1970 Volkswagen Westfalia Bus on 2040-cars

United States

|

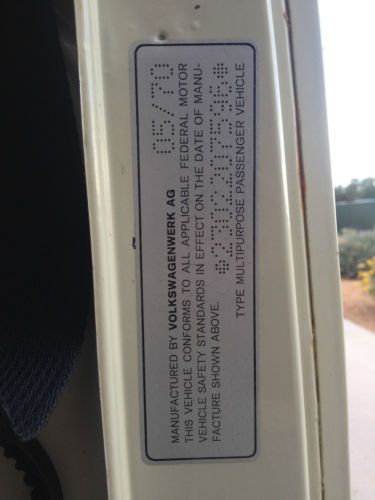

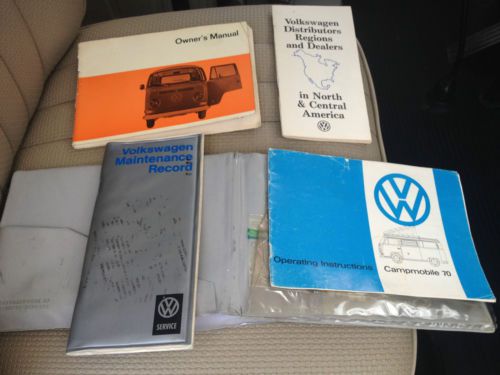

1970 VW Westfalia This is a 1970 Volkswagen Bus "Westfalia" Campmobile for sale. If you are looking for "the" bus to fully restore, this is the one! The interior is fantastic, runs great, and only minor body work needed. Since I have owned this beauty, I chose not to do anything to the exterior to keep it as original as possible. This bus could be used as a daily driver but I have always kept her in a garage and driven her when the weather was perfect. There is an upper cot (sleeps 1), fold out bed (sleeps 2) and child cot (sleeps 1-2, depending on the age of the children). Storage, Ice box, sink, table, and folding prep-table. Electrical hook up works great with 2 110v plugs on the interior. The only modification done by me was changing the muffler to a glass pack extractor (for some added horse power). I have the original muffler that will go with the bus as well. Tires are good and rides very smooth. Hoping to find a great home that will continue to care for and enjoy our "Bessy". Cheers! |

Volkswagen Bus/Vanagon for Sale

1988 volkswagen vanagon westfalia syncro diesel conversion(US $42,000.00)

1988 volkswagen vanagon westfalia syncro diesel conversion(US $42,000.00) 1970 vw westfalia original paint survivor, 2nd owner, patina time capsule(US $17,500.00)

1970 vw westfalia original paint survivor, 2nd owner, patina time capsule(US $17,500.00) Classic very rare 1971 vw double cab pickup up best year ever with 1600cc motor

Classic very rare 1971 vw double cab pickup up best year ever with 1600cc motor 1974 volkswagen bus/transporter (type ii). major upgrades; looks and runs great(US $10,500.00)

1974 volkswagen bus/transporter (type ii). major upgrades; looks and runs great(US $10,500.00) 1965 vw deluxe, 13 window, safari bus

1965 vw deluxe, 13 window, safari bus 1984 volkswagon transporter. classic van. drives well. many new parts. 7 seats

