1960 23 Windown Bus Double Doors. Project on 2040-cars

Bellflower, California, United States

Body Type:BUS

Engine:4CYLINDER.NOT INCLUDED/no engine

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: N/A

Make: Volkswagen

Number of Cylinders: N/A

Model: Bus/Vanagon

Trim: DELUX

Drive Type: 4 SPEED

Options: Sunroof

Mileage: 0

Sub Model: DELUX MODEL. W/DOUBLE DOORS

Exterior Color: N/A

Disability Equipped: No

Volkswagen Bus/Vanagon for Sale

1964 vw 11 window bus for parts or thorough resto

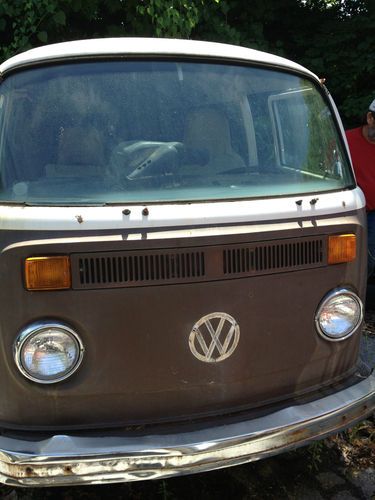

1964 vw 11 window bus for parts or thorough resto Lowered 1970 bay window vw bus(US $10,000.00)

Lowered 1970 bay window vw bus(US $10,000.00) 1977 volkswagen van / vanagon(US $1,999.00)

1977 volkswagen van / vanagon(US $1,999.00) 1984 volkswagen westfalia camper van - vw vanagon road trip machine!

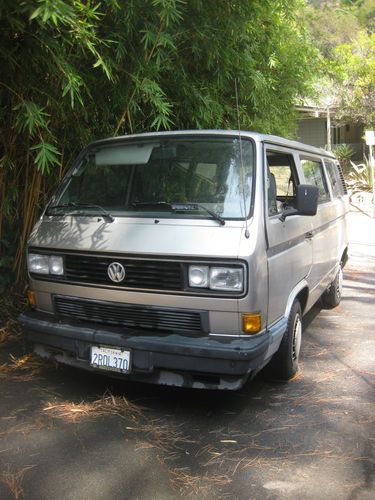

1984 volkswagen westfalia camper van - vw vanagon road trip machine! 1989 volkswagen vanagon gl standard passenger van 3-door 2.1l

1989 volkswagen vanagon gl standard passenger van 3-door 2.1l Vw transporter good condition for age, all original, 3 door, wing windows(US $10,000.00)

Vw transporter good condition for age, all original, 3 door, wing windows(US $10,000.00)

Auto Services in California

Windshield Repair Pro ★★★★★

Willow Springs Co. ★★★★★

Williams Glass ★★★★★

Wild Rose Motors Ltd. ★★★★★

Wheatland Smog & Repair ★★★★★

West Valley Smog ★★★★★

Auto blog

Recharge Wrap-up: Mercedes gets F1 efficiency, EV charging in Vermont, VW e-Golf to use Bosch

