1991 Toyota Mr2 Turbo 2.0 on 2040-cars

Hilliard, Ohio, United States

|

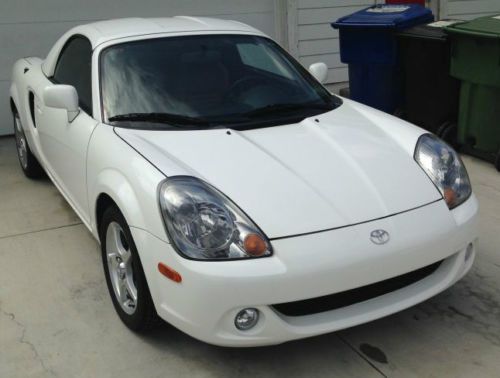

the good you are looking at 1991 Toyota a Mr2 turbo 2.0 runs and drive I have replaced the engine with in engine has only 129k on it I have all the paper work for it I also replaced the clutch also front and rear struts ,interior ,floor on the driver side also changed the timing belt and the water pump while the engine was out new spark plugs wires distributor cap and I still have the old engine it come with the car it has a new paint job I bought it as project car I finish most of it but I just open a dealer ship so I have no time for it now I hate to let it go but I have to also the t top works good no leaks the bad emergency brake need to be fix it will need a cold start sensor trunk dos not latch das tank it has tiny hole on it with little tlc you will good sports car and this cars hard to fine anymore especially there turbo addition |

Toyota MR2 for Sale

2003 toyota mr2 spyder with original 19,128 miles as of 03-22-2014(US $16,500.00)

2003 toyota mr2 spyder with original 19,128 miles as of 03-22-2014(US $16,500.00) 2000 toyota mr2 spyder base convertible 2-door 1.8l with factory hardtop 6 sp!

2000 toyota mr2 spyder base convertible 2-door 1.8l with factory hardtop 6 sp! 1989 toyota mr2, no reserve

1989 toyota mr2, no reserve A rare find-1988 mr2 supercharged-t-tops-serviced-carfax certified-no reserve

A rare find-1988 mr2 supercharged-t-tops-serviced-carfax certified-no reserve 1993 toyota mr2 59k original miles-great shape

1993 toyota mr2 59k original miles-great shape 1993 toyota mr2 base coupe 2-door 2.2l

1993 toyota mr2 base coupe 2-door 2.2l

Auto Services in Ohio

World Auto Parts ★★★★★

West Park Shell Auto Care ★★★★★

Waterloo Transmission ★★★★★

Walt`s Auto Inc ★★★★★

Transmission Engine Pros ★★★★★

Total Auto Glass ★★★★★

Auto blog

Weekly Recap: Toyota, Mazda team up to 'make cars better'

Sat, May 16 2015Toyota and Mazda are teaming for a noble purpose: to "make cars better." That's how the two Japanese automakers termed their partnership, which was announced this week. So what does this actually mean? The companies said they will set up a joint committee to look for areas of cooperation and named safety and the environment as issues they plan to tackle. From a product perspective, it's believed that Toyota is interested in Mazda's Skyactive engine portfolio. In turn, Mazda has its eye on Toyota's fuel-cell and plug-in hybrid technology. While more specifics were not confirmed, the companies said the "agreement will go beyond the traditional framework of cooperation," and it has the potential to be a long-range partnership. "The main purpose of this initiative is to enhance the appeal of our cars," Toyota president Akio Toyoda said at the announcement. Previously, Mazda has licensed Toyota's hybrid tech and assembled compact cars for Toyota in Mexico. Akio Toyoda said these projects "triggered" the automakers to explore further collaboration. Dave Sullivan, product analysis manager for AutoPacific, said the tie-up echoes Daimler's wide-ranging work with the Renault-Nissan alliance. "This could be a well-groomed match due to each having very unique skill sets," he said. OTHER NEWS & NOTES Volvo selects South Carolina for US factory Volvo confirmed this week that it will build its first US factory in South Carolina, with construction set to begin this fall. The company first revealed plans in March, though it didn't announce a site. The plant will have initial annual production of 100,000 units, though the vehicle or vehicles to be assembled were not specified. The factory, located near Charleston, will open in 2018 and ultimately employ 4,000 people. The facility will help Volvo continue its growth strategy, which includes strengthening its presence in the US market, where it wants to sell more than 100,000 cars per year. "Building a plant in the US is a reflection of Volvo Cars' commitment to the US and the key role the US plays in our growth objectives," Lex Kerssemakers, senior vice president, Americas, said in a statement. Ford GT spied on the road The 2017 Ford GT was spotted testing around the Blue Oval's headquarters in Dearborn, MI, this week. The raw body panels were exposed, and they lacked paint or camouflage. It's the first time the GT has been captured on the street after a spring of auto show reveals.

Successor to the Toyota 86 is on the way

Thu, Dec 8 2016Until now, Toyota and Subaru have been mum on the prospect of a follow up to the Toyota 86 and Subaru BRZ. Although both cars received mild refreshes and even milder power bumps, they're both essentially the same cars that hit the market nearly five years ago. It appears a successor is indeed on the way, as Autocar confirms that Toyota is developing a next-gen 86. Karl Schlicht, executive vice-president at Toyota Motor Europe, said that the 86 will live on past the current generation. "The car serves a big purpose," Schlicht said. "We are not getting out of that business. Sporty cars go through their phases. It's our intention to continue with that car." Toyota seems to be back in the sports car business, as the company has partnered with BMW on a new Supra. Like the current Toyota 86, it seems likely that the successor will be co-developed with Subaru. Schlicht says that to get the low center of gravity and the handling characteristics that come along with it, a horizontally opposed engine is a necessity. He admits that there is no firm confirmation of a commitment from Subaru. While no Schlicht gave no details about the new car, he did nix any possibility of a convertible variant. "We wouldn't do it on the current model," he said. "That doesn't mean dealers wouldn't like one, but there are so many other priorities that I don't think we've got spare capacity for that." Related Video:

Toyota investing $30 million in Indiana for more Highlander production

Sun, 28 Jul 2013Indiana seems like the place to be if you're looking for work in a car factory. In May, Subaru announced plans to invest $400 million in its Lafayette, Indiana plant, creating 900 new jobs in the process and increasing capacity to 300,000 units per year. Now, Toyota has announced plans to invest $30 million in its Princeton, Indiana plant, 170 miles south of the Subaru factory, which also builds the Camry.

Toyota's investment will create an additional 200 jobs and increase the factory's volume by 15,000 units. Toyota announced an investment in the plant in February of 2012 that bumped volume up from 300,000 to 350,000 units. Toyota Motor Manufacturing Indiana, as the Princeton facility is officially known, produces the recently revised Toyota Highlander, the Sequoia and the Sienna. It employs 4,500 people, and this announcement represents Toyota's tenth production increase in under two years.

Scroll down below for the official announcement.