2024 Tesla Model X Standard Sport Utility 4d on 2040-cars

Engine:Dual AC Electric Motors

Fuel Type:Gasoline

Body Type:SUV

Transmission:Single-Speed Fixed Gear

For Sale By:Dealer

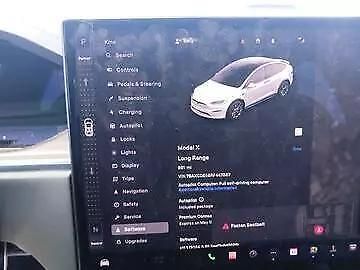

VIN (Vehicle Identification Number): 7SAXCDE58RF447887

Mileage: 890

Make: Tesla

Trim: Standard Sport Utility 4D

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: Model X

Tesla Model X for Sale

2018 tesla model x 100d(US $38,998.00)

2018 tesla model x 100d(US $38,998.00) 2018 tesla model x 75d(US $29,998.00)

2018 tesla model x 75d(US $29,998.00) 2020 model x 2020 long range plus awd fsd autopilot(US $42,995.00)

2020 model x 2020 long range plus awd fsd autopilot(US $42,995.00) 2020 tesla model x long range plus(US $49,995.00)

2020 tesla model x long range plus(US $49,995.00) 2017 tesla model x(US $34,900.00)

2017 tesla model x(US $34,900.00) 2022 tesla model x model x plaid(US $71,895.00)

2022 tesla model x model x plaid(US $71,895.00)

Auto blog

Sunday Drive: Performance comes in many shapes and sizes

Sun, Nov 19 2017The Chevrolet Corvette has always stood out as a bastion of reasonably priced performance, and the latest 'Vette has that in spades. And while its expected starting price of around $120,000 certainly isn't cheap, it's an undeniable deal in the supercar world – remember, this thing'll do 210 miles per hour thanks to its 755-horsepower supercharged V8 engine. And did you get a load of that massive rear wing? Team Corvette's longtime foe, the Porsche 911, is similarly hellbent on ultimate performance. And as a reminder of how long the Corvette/911 rivalry has been melting tires we present the 1990 Porsche 911 as reimagined by Singer you see below. It's beautiful, it's green, and it's packing 500 air-cooled horsepower. You don't have to burn gasoline to go fast, as proven by the second-generation Tesla Roadster, which was revealed as a surprise late last week. Elon Musk says it'll be the quickest car in the world with a 0-60 time of just 1.9 seconds. And while you may not think of a semi truck when you think speed, the Tesla Semi can do 0-60 in 5 seconds flat unloaded, or in 20 seconds with a load of 80,000 pounds. Compared to today's crop of diesel semis, that's amazing. Continuing the truck theme, we present an artists rendering of what the next-generation Ram 1500 pickup may look like. Spoiler alert: Ram's mini-semi look is giving way to something much more modern. There may even be a first-of-its-kind split tailgate at the rear. And if you don't think the Ram 1500 has anything to do with performance, we should remind you that it's one of the cheapest ways to get a tire-shredding Hemi V8 engine in America. 2019 Chevy Corvette ZR1: All hail the 755-horsepower C7 king This is the first Porsche 911 to get Singer and Williams' 500-horsepower engine Tesla Roadster surprise reveal | 'Quickest car in the world' Tesla Semi Truck revealed: Here are the key details This could be the next-generation 2019 Ram 1500 2019 Ram 1500 spotted with split tailgate

Tesla 'Model E' to likely get steel construction, sane price tag

Wed, 02 Jul 2014Tesla may have made major inroads with its Model S, and it's poised to enter new territory when it finally starts selling its Model X, an iconoclastic gullwing crossover. Neither of those may be as important as the model thereafter, which is expected to be its make-or-break sedan. It won't be called the Model E (thanks a lot, Ford), but the BMW 3 Series-challenging EV will be the litmus test that will determine if Tesla's EV future is palatable to the masses.

Part of that means proving that Tesla can be an affordable alternative to conventional internal-combustion-powered vehicles. According to the company's VP of engineering, Chris Porritt, the new sedan will do just that, thanks in no small part to the company's forthcoming gigafactory battery operations. But beyond that project, there are other things about this new EV that will make it a more alluring option to the average consumer.

Porritt mentioned "appropriate materials," to the UK's Autocar, which is likely another way of saying it's ditching the aluminum-intensive architecture of its big brother.

Recharge Wrap-up: Porsche Mission E charging for Tesla, net zero energy Toyota dealership

Wed, Oct 5 2016Porsche has confirmed that its Mission E charging infrastructure will also work with Tesla vehicles. The ultra-fast, 800-volt charging system will recharge the Mission E to 80 percent in about 15 minutes, and will also service new EVs from Volkswagen and Audi. Porsche CEO Oliver Blume told Top Gear that development of the charging infrastructure "sounds easy but getting the details agreed is hard. We already have the clear technical concept. It can even work with Teslas, with an adapter." Dieter Zetsche, Head of Mercedes-Benz, also tells Top Gear that they are "in talks" with Porsche regarding charging infrastructure. Read more at Top Gear, or from Electrek. An Oregon Toyota dealership is set to be the world's first net zero energy automotive dealership. The newly constructed, LEED Platinum certified Toyota of Corvallis produces more energy than it consumes, for which it is expected to receive Net Zero Energy certification. The 34,800-square-foot building is equipped with enough solar panels to produce as much energy that the dealership will use, with excess being put back into the grid, which will help during hours of peak demand. Toyota Motor Sales regional manager Steve Haag calls Toyota of Corvallis, "a first-of-its-kind template for the auto dealership of the future." Read more from Toyota. Valeo has introduced a new 48-volt hybrid system. The 48V e4Sport, as it is called, uses a 48-volt battery, electric starter-generator, electric supercharger, and eRAD electric rear axle drive for all-wheel drive. It maximizes regenerative braking and stores that energy for increasing torque with the starter-generator, and increasing acceleration with the electric supercharger. The system also supports all-electric driving modes. Valeo says the system is applicable across all vehicle segments, and works with both gasoline and diesel engines. Read more at Green Car Congress. PSA Group has created its own mobility solutions brand, called Free2Move. Free2Move will handle programs like car sharing, connected services, corporate fleet services, and affordable leasing programs for Peugeot, Citroen, DS, and other PSA partners. "For the PSA Group, mobility means not only making and selling excellent cars, but also offering a full range of mobility solutions," says PSA Group VP of Mobility Services Gregoire Olivier.