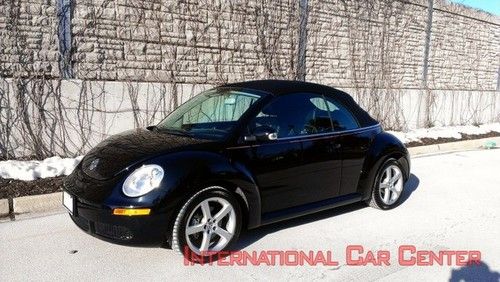

Volkswagen Beetle Salvage Repairable Rebuildable Lawaway Plan Available On All on 2040-cars

Cocoa, Florida, United States

Vehicle Title:Salvage

Engine:2.5L 2480CC 151Cu. In. l5 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Hatchback

Fuel Type:GAS

Make: Volkswagen

Warranty: Unspecified

Model: Beetle

Trim: S Hatchback 2-Door

Options: CD Player

Power Options: Power Locks

Drive Type: FWD

Mileage: 64,000

Number of Doors: 2

Sub Model: 2dr Man S

Exterior Color: Silver

Number of Cylinders: 5

Interior Color: Gray

Volkswagen Beetle-New for Sale

2000 volkswagen beetle gls 5 speed only 68,000 miles well maintained we finance

2000 volkswagen beetle gls 5 speed only 68,000 miles well maintained we finance Navigation chrome wheels auto 2.5l leather htd seats 2012 volkswagen beetle 12k(US $18,900.00)

Navigation chrome wheels auto 2.5l leather htd seats 2012 volkswagen beetle 12k(US $18,900.00) 2008 volkswagen beetle triple white w3 auto sunroof 47k texas direct auto(US $14,780.00)

2008 volkswagen beetle triple white w3 auto sunroof 47k texas direct auto(US $14,780.00) Nice - power top - couture - heated leather - sporty wheels - low miles(US $16,490.00)

Nice - power top - couture - heated leather - sporty wheels - low miles(US $16,490.00) 1999 volkswagen beetle gls hatchback 2-door 2.0l(US $1,500.00)

1999 volkswagen beetle gls hatchback 2-door 2.0l(US $1,500.00) 08 leather heated seats mp3 cpo certified pre owned warranty(US $12,995.00)

08 leather heated seats mp3 cpo certified pre owned warranty(US $12,995.00)

Auto Services in Florida

Workman Service Center ★★★★★

Wolf Towing Corp. ★★★★★

Wilcox & Son Automotive, LLC ★★★★★

Wheaton`s Service Center ★★★★★

Used Car Super Market ★★★★★

USA Auto Glass ★★★★★

Auto blog

Autoblog's Editors' Picks: Our complete list of the best new vehicles

Mon, May 13 2024It's not easy to earn an “EditorsÂ’ Picks” at Autoblog as part of the rating and review process that every new vehicle goes through. Our editors have been at it a long time, which means weÂ’ve driven and reviewed virtually every new car you can go buy on the dealer lot. There are disagreements, of course, and all vehicles have their strengths and weaknesses, but this list features what we think are the best new vehicles chosen by Autoblog editors. We started this formal review process back in 2018, so there's quite of few of them now. So what does it mean to be an EditorsÂ’ Pick? In short, it means itÂ’s a car that we can highly recommend purchasing. There may be one, multiple, or even zero vehicles in any given segment that we give the green light to. What really matters is that itÂ’s a vehicle that weÂ’d tell a friend or family member to go buy if theyÂ’re considering it, because itÂ’s a very good car. The best way to use this list is is with the navigation links below. Click on a segment, and you'll quickly arrive at the top rated pickup truck or SUV, for example. Use the back button to return to these links and search in another segment, like sedans. If youÂ’ve been keeping up with our monthly series of the latest vehicles to earn EditorsÂ’ Pick status, youÂ’re likely going to be familiar with this list already. If not, welcome to the complete list that weÂ’ll be keeping updated as vehicles enter (and others perhaps exit) the good graces of our editorial team. We rate a new car — giving it a numerical score out of 10 — every time thereÂ’s a significant refresh or if it happens to be an all-new model. Any given vehicle may be impressive on a first drive, but we wait until itÂ’s in the hands of our editors to put it through the same type of testing as every other vehicle that rolls through our test fleet before giving it the EditorsÂ’ Pick badge. This ensures consistency and allows more voices to be heard on each individual model. And just so you donÂ’t think weÂ’ve skipped trims or variants of a model, we hand out the EditorsÂ’ Pick based on the overarching model to keep things consistent. So, when you read that the 3 Series is an EditorsÂ’ Pick, yes, that includes the 330i to the M3 and all the variants in between. If thereÂ’s a particular version of that car we vehemently disagree with, we make sure to call that out.

