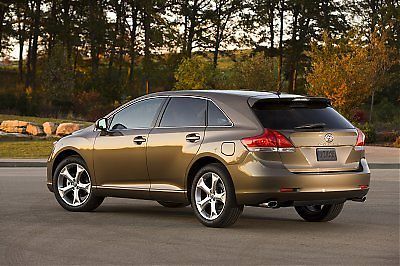

2013 Toyota Venza Le - $299 P/mo, $200 Down! on 2040-cars

Newton, North Carolina, United States

Body Type:Sedan

Engine:2.7L DOHC SFI 16-valve I4 engine w/dual VVT-i

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Year: 2013

Number of Cylinders: 4

Make: Toyota

Model: Venza

Mileage: 22,394

Sub Model: LE

Exterior Color: Red

Number of Doors: 4

Interior Color: Black

Drivetrain: Front Wheel Drive

Toyota Venza for Sale

2010 toyota venza v6(US $20,950.00)

2010 toyota venza v6(US $20,950.00) 2013 xle 16k low miles moonroof satellite radio cruise one owner(US $29,800.00)

2013 xle 16k low miles moonroof satellite radio cruise one owner(US $29,800.00) 2010 toyota fwd

2010 toyota fwd 2013 toyota venza xle htd leather nav rear cam 68 miles texas direct auto(US $31,980.00)

2013 toyota venza xle htd leather nav rear cam 68 miles texas direct auto(US $31,980.00) 2013 toyota venza xle v6 htd leather nav 20" wheels 6k texas direct auto(US $29,980.00)

2013 toyota venza xle v6 htd leather nav 20" wheels 6k texas direct auto(US $29,980.00) 2013 toyota venza xle leather sunroof nav rear cam 5k! texas direct auto(US $29,980.00)

2013 toyota venza xle leather sunroof nav rear cam 5k! texas direct auto(US $29,980.00)

Auto Services in North Carolina

Window Genie ★★★★★

West Lee St Tire And Automotive Service Center Inc ★★★★★

Upstate Auto and Truck Repair ★★★★★

United Transmissions Inc ★★★★★

Total Collision Repair Inc ★★★★★

Supreme Lube & Svc Ctr ★★★★★

Auto blog

LA Design Challenge invokes biology for 2025 concepts [w/poll]

Wed, 13 Nov 2013Participants in the annual LA Design Challenge always manage to come up with edgy, wacky designs for future vehicles, but with a theme of "Biomimicry and Mobility: 2025" this year's crop of cars might be the quirkiest we've ever seen. As usual, automotive designers from around the world participated in this year's competition, and all the designs will all be unveiled next week during the LA Auto Show with a winner being announced on November 21.

Chinese automakers made a strong showing with Qoros, SAIC Motor, JAC Motors (the company responsible for the Ford F-150 clone) and Changfeng all bringing interesting takes on the biology, human intelligence and sustainability theme. One of the more innovative ideas among these automakers is the Qoros Silk Road System allows autonomous vehicles to drive in packs similar to how ants travel. Speaking of ants, the SAIC Motor Mobiliant (shown above) gets its design from the shape of an ant's body, and, like the insect, it can climb building acting as a personal elevator as well. The JAC Motors design also merges vehicle and building design, while the Changfeng LaBrea inspired by the design of muscle fibers.

Other entrants include Subaru and US-based design teams for BMW, Toyota and Mazda. BMW's duo of concepts mimic plant and animal life. The LA Subways concept acts as a submersible, single-person vehicle to take advantage of the LA river, with a shape similar to an Ocean Sunfish. The Sustainable Efficient Exploratory Device (SEED) imitates the shape of a seed pod, and uses propulsion methods inspired by a shark, dragonfly and a water bug. Mazda's Auto Adapt might be the most car-like concept of the bunch, while the Subaru Suba-Roo and the Calty-designed, Toyota e-grus are the most mind-blowingly awesome.

Chevy Blazer and Easter Jeeps | Autoblog Podcast #576

Fri, Apr 12 2019In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder and Assistant Editor Zac Palmer. They do a rundown of the latest news, including rumors of the Toyota Tundra and Tacoma sharing a platform, Jeep's insane Easter Safari concepts and an upcoming "entry level" performance Ford Mustang. Then they talk about driving the new Chevrolet Blazer and Jeep Grand Cherokee Trailhawk, and compare driving the Genesis G70 to the Kia Stinger. Finally, they take to Reddit to spend someone's money on a new crossover. Autoblog Podcast #576 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Toyota Tacoma and Tundra to share a platform? Jeep Easter Safari concepts "Entry level" performance Mustang? Cars we're driving: 2019 Chevy Blazer 2019 Jeep Grand Cherokee Trailhawk 2019 Genesis G70 Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Driving the Toyota Tacoma, BMW 430i and Chevy Corvette Convertible | Autoblog Podcast #671

Fri, Mar 26 2021In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by West Coast Editor James Riswick and Road Test Editor Zac Palmer. First, they talk about driving the Toyota Tacoma TRD Off-Road (equipped with a TRD Lift Kit), Mini Cooper S Hardtop 2-Dor, BMW 430i xDrive, Chevy Corvette Convertible and Chevy Suburban with the Duramax diesel engine. They discuss the news, including Toyota's desire to differentiate the 86 from the BRZ, the new Jeep Magneto concept and Greg's opinion piece on why Stellantis needs Chrysler. Last, but not least, they dig into the mailbag to help a listener figure out how to replace their Honda S2000 and Honda Fit. Autoblog Podcast #671 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars We're Driving 2021 Toyota Tacoma TRD Off-Road 2021 Mini Cooper S Hardtop 2 Door 2021 BMW 430i xDrive 2021 Chevy Corvette Convertible 2021 Chevy Suburban Duramax diesel News Toyota 86 reportedly delayed to differentiate it from Subaru BRZ Jeep Magneto: Electrifying the Easter Jeep Safari with a Wrangler EV Why Stellantis needs Chrysler Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related Video: Podcasts BMW Chevrolet Chrysler GM MINI Toyota Truck Coupe SUV Diesel Vehicles Luxury Off-Road Vehicles Performance

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.346 s, 7902 u