1986 Toyota 4runner Rn60 on 2040-cars

Manhattan Beach, California, United States

Transmission:Automatic

Fuel Type:Gasoline

For Sale By:Private Seller

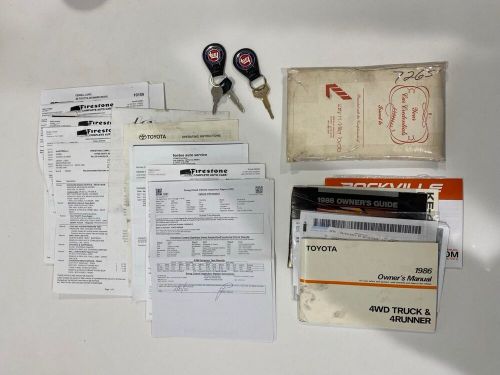

Vehicle Title:Clean

Engine:2.4L Gas I4

Year: 1986

VIN (Vehicle Identification Number): JT4RN62D1G0054946

Mileage: 258300

Interior Color: Brown

Trim: RN60

Number of Seats: 4

Number of Cylinders: 4

Make: Toyota

Drive Type: 4WD

Fuel: gasoline

Model: 4Runner

Exterior Color: White

Car Type: Off-road Vehicle

Number of Doors: 2

Toyota 4Runner for Sale

2000 toyota 4runner(US $4,500.00)

2000 toyota 4runner(US $4,500.00) 1998 toyota 4runner 1-owner * only 109k miles(US $8,425.00)

1998 toyota 4runner 1-owner * only 109k miles(US $8,425.00) 1992 toyota 4runner sr5 sport utility 4d(US $4,489.00)

1992 toyota 4runner sr5 sport utility 4d(US $4,489.00) 1986 toyota 4runner rn60(US $8,000.00)

1986 toyota 4runner rn60(US $8,000.00) 2018 toyota 4runner sr5(US $13,950.00)

2018 toyota 4runner sr5(US $13,950.00) 2002 toyota 4runner limited(US $500.00)

2002 toyota 4runner limited(US $500.00)

Auto Services in California

Zip Auto Glass Repair ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Repair Shop ★★★★★

Westside Body & Paint ★★★★★

Westcoast Autobahn ★★★★★

Westcoast Auto Sales ★★★★★

Auto blog

Toyota retires robots in favor of humans to improve automaking process

Sat, 12 Apr 2014Mitsuru Kawai is overseeing a return to the old ways at Toyota factories throughout Japan. Having spent 50 years at the Japanese automaker, Kawai remembers when manual skills were prized at the company and "experienced masters used to be called gods, and they could make anything." Company CEO Akio Toyoda personally chose Kawai to develop programs to teach workers metalcraft such as how to forge a crankshaft from scratch, and 100 workstations that formerly housed machines have been set aside for human training.

The idea is that when employees personally understand the fabrication of components, they will understand how to make better machines. Said Kawai, "To be the master of the machine, you have to have the knowledge and the skills to teach the machine." Lessons learned by the newly skilled workers have led to shorter production lines - in one case, 96percent shorter - improved parts production and less scrap.

Taking time to give workers the knowledge to solve problems instead of merely having them "feed parts into a machine and call somebody for help when it breaks down," Kawai's initiative is akin to that of Toyota's Operations Management Consulting Division, where new managers are given a length of time to finish a project but not given any help - they have to learn on their own. It's not a step back from Toyota's quest to build more than ten million cars a year; it's an effort to make sure that this time they don't sacrifice quality while making the effort. Said Kawai, "We need to become more solid and get back to basics."

Tesla expects another higher-volume deal with Toyota in next few years

Tue, 09 Sep 2014Four months have passed since Toyota ended its relationship with Tesla Motors, in which the electric-vehicle specialist supplied full lithium-ion battery packs to the Japanese behemoth for its RAV4 EV rollout, of which 2,500 vehicles will be completed. Now, Tesla founder and CEO Elon Musk has been heard suggesting that a future collaboration is likely within the next two to three years, and that it will probably be much larger than the last one.

Both Tesla and Toyota have sung each other's praises in the not-too-distant past, Toyota telling Autoblog back in May, "We have a good relationship with Tesla and will evaluate the feasibility of working together on future projects." According to Automotive News, Musk said of the Japanese giant, "We love working with Toyota... We have a huge amount of respect for them as a company and certainly much to learn."

Interestingly, though, the two automakers have rather divergent strategies for eco-friendly automobiles. Toyota, as you're surely aware, is the clear-cut leader in hybrids and has thrown its massive support in the direction of hydrogen fuel cells, while Tesla has invested heavily in battery-electric technology and high-speed charging stations.

Recharge Wrap-up: 1M Lexus hybrids, Best Buy Geekmobile goes Prius

Wed, Apr 13 2016Cummins is developing a plug-in hybrid system for heavy trucks. Its plug-in system for Class 6 trucks (those with a gross vehicle weight between 19,000 and 26,000 pounds) is expected to improve fuel economy by 50 percent. Funded in part by a $4.5-million grant from the US Department of Energy (DOE), the system will use a battery pack and some form of range extending internal combustion engine. The system will employ various drive cycles in order to help commercial fleets save fuel based on their needs. Read more at Gas2. German automaker Borgward, LG Chem, Bosch, and software firm SAP have joined forces to form an electric mobility partnership. Borgward recently revived its brand with a new model, the BX7. Borgward has also announced that two other models, the BX5 and BX6, will be available as plug-in hybrids. SAP will provide software services, and LG Chem will supply battery technology to Borgward. Bosch will supply and help develop a number of components for Borgward cars. Read more at Inside EVs. Lexus has sold its millionth hybrid. The luxury automaker began selling hybrids with the electrified RX in 2005, and the millionth hybrid was a NX 300h sold to a customer in Milan, Italy. "This is my first Lexus," says the customer of that vehicle in a Lexus release, Aldo Pirronello. "... and I am honored to celebrate this important milestone with Lexus!" Lexus currently sells 10 hybrid models worldwide. Read more from Lexus. Best Buy's Geek Squad is switching from Volkswagen Beetle Geekmobiles to the Toyota Prius C. As part of an update to the home electronics chain's house call service, the Geeks will be driving more eco-friendly cars with a refreshed logo. More than 1,000 Prius C Geekmobiles are being deployed nationwide. With the Geek Squad answering more than 5 million house calls a year, the fuel savings from switching to a more efficient hybrid cars means reduced emissions over the 12.6 million miles they'll drive per year. Read more in the press release below. Vehicle of Choice for Geeks? Toyota Prius c An armada of agents is about to roll out in Toyota Prius c. Their mission: to help people across America get the most from their technology. Starting today, Best Buy's Geek Squad will dispatch more than 1,000 of the vehicles – fully decked out as the new Geekmobile – nationwide.