, too. View 17 Photos Moving up to the V6 class, the Outlander is once again at the bottom. It actually makes less torque than the turbo VW Tiguan. The Journey and Sorento are almost perfectly matched. The Journey makes a bit more torque; the Sorento makes a bit more power. The Journey also gets upgraded to a 6-speed automatic. Another powertrain consideration to bare in mind is whether all-wheel-drive is necessary.

VW debuts Get Happy Super Bowl ad

Mon, 28 Jan 2013

Brace yourself for another tidal wave of Super Bowl commercials. Volkswagen has released its spot for this year's big game. Set to air during the second quarter, the Get Happy spot follows one jubilant office worker as he makes his way through the day, spreading joy wherever he goes. The source of his happiness? A Volkswagen Beetle, of course. Now, if you're wondering why a gaggle of white guys are running around on your screen with Jamaican accents, it will help to know the spot is part of a larger Get Happy campaign featuring Jimmy Cliff.

The first ad in the series featured the artist singing his rendition of "C'Mon, Get Happy," complete with a little help from some notorious unhappy YouTube stars. You can take a look at the new ad before it airs below, along with the complete press release for a little more background.

VW invests in QuantumScape for potentially fireproof, long-range EV batteries

Mon, Dec 8 2014VW might be getting ready to push its plug-in technology in a big way thanks to an investment in the battery startup QuantumScape. Key point: the solid-state battery is said to be fireproof and will offer tremendous range advantages. Details are not abundant yet, but according to Bloomberg, VW of America bought a five-percent stake in QuantumScape (and has an option to raise its holding). The tech could "more than triple" the EV range of VW, Porsche and Audi plug-in vehicles as soon as the middle of 2015, according to unnamed sources that Bloomberg talked to. Former Stanford University researchers started QuantumScape in 2010. The bare-bones QuantumScape website (there's nothing there other than some contact information) doesn't offer many hints about what's happening at the company, but GigaOM's Katie Fehrenbacher notes that QuantumScape is licensing tech from the "All Electron Battery" project at Stanford a few years ago. It certainly sounds amazing: [It's] a completely new class of electrical energy storage devices for electric vehicles that has the potential to provide ultra-high energy and power densities, while enabling extremely high cycle life. The All-Electron Battery stores energy by moving electrons, rather than ions, and uses electron/hole redox instead of capacitive polarization of a double-layer. ... If successful, this project will develop a completely new paradigm in energy storage for electrified vehicles that could revolutionize the electric vehicle industry. If that's what's coming in a future e-Golf or E-Tron, sign us up.