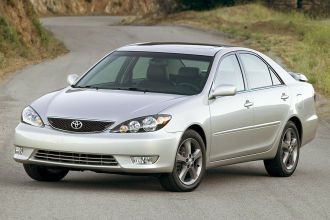

2009 Toyota Camry Le on 2040-cars

1200 W Bloomington Rd, Champaign, Illinois, United States

Engine:2.4L I4 16V MPFI DOHC

Transmission:5-Speed Automatic

VIN (Vehicle Identification Number): 4T1BE46K09U270633

Stock Num: 02883

Make: Toyota

Model: Camry LE

Year: 2009

Exterior Color: Red

Interior Color: Charcoal

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 62485

**CLEAN CARFAX**, **FUEL EFFICIENT**, **KEYLESS ENTRY**, **POWER DRIVER SEAT**, and **REMOTE START**. Logical instrument panel is foolproof. Creampuff! This beautiful 2009 Toyota Camry is not going to disappoint. There you have it, short and sweet! Motor Trend Comparison calls Camry quiet, comfortable, and profoundly confidence-inspiring. New Car Test Drive said, ...new energy and style. More powerful and livelier engine... Toyota has established itself as a name associated with quality. This Toyota Camry will get you where you need to go for many years to come. Bob Simpson's Autotown Sharp Cars, Sharper Pencils !! Visit Bob Simpson's Autotown online at www.autotownonline.com to see more pictures of this vehicle or call us at 866-292-1487 today to schedule your test drive. Bob Simpson's Autotown Inc. was started in 2001 after Bob sold his interest in Continental Limited Nissan-Subaru and Saturn of Champaign, We offer only high quality pre-owned Certified Vehicles, All of our inventory is inspected, fully detailed and test driven BEFORE it hits the lot. Contact Toby Brown Internet Sales Manager for details.

Toyota Camry for Sale

2007 toyota camry le(US $9,895.00)

2007 toyota camry le(US $9,895.00) 2009 toyota camry le(US $11,980.00)

2009 toyota camry le(US $11,980.00) 2002 toyota camry se(US $5,488.00)

2002 toyota camry se(US $5,488.00) 2011 toyota camry le(US $14,287.00)

2011 toyota camry le(US $14,287.00) 2005 toyota camry le

2005 toyota camry le 2012 toyota camry se(US $20,490.00)

2012 toyota camry se(US $20,490.00)

Auto Services in Illinois

X Way Auto Sales ★★★★★

Twins Auto Body Shop ★★★★★

Trevino`s Transmission & Auto ★★★★★

Thompson Auto Supply ★★★★★

Sigler`s Auto Ctr ★★★★★

Schob`s Auto Repair ★★★★★

Auto blog

First 2014 Toyota Corolla commercial dances through time

Sat, 07 Sep 2013Despite the fact that the Toyota Corolla pretty much sells itself, the eleventh-generation 2014 model is getting a huge marketing push that aims to appeal to both Millennials (of course), as well as the older generations that have lived with the stalwart Japanese compact for decades. The first television advertising spot, called, "Style Never Goes Out of Style," shows that the Corolla has had a place in mainstream culture since its launch in the 1960s. We have to admit, it's pretty cool to see older models from the '60s, '70s and '80s come out to play for this commercial, especially the latter of those, as it gives us enthusiasts fond memories of the infamous AE86.

The whole web/broadcast/print/social media marketing campaign surrounding the 2014 Corolla is called "Elevate," because, according to Toyota:

Extensive market research shows that Millennials are looking to take their career to the next level and are looking to buy their first 'real' car to get them there. The design of the all-new Corolla is significantly elevated from the previous generations, creating a more dynamic and desirable image for the Corolla nameplate that will appeal to these younger buyers.

Vehicles awarded IIHS Top Safety Pick awards skyrockets for 2015 [w/video]

Wed, Dec 24 2014By practically every measure, passenger vehicles in the US are continuing to get safer. With the year rapidly coming to an end, the Insurance Institute for Highway Safety is releasing its annual list tallying of the scores for the latest vehicles to see how they compare to last year. Judging by the agency's evaluations, the numbers look quite positive. According to the institute, 71 vehicles earned either the Top Safety Pick or Top Safety Pick+ rating so far in its testing for 2015. Among the latest winners, there have been 33 TSP+ awards and 38 TSP medalists. That's a healthy increase over the 22 TSP+ and 17 TSP grades in 2014. The figures appear even more impressive when you consider that it keeps getting harder to earn the + designation. In the latest round of testing, a vehicle must offer some form of front crash prevention automatic braking to get the mark. Previously, just a warning to drivers was necessary. This list also illustrates the ways that automakers adapt to new testing procedures. In 2013 there were 117 TSP ratings and 13 TSP+ awards. Then, the IIHS mandated that to be a safety pick, a model had to score Good in the institute's four crash tests, plus a Good or Acceptable in the small overlap front test. That brought a plunge in 2014 to just 17 TSP grades. With the numbers climbing again, companies apparently have deciphered how to perform better. Some brands especially stood out on this year's list. The IIHS praised Volvo, Mercedes-Benz and Acura for offering standard front crash prevention systems on some models. Subaru received at least one of the awards for all seven of its models. Toyota also had seven, and the Honda brand did too – though the institute counts the two- and four-door versions of the Civic and Accord separately. Check out the full announcement below and a video about this year's winners. The full list can be viewed, here. Safety gains ground: More vehicles earn top honors from IIHS The number of vehicles earning either of the Institute's two awards has jumped to 71 from 39 this time last year, giving consumers more choices for optimum protection in crashes. The number of winners in the top tier - TOP SAFETY PICK+ - has increased by 11 for 2015, despite a tougher standard for front crash prevention. "This is the third year in a row that we are giving automakers a tougher challenge to meet," says IIHS President Adrian Lund.

Toyota temporarily idles pair of Indian plants due to labor unrest

Thu, 20 Mar 2014The Detroit News reported today that Toyota will restart production at two Indian plants, following a shutdown on Monday.

Factory labor, management and police in Asia engage in the kind of violent altercations that we're not used to, having almost entirely walked away from the overtly brutal relations epitomized by the Pinkerton Detective Agency and the Flint Sit-Down Strike. In India, a plant owned by a Ford transmission supplier plant was shut down in 2009 after incidents between workers and armed men around the same time as Ssangyong workers occupied a factory in South Korea, in 2012 Suzuki Maruti workers rioted over wages around the same time upset employees beat a ceramics factory president to death in retaliation for a labor leader's killing.

Toyota is the latest to company trying to avoid that road. The Detroit Free Press reported earlier this week that it shut down two plants in India after 11 months of acrimonious wage negotiations and arbitration have gone nowhere. Toyota said the plant workers in Bidadi, near Bangalore, had deliberately stopped production at times over the past 45 days and threatened management. The workers said they wanted their wages raised by an amount already agreed to by management, but that management had reneged; news reports weren't clear on the amount, some saying nearly 10,000 rupees ($165 US) more per month, another saying 4,000 rupees ($65 US), but reports agree that Toyota has said it will only go as high as 3,050 rupees ($50 US).