2000 Volkswagen New Beetle Glx on 2040-cars

Newton, New Jersey, United States

For Sale By:Dealer

Engine:1.8L 1781CC l4 GAS DOHC Turbocharged

Body Type:Hatchback

Transmission:Automatic

Fuel Type:GAS

Make: Volkswagen

Model: Beetle

Disability Equipped: No

Trim: GLX Hatchback 2-Door

Doors: 2

Drive Train: Front Wheel Drive

Drive Type: FWD

Number of Doors: 2

Mileage: 0

Sub Model: GLX

Number of Cylinders: 4

Volkswagen Beetle-New for Sale

Volkswagen beetle coupe

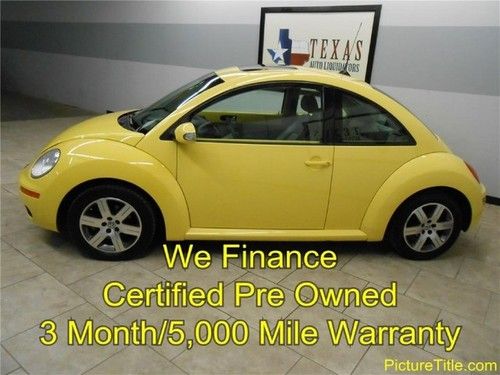

Volkswagen beetle coupe 2008 new model,vw beetle, conv, exc. low miles-warranity,black interior, sharp!!(US $17,700.00)

2008 new model,vw beetle, conv, exc. low miles-warranity,black interior, sharp!!(US $17,700.00) 2000 volkswagen beetle gls hatchback 2-door 2.0l blacked out new parts installed(US $5,500.00)

2000 volkswagen beetle gls hatchback 2-door 2.0l blacked out new parts installed(US $5,500.00) 2005 volkswagen beetle gls auto sunroof cruise ctrl 49k texas direct auto(US $10,780.00)

2005 volkswagen beetle gls auto sunroof cruise ctrl 49k texas direct auto(US $10,780.00) 2012 volkswagen beetle turbo nav. fender leather rebuildable salvage 2k miles(US $11,200.00)

2012 volkswagen beetle turbo nav. fender leather rebuildable salvage 2k miles(US $11,200.00) 06 tdi gls diesel auto leather sunroof heated seats prius hybrid(US $9,995.00)

06 tdi gls diesel auto leather sunroof heated seats prius hybrid(US $9,995.00)

Auto Services in New Jersey

Wales Auto Body Repair Shop ★★★★★

Virgo Auto Body ★★★★★

VIP Car Care Center Inc. ★★★★★

Vince Capcino`s Transmissions ★★★★★

Usa Exporting ★★★★★

Universal Auto Repair, Inc ★★★★★

Auto blog

Recharge Wrap-up: Arcimoto SRK video, BAIC EV at CES

Tue, Jan 12 2016Kelley Blue Book took a spin in the Arcimoto SRK three-wheeled EV at CES in Las Vegas. In the video above, KBB Managing Editor Micah Muzio gets behind the handlebars for a spin around an empty parking lot. He notes a gradual throttle tip-in, though from the video, it appears the trike has a bit of pep. While the hydraulic brake pedal requires a bit of extra effort, the regenerative brake lever located on the right handlebar is effective and easy to use. The steering is a little heavy, but manageable, at low speeds. He calls it "kind of a fun little conveyance," adding, "Maybe this is the future." See the full review in the video above. CARB Chairman Mary Nichols spoke with German television about Volkswagen's emissions scandal. In a photo she posted on Twitter, Nichols can be seen in front of cameras with CARB's test bay in the background. In the bay is a Volkswagen Jetta TDI. She says in her tweet, "Discussing VW cheating case w/German TV in front of ARB lab test bay & '07 diesel Jetta. Time to move on to #EVs!" Late last year, a group of environmentalists and Silicon Valley leaders Ė Elon Musk included ¬Ė sent Nichols an open letter suggesting CARB help urge Volkswagen to give up on diesels and focus on electric vehicles. See Nichols's post on Twitter. South Korea's most popular EV is the Renault Samsung Motors (RSM) SM3 ZE (also known as the Renault Fluence ZE). The all-electric vehicle has sold 1,767 units since its arrival in Korea since November 2013, with 2015 sales reaching 1,043 units. This makes one in three EVs in Korea a RSM SM3 ZE. The car has been selected as Korea's official government vehicle, and RSM has supplied over 100 EV taxis, 60 of which are in Seoul. Read more in the press release from Renault. BAIC EV announced it has established an R&D center in Detroit at CES. It will work with its other centers in Silicon Valley and Aachen, Germany in order to develop automotive technology and evaluate global demand. The EV branch of the Chinese automaker also debuted its i-Link information system, which uses 4G to connect car telematics to the cloud. The i-Link system also provides wireless phone charging, remote inquiry services and connects sensing technologies to the internet. Read more in the press release below.

