2009 Volkswagen New Beetle Convertible 2dr Auto Blush on 2040-cars

Irving, Texas, United States

Vehicle Title:Clear

Vehicle Inspection: Vehicle has been Inspected

Make: Volkswagen

CapType: <NONE>

Model: Beetle-New

FuelType: Gasoline

Mileage: 35,786

Listing Type: Certified Pre-Owned

Sub Model: Auto Blush

Certification: Manufacturer

Exterior Color: Silver

BodyType: Coupe

Warranty: Unspecified

Cylinders: 5 - Cyl.

DriveTrain: FRONT WHEEL DRIVE

Volkswagen Beetle-New for Sale

2003 volkswagon beetle runs 100% 5speed

2003 volkswagon beetle runs 100% 5speed Accident free non smoker 2 owner carfax no reserve great on gas reliable clean

Accident free non smoker 2 owner carfax no reserve great on gas reliable clean 2003 volkswagen beetle gls tdi happiest beetle on the road

2003 volkswagen beetle gls tdi happiest beetle on the road 2004 vw beetle,2.0 gls,no rust fla. ultimate tanning machine,low miles,roadster

2004 vw beetle,2.0 gls,no rust fla. ultimate tanning machine,low miles,roadster 2002 volkswagen new beetle sport **5 speed, leather, loaded!!(US $6,495.00)

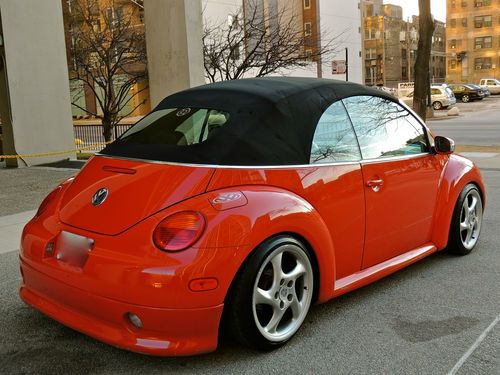

2002 volkswagen new beetle sport **5 speed, leather, loaded!!(US $6,495.00) 2003 vw bettle convertible w/ porsche wheels staggered

2003 vw bettle convertible w/ porsche wheels staggered

Auto Services in Texas

Woodway Car Center ★★★★★

Woods Paint & Body ★★★★★

Wilson Paint & Body Shop ★★★★★

WHITAKERS Auto Body & Paint ★★★★★

Westerly Tire & Automotive Inc ★★★★★

VIP Engine Installation ★★★★★

Auto blog

Cars with the most reckless drivers are full of surprises

Wed, Oct 13 2021Insurify is a site for comparing auto insurance quotes. Because insurance shoppers need to submit information like the vehicles they're driving and the infractions they've compiled while driving those vehicles, Insurify has quite the database of correlations tying certain models to a habit of breaking certain laws. When the site's data analysts decided to compile a list of the top ten models for reckless driving citations in the decade from 2010 to 2019, the ranking contained a few wild entries. The Dodge Challenger making the countdown will surprise precisely zero people. But the Saturn L200? First, a definition: USLegal.com defines reckless driving as "driving with a willful or wanton disregard for safety. It is the operation of an automobile under such circumstances and in such a manner as to show a willful or reckless disregard of consequences." So this list is a caution about particular drivers more than the cars. For a baseline, according to Insurify data, for any random model, 15 out of 10,000 people who drive that model have picked up one citation for reckless driving. Back to that Challenger, then. No shocker for being here, but it's actually number 10, with 44 out of 10,000 Challenger drivers nabbed for a willful disregard of consequences on the road. That's better than the first surprise entry, the Saturn L200, a sedan only on sale for six years, with the least horsepower on the list, and out of production since 2005. The data set put drivers of GM's extraterrestrial sedan at 45 reckless pilots per 10,000 drivers. There are two pickups on the list, the only modern one being the Ram 1500 at eighth, with a rate of 46 in 10,000. Somehow, drivers of the third-best-selling pickup in the U.S. outrun the overwhelming numerical superiority of the best-selling vehicle in the States, the Ford F-150. The other pickup is the Chevrolet K1500 at number five, with a rate of 56 in 10,000. This is not only the oldest vehicle on the list, it went out of production in 2002, before any other vehicle on the list. Between the trucks, the Volkswagen CC slotted in at seven with 47 in 10,000 reckless driving chits, the Cadillac ATS slipped into sixth with 48 in 10,000. The top four is a bag of unexpected. The Nissan 370Z is the first hardcore sports car on the list at number four, with 61 in 10,000 Z drivers flaunting their Fairladys in the face of Johnny Law.