1984 volkswagon transporter. classic van. drives well. many new parts. 7 seats

Auto blog

Coronavirus prompts VW to stop production throughout Europe

Tue, Mar 17 2020FRANKFURT — Volkswagen Group, the world's biggest carmaker, is suspending production at factories across Europe as the coronavirus pandemic hits sales and disrupts supply chains, the company said on Tuesday. The German carmaker, which owns the Audi, Bentley, Bugatti, Ducati, Lamborghini, Porsche, Seat and Skoda brands, also said that uncertainty about the fallout from coronavirus meant it was impossible to give forecasts for its performance this year. "Given the present significant deterioration in the sales situation and the heightened uncertainty regarding parts supplies to our plants, production is to be suspended in the near future at factories operated by group brands," Chief Executive Herbert Diess said on Tuesday. Volkswagen's powerful works council concluded it was not possible for workers to maintain a safe distance from each other to prevent contagion and recommended a suspension of production at its factories from Friday. Production will be halted at VW's Spanish plants, in Setubal in Portugal, Bratislava in Slovakia and at the Lamborghini and Ducati plants in Italy before the end of this week, Diess said. Most of its other German and European factories will prepare to suspend production, probably for two to three weeks, while Audi said separately it would halt output at its plants in Belgium, Germany, Hungary and Mexico. Volkswagen's vast factories in Chattanooga, Tennessee, in Puebla, Mexico, and plants in Brazil were not affected, but that would depend on how the coronavirus spreads, VW said. Volkswagen has 124 production sites worldwide of which 72 are in Europe, with 28 in Germany alone. "2020 will be a very difficult year. The coronavirus pandemic presents us with unknown operational and financial challenges. At the same time, there are concerns about sustained economic impacts," Diess said. Â Production in China resumes Volkswagen Group sold 10.96 million vehicles last year, putting it ahead of Toyota based on the latest figures from the Japanese carmaker. Globally, VW employs 671,000 people and it delivered 4.86 million vehicles to European customers in 2019. Only last month the car and truck maker based in Wolfsburg, Germany, predicted that vehicle deliveries this year would match 2019 sales and forecast an operating return on sales in the range of 6.5% to 7.5%. "The spread of coronavirus is currently impacting the global economy. It is uncertain how severely or for how long this will also affect the Volkswagen Group.

Volkswagen sketches Geneva-bound concept

Wed, Feb 25 2015Volkswagen has released a pair of sketches that give us our first official glimpse at the company's new concept car, set to debut at the Geneva Motor Show next week. Details are slim – the car doesn't even have a name yet – but we do have some facts about VW's swoopy new showcar. First off, it's a sedan – well, "four-door coupe" – but is said to have a hatchback configuration. Autoblog has also learned that the car will be powered by a hybrid powertrain, using a TSI gasoline engine paired with two electric motors, and uses an all-wheel-drive configuration that's likely similar to that in the recently unveiled Cross Coupe GTE concept. Volkswagen says this showcar uses a new, progressive design language for the brand. And while it sort of looks like a dead ringer for a new CC, we're told this concept is positioned above that model. For now, that's all we know, but we expect a host of other details to be released closer to the car's official debut in Geneva next week. Stay tuned. Related Gallery Volkswagen Geneva Showcar Sketches News Source: Volkswagen Design/Style Green Geneva Motor Show Volkswagen Concept Cars Hybrid Sedan 2015 Geneva Motor Show

Here are a few of our automotive guilty pleasures

Tue, Jun 23 2020It goes without saying, but I'll say it anyway. The world is full of cars, and just about as many of them are bad as are good. It's pretty easy to pick which fall into each category after giving them a thorough walkaround and, more important, driving them. But every once in a while, an automobile straddles the line somehow between good and bad — it may be hideously overpriced and therefore a marketplace failure, it may be stupid quick in a straight line but handles like a drunken noodle, or it may have an interior that looks like it was made of a mess of injection-molded Legos. Heck, maybe all three. Yet there's something special about some bad cars that actually makes them likable. The idea for this list came to me while I was browsing classified ads for cars within a few hundred miles of my house. I ran across a few oddballs and shared them with the rest of the team in our online chat room. It turns out several of us have a few automotive guilty pleasures that we're willing to admit to. We'll call a few of 'em out here. Feel free to share some of your own in the comments below. Dodge Neon SRT4 and Caliber SRT4: The Neon was a passably good and plucky little city car when it debuted for the 1995 model year. The Caliber, which replaced the aging Neon and sought to replace its friendly marketing campaign with something more sinister, was panned from the very outset for its cheap interior furnishings, but at least offered some decent utility with its hatchback shape. What the two little front-wheel-drive Dodge models have in common are their rip-roarin' SRT variants, each powered by turbocharged 2.4-liter four-cylinder engines. Known for their propensity to light up their front tires under hard acceleration, the duo were legitimately quick and fun to drive with a fantastic turbo whoosh that called to mind the early days of turbo technology. — Consumer Editor Jeremy Korzeniewski Chevrolet HHR SS: Chevy's HHR SS came out early in my automotive journalism career, and I have fond memories of the press launch (and having dinner with Bob Lutz) that included plenty of tire-smoking hard launches and demonstrations of the manual transmission's no-lift shift feature. The 260-horsepower turbocharged four-cylinder was and still is a spunky little engine that makes the retro-inspired HHR a fun little hot rod that works quite well as a fun little daily driver.