2007 Toyota Sienna Le 8 Passenger on 2040-cars

Cornelius, North Carolina, United States

|

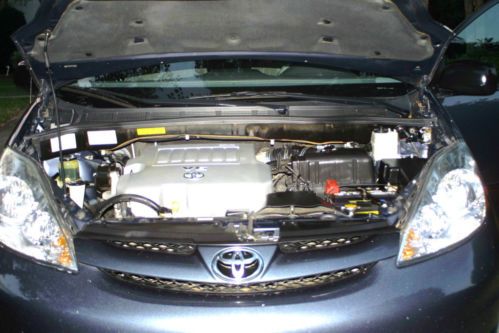

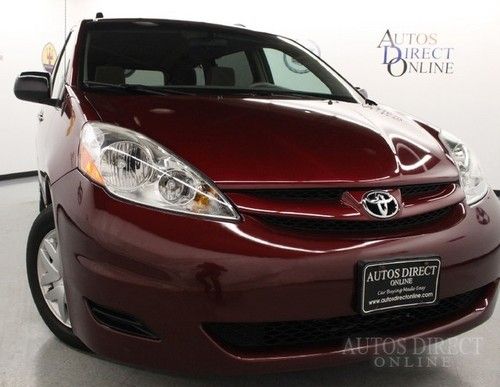

This car is in very good condition. only 2 owners. Scratches on front fender and some on rear but otherwise body in very good condition. Interior is grey. All seats and upholstery in excellent condition. There is a stain on front rug that resembles a clay color and small stain on rug in trunk. Owned by nonsmokers.

Power Train Warranty for 7 years/100,000 miles starting from January 1, 2007. Transmission was replaced in 2011 per Warranty. Options include: Keyless entry, Front Wheel drive with traction, front driver power seat, power sliding right door, DVD, CD, |

Toyota Sienna for Sale

We finance 08 le 3rd row v6 cd changer power door/seat keyless entry one owner(US $11,500.00)

We finance 08 le 3rd row v6 cd changer power door/seat keyless entry one owner(US $11,500.00) 2005 toyota sienna xle limited 3.3l * no reserve * clean carfx 06 * 1 owner *

2005 toyota sienna xle limited 3.3l * no reserve * clean carfx 06 * 1 owner * 2012 toyota sienna le 3rd row - $339 p/mo, $200 down!(US $21,995.00)

2012 toyota sienna le 3rd row - $339 p/mo, $200 down!(US $21,995.00) 2003 toyota sienna ce

2003 toyota sienna ce 2004 toyota sienna xle with leather upholstery passenger family mini-van!

2004 toyota sienna xle with leather upholstery passenger family mini-van! 2008 toyota sienna xle mini passenger van 5-door 3.5l- mobility(US $24,200.00)

2008 toyota sienna xle mini passenger van 5-door 3.5l- mobility(US $24,200.00)

Auto Services in North Carolina

Window Genie ★★★★★

West Lee St Tire And Automotive Service Center Inc ★★★★★

Upstate Auto and Truck Repair ★★★★★

United Transmissions Inc ★★★★★

Total Collision Repair Inc ★★★★★

Supreme Lube & Svc Ctr ★★★★★

Auto blog

Toyota, Lexus expanding Takata airbag recall, re-notifying customers

Mon, 20 Oct 2014Toyota is re-notifying owners and expanding its Takata airbag inflator recall for some regions. The renewed campaign covers 247,000 examples of the Toyota Corolla, Matrix, Sequoia, Tundra and Lexus SC430 that are located in southern Florida, along the Gulf Coast, Puerto Rico, Hawaii, the US Virgin Islands, Guam, Saipan and American Samoa. All of the models come from the 2001-2004 model years and have potentially faulty Takata-made inflators on the front passenger side. According to the company, testing shows the problem warrants "immediate action," and its press release says, "this action intensifies Toyota's efforts to reach customers and remedy previously recalled vehicles, and a small number of newly included vehicles."

According to Toyota, it submitted some recalled inflators to Takata for testing, and it found a high probability of rupturing in high humidity areas. The automaker said it had no reports yet of injuries or fatalities related to the problem.

This is Toyota's third inflator recall this year. In June, it called in for repair the same vehicles from the 2003-2005 model years in high-humidity areas, and it conducted a separate campaign nationwide for the parts in additional models. In April 2013, it also announced a fix campaign for 1.73-million vehicles worldwide for the same issue.

Has the auto industry hit peak hybrid?

Thu, 12 Jun 2014Hybrids are known for their great fuel economy and low emissions, but it looks like given current market conditions, only about three percent of new car consumers are willing to pay the premium for them. A new study from IHS/Polk finds that the hybrid market share among overall US auto sales are falling, despite more models with the technology on sale than ever before.

The study examined new car registrations in March from 2009 through 2014. In that time, the auto industry grew from 24 to 47 hybrid models available to consumers, but market share for the powertrain remained almost stagnant in that time. As of 2009, hybrids held 2.4 percent of the market; it fell slightly to 2.3 percent in 2010 and grew to 3.3 percent in 2013. However, 2014 showed a drop back to 3 percent. Overall hybrid sales have been growing since 2010, but they just aren't keeping up with the total auto market.

According to IHS/Polk, this isn't what you would expect to see. Usually, each new model in the market brings along with it a boost in sales. The growth in hybrid models 2009 to 2014 should have shown a larger increase in share for the segment.

Toyota, Kaley Cuoco grant wishes in Super Bowl XLVII ad

Mon, 28 Jan 2013For viewers who plan on watching the Super Bowl only for the commercials, here's one for you to enjoy ahead of time. As we saw in the teaser video that Toyota released last week, will be making the transition from Big Bang to The Big Game as a wish-granting genie in a commercial for the 2013 Toyota RAV4.

Though not as entertaining as the actual teaser for this commercial, it still garnered a couple chuckles from the Autoblog crew. We won't spoil it for you, but a word of advice: if Cuoco ever shows up in your driveway granting you wishes, we'd suggest you be very clear what you want... and enunciate.

If you want to see the commercial before this Sunday's game, we have the video (and an accompanying press release) posted after the jump.