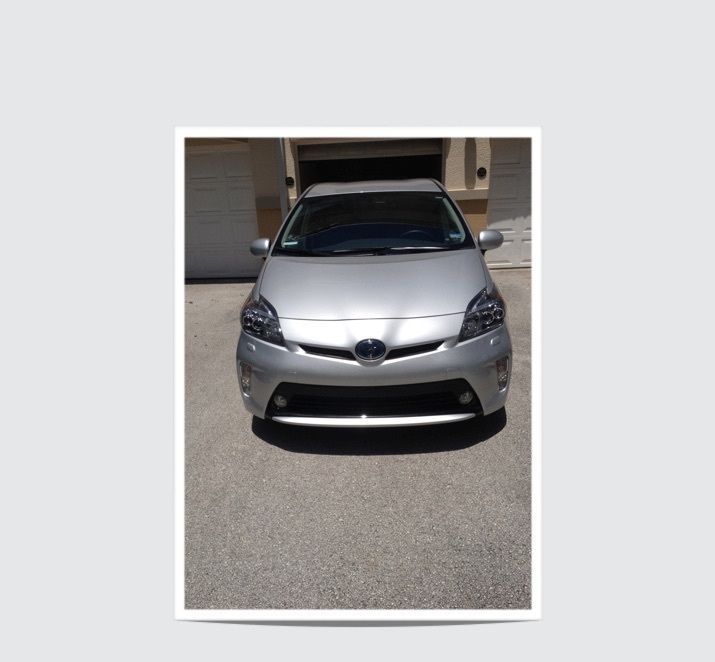

2016 Toyota Prius on 2040-cars

Bakersfield, California, United States

Email me at : KalubBuchanan9q09o336@yahoo.com The front windshield is in excellent condition, The paint is in great shape and condition, No dings are visible on this vehicle, This vehicle comes with a new set of tires, The interior was well maintained and is extra clean, The exterior was well maintained and is extra clean, The engine is functioning properly and has no issues, This vehicle has no previous collision damage, The transmission shifts very smoothly, The brakes are in great condition, The car was previously owned by a non smoker, A full size spare is included with this vehicle, This vehicle comes with a spare key

Toyota Prius for Sale

2012 toyota prius c 3(US $2,500.00)

2012 toyota prius c 3(US $2,500.00) 2014 toyota prius(US $7,500.00)

2014 toyota prius(US $7,500.00) Toyota: prius 2(US $9,800.00)

Toyota: prius 2(US $9,800.00) 2015 toyota prius v five wagon 4-door(US $13,000.00)

2015 toyota prius v five wagon 4-door(US $13,000.00) 2010 toyota prius prius iv(US $10,000.00)

2010 toyota prius prius iv(US $10,000.00) 2014 toyota prius(US $11,200.00)

2014 toyota prius(US $11,200.00)

Auto Services in California

Your Car Valet ★★★★★

Xpert Auto Repair ★★★★★

Woodcrest Auto Service ★★★★★

Witt Lincoln ★★★★★

Winton Autotech Inc. ★★★★★

Winchester Auto ★★★★★

Auto blog

Toyota ready to design more heart-racing Prius

Sat, Jan 25 2014Long praised for its fuel economy and reliability, the Toyota Prius has been no stranger to less-than-flattering remarks about its styling and sense of excitement. In fact, the model is a regular movie punchline. For evidence, see Mark Wahlberg in The Other Guys or, more recently, Ice Cube in Ride Along. Apparently, Toyota President Akido Toyoda is getting the message and is pushing for what's been translated as a more "heart-racing" design for both the Prius and the Camry, the Canadian website Driving says. The Camry and Prius accounted for about a third of Toyota's US sales last year. With the Camry as the best-selling US model for each of the last dozen years, Toyota US head designer Kevin Hunter noted at the Detroit Auto Show last week that the Japanese automaker is looking for a "more emotional" design for the boxy sedan. The Prius redesign may have more constraints, as aerodynamics have to be factored in to ensure top-line fuel economy for the world's best-selling hybrid. Toyota used the Detroit show to show off the FT-1, a concept that many consider a preview of the new Supra. How this "Future Toyota 1" will affect the Prius and Camry redesigns, whenever they appear, remains in question but we like where things are headed.

Lexus planning a hydrogen fuel-cell LS by 2017

Sun, Jan 4 2015Toyota's Fuel Cell System will certainly migrate to other vehicles in the carmaker's lineup, but Australian car site Motoring reports that one of the models at the head of the queue is the Lexus LS. According to its sources, the executive barge powered by hydrogen will be released by 2017 and take the top spot in the range, rolling in above the LS Hybrid. We're told that Toyota engineers will find a way to slide two hydrogen tanks into its bodywork with the same general setup as on the Mirai – one under the rear seats and another under the rear parcel shelf. The 150-kW fuel cell stack will be placed under the front seats. Motoring says the resulting sedan and its 220-kW electric motor would come in "at around 2,100 kg," which is 4,620 pounds; that's a ginormous 539 pounds less than the listed curb weight of the current LS Hybrid, and 387 pounds more than the standard LS. Assuming all goes as planned, it would have a range of roughly 238 miles, a few dozens less than the Mirai's range of about 300 miles. It would look slightly different, too, the front end getting larger intakes to cool the power unit. It wouldn't surprise us if Lexus does have a hydrogen LS planned – it would be a statement car, and the company likes making statements, even if few heed them; it has stuck with its LS 600h for the past seven years, yet of the 7,539 LS models sold through the end of November this year, only 61 of them were hybrids. The timing would be intriguing, however; by the time the LS hybrid came out, Lexus had already worked over its filet-and-potatoes models. And if the hydrogen version is going to come in above the $120,440 hybrid, well, that will be a statement indeed.

2015 Toyota Sienna SE keeps the swagger, adds thoughtful updates [w/videos]

Thu, 17 Jul 2014Toyota found huge success with its "Swagger Wagon" rap video for the 2011 Sienna SE. It showed that a minivan could actually sort of maybe be fun and didn't have to be a lame vehicle for people who long ago lost their sense of humor. Now that there is a slight refresh for the 2015 model, the company is trying to capture that effervescent image again with a bunch of videos aimed at families.

For the latest launch, Toyota is partnering with some family-friendly online video stars and having them show off the Sienna's features. It's releasing YouTube videos from the creators of Action Movie Kid and Convos with My 2-Year-Old and a Vine from Eh Bee Family, and they all hope to show that it's cool to be a family with a minivan.

In terms of actual changes, though, the update is pretty light aesthetically, but the new tech inside seems aimed directly at mom and dad. However, unless you've got a sharp eye, spotting the exterior refresh might be tough. Toyota is tweaking the front end slightly by adding a dark mesh grille and trim. The headlights are also slightly reshaped to incorporate a new strip of available LED running lights.