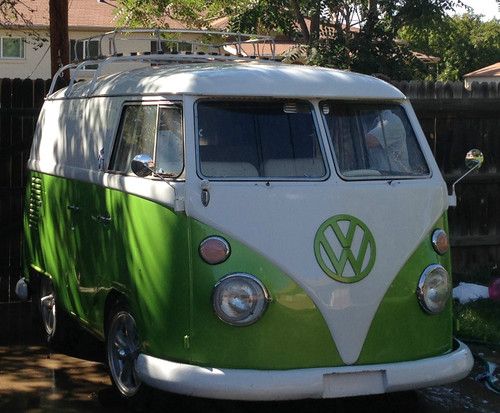

1965 Volkswagen Custom Shortened Body Bus Safari Window Windshield Lime Green on 2040-cars

Denver, Colorado, United States

Engine:Original

Vehicle Title:Clear

For Sale By:Private Seller

Mileage: 156,293

Make: Volkswagen

Exterior Color: Green

Model: Bus/Vanagon

Interior Color: White & Green

Trim: White

Drive Type: rear

Volkswagen Bus/Vanagon for Sale

1978 champagne edition westfalia camper(US $5,000.00)

1978 champagne edition westfalia camper(US $5,000.00) 1971 vw bus(US $5,850.00)

1971 vw bus(US $5,850.00) Vw syncro single cab pickup ,very rare(US $11,000.00)

Vw syncro single cab pickup ,very rare(US $11,000.00) Syncro(US $12,500.00)

Syncro(US $12,500.00) *** 3 owner 1973 vw campmobile "riviera" only 61,150 original miles ***

*** 3 owner 1973 vw campmobile "riviera" only 61,150 original miles *** 1991 volkswagen vanagon gl 2.1l(US $5,300.00)

1991 volkswagen vanagon gl 2.1l(US $5,300.00)

Auto Services in Colorado

Tight Curves LTD ★★★★★

TheDingGuy.com ★★★★★

Select Auto Brokers ★★★★★

Ramsey Auto Body Inc ★★★★★

Precision Auto Glass ★★★★★

Northglenn Auto Body ★★★★★

Auto blog

Peugeot will prove it doesn't offer cheater diesels

Thu, Oct 29 2015Our diesels are clean, really. That's the message from French automaker PSA/Peugeot-Citroen as it plans to go on the offensive in response to Volkswagen's diesel-emissions scandal. PSA will go out of its way to prove its diesels are as clean as advertised. The company is looking at disclosing "real-world" fuel-economy statistics as soon as next spring and will use an independent entity to vet the numbers, Automotive News Europe says, citing comments that PSA/Peugeot-Citroen financial chief Jean-Baptiste de Chatillon made to reporters this week. Such efforts may be vital, since roughly two-thirds of the vehicles Peugeot-Citroen sells in Europe are powered by a diesel engine. Last month, VW admitted that as many as 11 million of its diesel-powered vehicles were programmed with software designed to cheat emissions-testing systems. The news shook up the industry, especially companies that sell a good chunk of diesels. The EU itself may start instituting "real world" fuel-economy and emissions testing as soon as 2017. French regulators have said they may eliminate diesel-fuel subsidies that currently make diesel fuel cheaper to customers than gas. That adjustment may occur as soon as next year, since it's been pushed up in response to the VW scandal. Peugeot-Citron continues to reiterate that it has never installed software that was designed to cheat emissions-testing systems. Additionally, the automaker was more than a decade ahead of European Union mandates for engine components designed to cut soot emissions, so the company is hoping its track record makes a difference. It wants to be perfectly clear about that. News Source: Automotive News Europe-sub.req.Image Credit: Cletus Awreetus/Flickr Green Volkswagen Citroen Peugeot Diesel Vehicles vw diesel scandal France psa peugeot citroen

Porsche board members facing another ˆ1.8B lawsuit over VW takeover bid

Mon, 03 Feb 2014Back in 2008, Porsche got the bright idea that it could take over Volkswagen in the midst of the worst economic slump since the Great Depression. Ignoring that this was a catastrophic move for the Stuttgart sports car manufacturer that that eventually resulted in it nearly going bankrupt and eventually being taken over by the same company it sought to control, the aftermath has left Porsche Chairman Wolfgang Porsche and board member Ferdinand Piëch in the crosshairs of seven hedge funds that lost out during the takeover and are now seeking €1.8 billion - $2.43 billion US - in damages from the two execs, according to the BBC.

See, investors bet on Volkswagen's share price going down, partially because Porsche said it wasn't going to attempt a takeover. But Porsche was attempting to take over VW, having bought up nearly 75-percent of VW's publicly traded shares. When word broke that Porsche owned nearly three-quarters of VW (which indicated an imminent takeover attempt), rather than go down like the hedge funds bet it would, VW's share price skyrocketed to over 1,000 euros per share, according to Reuters.

Naturally, when you bet that a company's share price is going to drop and it in turn (temporarily) becomes the world's most valuable company, you lose a lot of money, unless you're able to buy up shares before prices jump too much. This led to a squeeze on the stock, which the hedge funds accuse Porsche and Piëch (who are both members of the Porsche family and supervisory board) of organizing.

$1.4B hedge fund suit against Porsche dismissed

Wed, 19 Mar 2014Investors have canvassed courts in Europe and the US to repeatedly sue Porsche over its failed attempt to take over Volkswagen in 2008 (see here, and here and here), and they have repeatedly failed to win any cases. You can add another big loss to the tally, with Bloomberg reporting that the Stuttgart Regional Court has dismissed a 1.4-billion euro ($1.95B US) lawsuit, the decision explained by the court's assertion that the investors would have lost on their short bets even if Porsche hadn't misled them.

Examining the hedge funds' motives for stock purchases and the bets that VW share prices would fall, judge Carola Wittig said that the funds didn't base their decisions on the key bits of "misinformation," and instead were participating simply in "highly speculative and naked short selling," only to get caught out.

With other cases still pending, the continued streak of victories bodes well for Porsche's courtroom fortunes, since judges will expect new information to consider overturning precedent. If there is any new info, it could come from the potential criminal cases still outstanding against former CEO Wendelin Wiedeking and CFO Holger Härter, who were both indicted on charges of market manipulation.