2022 Tesla Model X Plaid on 2040-cars

Staten Island, New York, United States

Engine:ELECTRIC

Fuel Type:Gasoline

Body Type:SUV

Transmission:--

For Sale By:Dealer

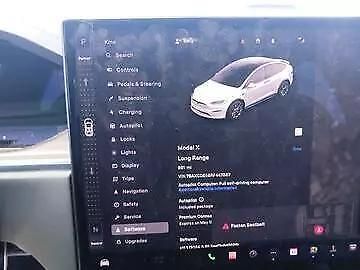

VIN (Vehicle Identification Number): 7SAXCBE69NF346655

Mileage: 18000

Make: Tesla

Trim: Plaid

Features: --

Power Options: --

Exterior Color: White

Interior Color: --

Warranty: Unspecified

Model: Model X

Tesla Model X for Sale

2022 tesla model x(US $79,900.00)

2022 tesla model x(US $79,900.00) 2024 tesla model x standard sport utility 4d(US $77,999.00)

2024 tesla model x standard sport utility 4d(US $77,999.00) 2018 tesla model x 100d(US $38,998.00)

2018 tesla model x 100d(US $38,998.00) 2018 tesla model x 75d(US $29,998.00)

2018 tesla model x 75d(US $29,998.00) 2020 model x 2020 long range plus awd fsd autopilot(US $42,995.00)

2020 model x 2020 long range plus awd fsd autopilot(US $42,995.00) 2020 tesla model x long range plus(US $49,995.00)

2020 tesla model x long range plus(US $49,995.00)

Auto Services in New York

X-Treme Auto Glass ★★★★★

Wheelright Auto Sale ★★★★★

Wheatley Hills Auto Service ★★★★★

Village Automotive Center ★★★★★

Tim Voorhees Auto Repair ★★★★★

Ted`s Body Shop ★★★★★

Auto blog

Analyst calls on Apple to buy Tesla

Tue, 29 Oct 2013This is the layman's understanding of how the tech world works: come up with an idea; execute idea; start making money; get bought out by Apple, Google or some other wealthy company seeking the Next Big Thing; retire to Fiji at age 23. Occasionally, though, one of those startups grows quickly enough to avoid being bought out by the big boys of Silicon Valley. Tesla is one such startup, and while it's an automaker as much as a tech company, the mingling of both worlds in its business model has helped the company survive since 2003, become publicly traded in 2010 and avoid being bought out by a bigger company (though the personality of its co-founder and CEO, Elon Musk, may have something to do with that, too).

This record of independence hasn't stopped the analysts from talking, though. According to CNN Money, Andaan Ahmad, a London-based investment banker with German bank Berenberg, has petitioned Apple CEO Tim Cook to buy out Tesla and bring Elon Musk into the Apple family. On paper, the move would sort of make sense: since the death of Steve Jobs, Apple appears to some to have been sagging, releasing better iterations of its currents products but lacking the big, new, industry-investing widget that makes people go mad. Expanding into the automotive market, a long-rumored destination for Apple, would allow the Cupertino, CA-based brand to stretch its legs in a new direction. As Ahmad notes, Apple needs to go "out of the box" or "the key debate will always be about [Apple's] ability to sustain these abnormal margins in [the] iPhone business."

Although not expressly discussed in the CNN story, we could also see some big benefits for Tesla. The Palo Alto-based automaker has been locked in a war over direct sales to customers with a number of dealership groups across the country, many of which have particularly powerful political lobbies. If Tesla had the backing of the world's most powerful company, which also has success in the business of upgrading traditional retail experiences, it could help establish the direct-sale model on a wider scale.

Mixed sales results, but automaker stocks rise on need for cars in Houston

Fri, Sep 1 2017DETROIT — The Big Three Detroit automakers on Friday reported better-than-expected August sales and issued optimistic outlooks for demand as residents of the Houston area replace flood-damaged cars and trucks after Hurricane Harvey, sending their stocks higher. General Motors, Ford and Fiat Chrysler posted mixed August U.S. sales, with GM up 7.5 percent and Ford and Fiat Chrysler down. Japanese automaker Toyota improved sales by nearly 7 percent, while Honda fell 2.4 percent. Still, analysts focused on the potential for Detroit automakers to cut inventories and stabilize used vehicle prices as residents of Houston, the fourth largest city in the United States, are forced to replace tens of thousands, perhaps hundreds of thousands, of vehicles after the devastation from Hurricane Harvey. Mark LaNeve, Ford's U.S. sales chief, told analysts on Friday that following Hurricane Katrina in 2005 "we saw a very dramatic snapback" in demand. That said, Ford sales fell 2.1 percent in August. It sold 209,897 vehicles in the United States, compared with 214,482 a year earlier. Sales were down 1.9 percent in the Ford division and off 5.8 percent at Lincoln. Demand was down for cars, crossovers and SUVs. It was not clear how many vehicles in the Houston area will be scrapped, LaNeve said, saying he had seen estimates ranging from 200,000 to 400,000 to 1 million. Ford's Houston dealers may have lost fewer than 5,000 vehicles in inventory, he said. Ford is the No. 1 automaker in the Houston market, with 18 percent share, according to IHS Markit. The company plans to ship used vehicles to Houston dealers and has "every indication we would have to add some production" of new vehicles to meet demand, LaNeve said. Investor concerns about inventories of unsold vehicles and falling used car prices have weighed on Detroit automakers' shares most of this year. Now, automakers can anticipate a jolt of demand from a big market that is a stronghold for Detroit brand trucks and SUVs. "It's got to be a positive for the industry," LaNeve said. Investors appeared to agree. GM shares rose as much as 3.3 percent to their highest since early March. Ford increased 2.8 percent at $11.34, and Fiat Chrysler's U.S.-traded shares were up 5.2 percent $15.91, hitting their highest in more than five years. GM reported a 7.5 percent increase in U.S. auto sales in August, helped by robust sales of crossovers across its four brands.

Tesla will fix 1,100 Model S motors in Norway

Thu, Nov 27 2014As far as we know, Tesla didn't build all of the Model S sedans it has sold in Norway at once, but it is just those vehicles that have been found defective and will soon be fixed. Tesla CEO Elon Musk has said that the company will replace defective Model S drive units sold in the Northern European country. Not a great way to start the holiday season. The issue involves a part that connects the Model S' drive motor to the gearbox, according to Dow Jones Business News. The part could break down because the company didn't apply enough grease to the part when the cars were produced. The issue may impact about 1,100 vehicles that had been shipped to Norway, though about one percent of those have already experienced "premature" wear and tear. The repairs for the couplings will take about a month. We suspect the news won't put much of a damper on Model S demand in a country that's been on the leading edge of electric-vehicle adoption with its high subsidies and cheap electricity. In March, Tesla set an all-time monthly sales record for any type of vehicle in Norway, moving almost 1,500 units that month. In fact, on a per-capita basis, the Model S sold more than the best-selling Ford F-150 here in the states that month.