Mon, Jul 14 2014Efficiency equals performance, especially in the case of Formula 1 racing. The Mercedes AMC Petronas team points to several key efficiency technologies it uses to get the most out of its cars. And if their utter dominance so far this season is testament to this relationship, perhaps we should pay attention. Mercedes highlights hybrid tech, turbocharging, aerodynamics, lightweight construction, tribology (both in making internal components and lubricants more slippery) and simulation as crucial to getting around the track faster than anyone else. These just happen to be some of the same things that make the cars we drive on public roads more fuel-efficient. Learn more in the press release below. It's a good read. Brammo, maker of sweet electric motorcycles, is teaming up with TEAM Industries to make drivetrains for electric vehicles. TEAM, which specializes in drivetrain technology, will also become an investor in Brammo as part of the partnership. "The electric vehicle market is a growth market," says TEAM CEO and President David Ricke, "and TEAM and Brammo will be providing a wide range of solutions for OEM manufacturers." Read more over at EV World. Vermont celebrated the installation of a new EV charging station as part of a Green Energy Corridor between Boston and Montreal. When finished, drivers will be able to make the whole trip in an EV with access to charging along the way. For $5, customers can charge their vehicle in about 30 minutes at the Red Hen Baking Company in Middlesex. There are currently only about 700 EVs on the road in Vermont. The state has a goal to get 90 percent of its energy from renewable sources by 2050, and getting more EVs on the road is crucial to that mission. Vermont hopes that expanding the charging infrastructure will convince more people to go electric. Read more at Vermont Public Radio's website. For it's new e-Golf, Volkswagen will use Bosch chargers for home installation and ChargePoint stations at its dealerships. Bosch will have various 240-volt options for the home, and will also provide installation. e-Golf customers will also get a free ChargePoint membership, and will have access to the company's network of charging stations worldwide. The 2015 e-Golf goes on sale in the US later this year. Read more in the press release below. Synergies between F1 and Road Car Development: Efficiency equals performance In Formula 1 Racing, performance is everything.

A car writer's year in new vehicles [w/video]

Thu, Dec 18 2014Christmas is only a week away. The New Year is just around the corner. As 2014 draws to a close, I'm not the only one taking stock of the year that's we're almost shut of. Depending on who you are or what you do, the end of the year can bring to mind tax bills, school semesters or scheduling dental appointments. For me, for the last eight or nine years, at least a small part of this transitory time is occupied with recalling the cars I've driven over the preceding 12 months. Since I started writing about and reviewing cars in 2006, I've done an uneven job of tracking every vehicle I've been in, each year. Last year I made a resolution to be better about it, and the result is a spreadsheet with model names, dates, notes and some basic facts and figures. Armed with this basic data and a yen for year-end stories, I figured it would be interesting to parse the figures and quantify my year in cars in a way I'd never done before. The results are, well, they're a little bizarre, honestly. And I think they'll affect how I approach this gig in 2015. {C} My tally for the year is 68 cars, as of this writing. Before the calendar flips to 2015 it'll be as high as 73. Let me give you a tiny bit of background about how automotive journalists typically get cars to test. There are basically two pools of vehicles I drive on a regular basis: media fleet vehicles and those available on "first drive" programs. The latter group is pretty self-explanatory. Journalists are gathered in one location (sometimes local, sometimes far-flung) with a new model(s), there's usually a day of driving, then we report back to you with our impressions. Media fleet vehicles are different. These are distributed to publications and individual journalists far and wide, and the test period goes from a few days to a week or more. Whereas first drives almost always result in a piece of review content, fleet loans only sometimes do. Other times they serve to give context about brands, segments, technology and the like, to editors and writers. So, adding up the loans I've had out of the press fleet and things I've driven at events, my tally for the year is 68 cars, as of this writing. Before the calendar flips to 2015, it'll be as high as 73. At one of the buff books like Car and Driver or Motor Trend, reviewers might rotate through five cars a week, or more. I know that number sounds high, but as best I can tell, it's pretty average for the full-time professionals in this business.

Volkswagen shows off performance-ish Passat concept

Mon, 14 Jan 2013As part of its 2013 Detroit Auto Show debut package, Volkswagen has rolled out a sportier version of the Passat sedan, though it's strictly conceptual for now. A small dose of go-fast visuals have been added to the handsome Volkswagen, including 19-inch wheels, carbon-capped mirrors, an advanced front lighting system, LED taillamps and dual exhaust. Some carbon bits and upgraded leather are found inside the cabin, as well.

But the real performance chops come in the form of a 1.8-liter turbocharged four-cylinder engine that sends 250 horsepower to the Passat's front wheels via a six-speed automatic transmission. That's a good boost in power over the 170 hp of the base 2.5-liter inline-five, but not quite as potent as the 3.6-liter VR6. A lowered sport suspension and revised electronic steering are also on hand, making things slightly more involving out on the road... we assume.

It's not quite the performance concept we were hoping for, but a more enthusiastic Passat isn't necessarily a bad thing. Scroll down for the press release.