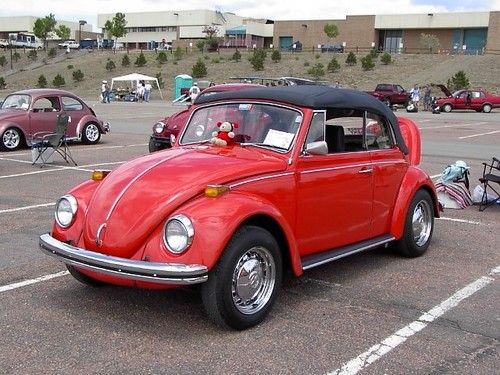

1978 Volkswagon Beetle Convertible - White on 2040-cars

Park Ridge, Illinois, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:4 cylinder

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 4

Make: Volkswagen

Model: Beetle - Classic

Trim: convertible

Options: CD Player, Convertible

Drive Type: RWD

Mileage: 60,176

Exterior Color: White

Disability Equipped: No

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Original VW Convertible. In family years and years. White with White top, black seats, 4 speed, reads 60,000 miles, likely original but not certified. Very good condition, good runner and pleasant to look at. Garaged almost its whole life. A Classic.

Volkswagen Beetle - Classic for Sale

1979 volkswagon beetle convertible(US $8,500.00)

1979 volkswagon beetle convertible(US $8,500.00) 71 vw bug like new

71 vw bug like new Very clean 2002 volkswagen beetle turbo s hatchback 2-door 1.8l low reserve

Very clean 2002 volkswagen beetle turbo s hatchback 2-door 1.8l low reserve 1970 volkswagen beetle convertible

1970 volkswagen beetle convertible 1971 super beetle, canary yellow, less than 5,000 miles. good-great condition.(US $10,000.00)

1971 super beetle, canary yellow, less than 5,000 miles. good-great condition.(US $10,000.00) 1979 triple white vw super beetle convertible

1979 triple white vw super beetle convertible

Auto Services in Illinois

Waukegan-Gurnee Auto Body ★★★★★

Walker Tire & Exhaust ★★★★★

Twin City Upholstery ★★★★★

Tuffy Auto Service Centers ★★★★★

Top Line ★★★★★

Top Gun Red ★★★★★

Auto blog

Porsche board members facing another ˆ1.8B lawsuit over VW takeover bid

Mon, 03 Feb 2014Back in 2008, Porsche got the bright idea that it could take over Volkswagen in the midst of the worst economic slump since the Great Depression. Ignoring that this was a catastrophic move for the Stuttgart sports car manufacturer that that eventually resulted in it nearly going bankrupt and eventually being taken over by the same company it sought to control, the aftermath has left Porsche Chairman Wolfgang Porsche and board member Ferdinand Piëch in the crosshairs of seven hedge funds that lost out during the takeover and are now seeking €1.8 billion - $2.43 billion US - in damages from the two execs, according to the BBC.

See, investors bet on Volkswagen's share price going down, partially because Porsche said it wasn't going to attempt a takeover. But Porsche was attempting to take over VW, having bought up nearly 75-percent of VW's publicly traded shares. When word broke that Porsche owned nearly three-quarters of VW (which indicated an imminent takeover attempt), rather than go down like the hedge funds bet it would, VW's share price skyrocketed to over 1,000 euros per share, according to Reuters.

Naturally, when you bet that a company's share price is going to drop and it in turn (temporarily) becomes the world's most valuable company, you lose a lot of money, unless you're able to buy up shares before prices jump too much. This led to a squeeze on the stock, which the hedge funds accuse Porsche and Piëch (who are both members of the Porsche family and supervisory board) of organizing.

Ex-Fiat exec: VW diesel scandal will hurt plug-in hybrids

Thu, Apr 7 2016It doesn't sound right at first blush, but former Fiat executive and noted diesel-powertrain expert Rinaldo Rinolfi thinks that plug-in hybrid sales may be more impacted by the VW diesel-emissions scandal than diesel sales. Rinolfi, who worked for Fiat for 40 years, told Automotive News Europe, said that the Euro 6 emissions rules that went into effect in 2015 have already increased diesel-engine production costs enough to raise prices and ultimately flatten demand. By the end of the decade, diesel-vehicle sales will settle in at a 40-percent market share of new European vehicles, and that was going to happen with or without the scandal. "Every carmaker has found ways to achieve fuel consumption and emissions results that have progressively diverged from the real driving conditions." - Rinaldo Rinolfi Makers of plug-in hybrids have more to lose, though, because every PHEV maker has figured out a way to keep emissions figures artificially low, Rinolfi said. Under New European Driving Cycle (NEDC) standards, PHEVs can be tested part of the time with the electric motor in action, meaning emissions get driven down to 30 percent to 40 percent less than real-world figures. With the VW scandal pushing regulators to use real-world figures, those PHEV emissions numbers are expected to rise substantially. To a lesser extent, hybrid emissions figures are also tested as artificially low. "Over the years, even without defeat devices, every carmaker has found ways to achieve fuel consumption and emissions results that have progressively diverged from the real driving conditions the customer experiences," Rinolfi said in the Automotive News Europe interview. Rinolfi is a little sunnier about compressed natural gas (CNG) vehicles, estimating that CNG emissions are as much as 25 percent lower compared to conventional vehicles. As for battery-electrics, he's not so optimistic, estimating that there needs to be at least a tenfold improvement in energy efficiency for EVs to be truly competitive with conventional vehicles. "I've been waiting for a true breakthrough for the past 25 years, but I've not seen it yet," Rinolfi said about EVs in the Automotive News Europe interview. Related Video: News Source: Automotive News Europe-sub.req.Image Credit: Arnd Wiegmann / Reuters Green Fiat Volkswagen Diesel Vehicles Electric Hybrid diesel emissions scandal nedc

Winterkorn remains CEO of Volkswagen's majority shareholder

Sun, Oct 4 2015Martin Winterkorn may have stepped down as the chief executive of Volkswagen in the wake of the diesel emissions scandal, but he's not out from under the company's large umbrella just yet. In fact, according to a report from Reuters, he still holds four top-level positions not only within the industrial giant's bureaucracy, but at the top of it. And one of those is as CEO of the company's largest shareholder. That holding company is Porsche SE, the investment arm of the Piech and Porsche families (Ferdinand Porsche's descendants) which holds over 50 percent of VW's shares. In 2008, Porsche SE acquired majority interest in the Volkswagen Group which in turn acquired Porsche the automaker – and placed VW's Winterkorn at the head of the executive board of the holding company. Though Winterkorn has resigned from his position as chairman of VW's management board, he has apparently yet to step down from running Porsche SE. That's not the only job that Winterkorn still retains in VW's senior management. He also continues to serve as chairman of Audi, as well as truck manufacturer Scania, and the new Truck & Bus GmbH into which Scania has been grouped together with Man. It remains unclear if or when Winterkorn might resign from those positions as well, or how his tenure in those posts might affect the company's effort to start over in the aftermath of the scandal in which it is currently embroiled. Also unclear, Reuters reports, is how much, exactly, Winterkorn will receive in compensation after having stepped down from his chair at the head of the VW executive board. His pension is reported at over $30 million, but he could be awarded a large severance package as well amounting to as much as two years' worth of his annual compensation, which amounted to around $18 million last year. Whether he receives the severance pay or not is expected to depend on whether his resignation is considered by the supervisory board to have been the result of his own missteps or independent of the situation that resulted in his resignation. One way or another, he's not likely to go poor anytime soon.