Volkswagen sketches Geneva-bound concept

Wed, Feb 25 2015Volkswagen has released a pair of sketches that give us our first official glimpse at the company's new concept car, set to debut at the Geneva Motor Show next week. Details are slim – the car doesn't even have a name yet – but we do have some facts about VW's swoopy new showcar. First off, it's a sedan – well, "four-door coupe" – but is said to have a hatchback configuration. Autoblog has also learned that the car will be powered by a hybrid powertrain, using a TSI gasoline engine paired with two electric motors, and uses an all-wheel-drive configuration that's likely similar to that in the recently unveiled Cross Coupe GTE concept. Volkswagen says this showcar uses a new, progressive design language for the brand. And while it sort of looks like a dead ringer for a new CC, we're told this concept is positioned above that model. For now, that's all we know, but we expect a host of other details to be released closer to the car's official debut in Geneva next week. Stay tuned. Related Gallery Volkswagen Geneva Showcar Sketches News Source: Volkswagen Design/Style Green Geneva Motor Show Volkswagen Concept Cars Hybrid Sedan 2015 Geneva Motor Show

Volkswagen Beetle special edition concepts hit NY [w/poll]

Wed, Apr 1 2015Buying a retro hatchback or convertible like a VW Beetle is nothing if not a fashion statement, and nobody knows that better than Volkswagen itself. Which is likely why the German automaker is bringing four concept versions of the Bug to the New York Auto Show this year. Most intriguing of the quartet – to our eyes at least – is the Beetle R-Line concept, which takes a more performance-oriented approach. It's got 20-inch alloys riding on a wider track, an aero pack including a rear diffuser and spoiler, and black trim that looks great in contrast to the white pearl finish. The interior has been upgraded, as well, with sport buckets, carbon trim and yellow details, and the concept is powered by the 2.0-liter TSI engine with 217 horsepower. The R-Line concept won't be taking the stage alone, however, joined as it will be by the magenta-sprayed Pink Color Edition hatch, the beach-themed Wave and jeans-wearing Denim edition convertibles. Though all are billed strictly as showcars for the time being, VW admits it will be gauging public reaction to all four to determine potentially putting them into production for public consumption. So, that in mind, have a look at all the concepts in the gallery above, and tell us which one you like best in the poll below. VOLKSWAGEN AT THE 2015 NEW YORK INTERNATIONAL AUTO SHOW - Four Beetle Special Edition concepts introduced: Beetle Convertible Denim, Beetle R-Line, Beetle Convertible Surfer, and Beetle Pink Color Edition - All-wheel-drive Golf SportWagen Alltrack announced for production in 2016 - Volkswagen celebrates 60 years of Beetle heritage New York, New York - Volkswagen of America, Inc., today announced that it will produce the all-wheel-drive Golf SportWagen Alltrack for the U.S. market beginning in 2016, and showed four unique Beetle and Beetle Convertible models that help to commemorate Volkswagen of America's 60th anniversary. Golf SportWagen Alltrack Coinciding with the arrival of the all-new Golf SportWagen, currently available in dealer showrooms, Volkswagen is pleased to announce that the all-wheel-drive Alltrack model will go on sale in 2016 as a 2017 model. "We have heard from dealers and customers that they want to see a Golf SportWagen with the all-terrain capability that comes from all-wheel drive," said Michael Horn, President and CEO of Volkswagen Group of America, Inc.