European new car sales drop nearly 8% in first half of 2019

Thu, Jul 18 2019PARIS ó European car sales dropped 7.9% in June, led by bigger declines for Nissan, Volvo and Fiat Chrysler (FCA), according to industry data published on Wednesday. Registrations fell to 1.49 million cars last month from 1.62 million a year earlier across the European Union and EFTA countries, the Brussels-based Association of European Carmakers said in a statement. Calendar effects resulted in two fewer sales days in most markets, accentuating the decline. Registrations for the first half closed 3.1% lower, ACEA said. For European carmakers, weakening demand at home compounds the pressure from a sharper contraction in China and emerging markets that may yet bring more profit warnings. Nissan¬ís aging model lineup contributed to a 26.6% June sales slump while Volvo Cars, owned by China¬ís Geely, saw deliveries tumble 21.7%. Registrations also fell 13.5% last month at FCA, 10.1% at BMW, 9.6% at Volkswagen Group and 8.2% for both Mercedes parent Daimler and France¬ís PSA Group. The Peugeot maker¬ís domestic rival Renault suffered less, posting a 3.9% decline. By the Numbers BMW Chrysler Fiat Nissan Volkswagen Volvo Peugeot Renault

Former Audi chief designer Wolfgang Egger leaves Italdesign

Sat, Dec 27 2014The latest word from the international community of automotive designers has it that Wolfgang Egger is leaving Italdesign, but just where the accomplished designer will land next and who will take his place remain big question marks. Egger is a designer who has bounced back and forth between Italy and Germany over the course of his career. He was born in Germany but studied in Milan. He began his career at Alfa Romeo in 1989 and was named its chief designer by 1993 before being head-hunted by the Volkswagen Group in 1998 to head up the design department at Seat. A few years later he went returned to Italy to run the Lancia design department, and was subsequently renamed to the same post at Alfa Romeo. In 2007 he went back to his native Germany to head up the Audi design office, over which he assumed complete responsibility by 2012, but left Audi in 2013 to run Italdesign. For those unfamiliar, Italdesign is the studio founded by Giorgetto Giugiaro (pictured at left next to Egger) back in 1968 but which, along with many other Italian design houses, fell on hard times in recent years. The Volkswagen Group swooped in to rescue the troubled studio in 2010, turning it into something of an in-house advanced design department to provide an alternative perspective on the direction in which the group and its various brands could take their respective designs moving forward. With Egger now leaving its helm, Italdesign and its German parent company will need to find his replacement, and we're sure they'll announce one in due course. The bigger question on our minds, however, is where Egger himself will head next. Given the path his career has taken to date, we wouldn't be surprised to see him land elsewhere in the Volkswagen Group or find a new role in the expanding Fiat Chrysler Automobiles empire. Then again, Egger could find it time to open an entirely new chapter. Watch this space. News Source: Car Design NewsImage Credit: Newspress Design/Style Hirings/Firings/Layoffs Audi Volkswagen designer italdesign giugiaro wolfgang egger