Volkswagen Golf voted 2013 European Car of the Year

Tue, 05 Mar 2013The seventh-generation Volkswagen Golf just went on sale in Europe, but it is already off to a promising start. Announced as the Geneva Motor Show kicked off, the newest Golf was named European Car of the Year for 2013 in dominating style over cars like the Subaru BRZ/Toyota GT86 twins, Volvo V40, Ford B-Max and Mercedes-Benz A-Class.

According to Automotive News Europe, the MkVII Golf won handily over its rivals with a total of 414 votes. The Subaru BRZ and Toyota GT86 received 202 votes finishing in a distant second, while the Volvo V40 (189 votes), Ford B-Max (148 votes) and Mercedes-Benz A-Class (138 votes) round out the top five. The new Golf marks the third Volkswagen product to receive the prestigious award with previous cars including the MkIII Golf and the most recent iteration of the Polo.

2018 Buick Regal TourX vs. wagon competitors: How it compares on paper

Wed, Jan 31 2018To the great joy of auto enthusiasts nationwide, wagons are back! Well, at least there's a few more of them. The latest is the 2018 Buick Regal TourX, which we just had our first drive of and found to actually be quite good with pleasant handling, solid power and plenty of space. But, how does the TourX compare to other cladded wagons? Well, let's dive into the specs and fire up the ol' spreadsheet maker for Buick Regal TourX vs Subaru Outback vs Audi A4 Allroad vs VW Alltrack vs Volvo V60 Cross Country. True, some are from mainstream brands and others are from luxury marques, but Buick straddles both realms, so it's appropriate to look at them all. Of course, there's more to these cars than just the numbers, but they're still important, and in the case of this class of crossover-aping wagons, can vary more than you'd expect. So check out the specs in the chart below, which are followed by more analysis and photos of each. Discover and compare other wagons and crossovers with our Car Finder and Compare tools. Engines and Transmissions When comparing powertrains, the Buick is far-and-away the winner as far as torque is concerned, and is in a nearly three-way tie for horsepower. Its 295 pound-feet of torque is 22 lb-ft more twist than the next-most-grunty Audi A4 Allroad. And in regards to power, the Buick's 250-horsepower engine is only down 6 hp to the most-powerful Subaru and its optional naturally aspirated flat-six, and just 2 hp less than the Audi. At the bottom of the pack is the Subaru Outback with the standard naturally aspirated flat-four, which only makes 174 hp and 174 lb-ft of torque. That may not seem too bad compared with the VW Golf Alltrack, which only makes 170 hp and 199 lb-ft of torque, but the VW is much lighter by between 200 and 300 pounds. Transmission-wise, there's quite a bit of variation in the group. The Regal TourX and the Volvo V60 Cross Country rely on eight-speed automatics, all Outbacks use CVTs, and the Alltrack and Allroad have dual-clutch automated manual transmissions with six and seven gears, respectively. But for people that want to shift for themselves, the only option is the Volkswagen, which offers a traditional six-speed manual transmission on the Golf Alltrack. Cargo and Interior Space One of the main reasons to buy a wagon is for the body style's large cargo capacity. And for the most space for things and stuff, you'll want to check out the Subaru and the Buick.