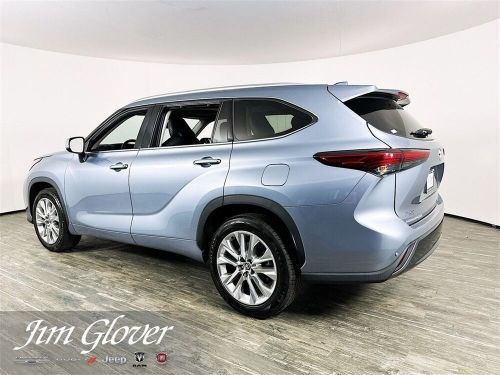

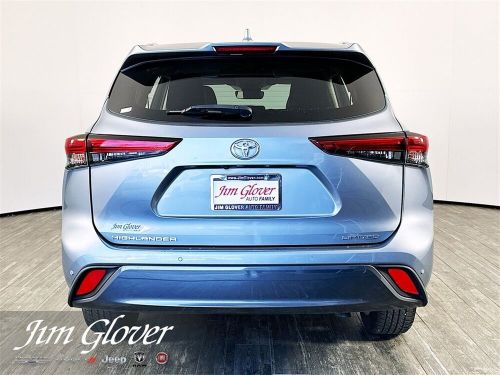

2021 Toyota Highlander Limited on 2040-cars

Engine:3.5L V6 DOHC

Fuel Type:Gasoline

Body Type:4D Sport Utility

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 5TDYZRAH9MS043157

Mileage: 102754

Make: Toyota

Trim: Limited

Features: --

Power Options: --

Exterior Color: --

Interior Color: Graphite

Warranty: Unspecified

Model: Highlander

Toyota Highlander for Sale

2022 toyota highlander xle(US $30,784.00)

2022 toyota highlander xle(US $30,784.00) 2012 toyota highlander limited(US $10,999.00)

2012 toyota highlander limited(US $10,999.00) 2018 toyota highlander le(US $25,987.00)

2018 toyota highlander le(US $25,987.00) 2021 toyota highlander xle(US $31,712.00)

2021 toyota highlander xle(US $31,712.00) 2023 toyota highlander le(US $33,848.00)

2023 toyota highlander le(US $33,848.00) 2021 toyota highlander xle(US $28,000.00)

2021 toyota highlander xle(US $28,000.00)

Auto blog

Toyota Sienna Swagger Wagon rides again with Busta Rhymes

Mon, 04 Aug 2014Let's face it: there are few things less "gangsta" than a minivan (which goes a long way towards explaining why crossovers have been gradually taking their place as the family-hauler of choice across America, but we digress). The point here is not lost on Toyota, which has embraced the uncool image of the minivan with the Swagger Wagon campaign.

We first saw the suburban-goes-urban campaign pop up with the introduction of the new Sienna back in 2010. And now that the Sienna's been updated for 2015, the campaign is back again, featuring none other than Trevor Tahiem Smith, Jr. himself... better known to most as Busta Rhymes. The decidedly white-bread video spot that follows may make you cringe, but you've got to admit that it's well done, even if it doesn't have the charm and freshness of the original.

2013 Pikes Peak Hill Climb, Practice Day 4

Fri, 28 Jun 2013The fourth and final practice day of the 91st Pikes Peak International Hill Climb is complete. Tomorrow everyone will make any last-minute adjustments and get their cars, their bits and bobs lined up in the pits for Sunday morning's this-time-it-counts run.

The Unlimited runners took on the top section of the course today, Sébastien Loeb and his big-mouth Peugeot acing the practice test again with a time of 2:11. Rhys Millen's team proved its got the engine issues of two days ago in the Hyundai PM580T sorted out, posting the next-best time at 2:27.16. The reason we had to dip all the way into the hundredths for his time is because he nipped Romain Dumas by just .31 of them, the Frenchman in the Norma M20FC PP running the course in 2:27.47. In fourth came the Frenchman in the monster Mini, Jean-Philippe Dayraut six seconds back at 2:33.

Time Attack competitors, also on the upper section, were led by Paul Dallenbach in the Hyundai Genesis Coupe with a time of 2:36, Porsche pilot Jeff Zwart crossing the line six seconds later at 2:42, fellow Porsche driver David Donner coming in another six seconds back at 2:48. Dallenbach has topped three of the four practice-day sessions, sliding into the second spot behind Donner only on Practice Day 2.

Next-gen Toyota Prius spied inside and out

Fri, 24 May 2013Toyota has built itself into the industry's standard-bearer when it comes to hybrids, and it isn't going to let the poster child for gas-electric vehicles get stale on the market. These spy shots captured in California are our first good look at the next-generation Prius, which could come to market wearing a 2015 model year designation.

Even though it looks like Toyota may have blown its annual camouflage budget on this mule, we can clearly see that it will have the same iconic half-moon design that has been with the car since 2003. If so, this goes against reports from last year that suggested the car would be getting a different look inspired by the 2013 NS4 Concept. Although, this could also indicate that the Prius family will continue to grow - adding a new sedan - to the existing Prius C, Prius V and Prius Plug-In lineup.

These spy shots also give us an indication as to what the interior will look like, with a more stylish three-spoke steering wheel and an instrument panel design that sort of reminds us of a BMW. On the other hand, all the tape, cobbled together pieces and lack of space for a center stack display screen has us thinking this isn't what the final product will resemble.