2018 Tesla Model X 100d on 2040-cars

Engine:Electric Motor

Fuel Type:Electric

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 5YJXCAE20JF138274

Mileage: 34419

Make: Tesla

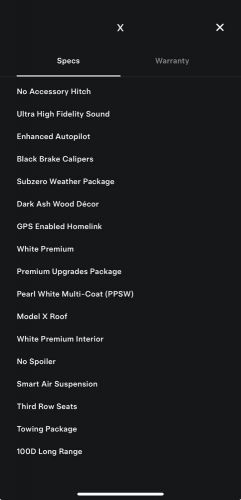

Trim: 100D

Drive Type: AWD

Features: --

Power Options: --

Exterior Color: Gray

Interior Color: CHARCOAL

Warranty: Unspecified

Model: Model X

Tesla Model X for Sale

2018 tesla model x 75d(US $29,998.00)

2018 tesla model x 75d(US $29,998.00) 2020 model x 2020 long range plus awd fsd autopilot(US $42,995.00)

2020 model x 2020 long range plus awd fsd autopilot(US $42,995.00) 2020 tesla model x long range plus(US $49,995.00)

2020 tesla model x long range plus(US $49,995.00) 2017 tesla model x(US $34,900.00)

2017 tesla model x(US $34,900.00) 2022 tesla model x model x plaid(US $71,895.00)

2022 tesla model x model x plaid(US $71,895.00) 2019 tesla model x long range(US $47,500.00)

2019 tesla model x long range(US $47,500.00)

Auto blog

Recharge Wrap-up: Tesla seeks Gigafactory architect, Uber hails carpools

Thu, Aug 7 2014Tesla is looking for an architect to help design its proposed Gigafactory battery manufacturing facility. According to the Palo Alto-based job listing, which is titled "Architect - Gigafactory," the applicant must have, among other qualifications, over five years of experience with "high-tech infrastructure and operational facilities (semiconductor, solar, battery, waste water treatment plants, etc.)." The job also includes being away from home quite a bit, as it the listing states, "This full time role requires the flexibility of traveling when needed (up to 70 percent) and doing whatever it takes to achieve project objectives." Think you've got what it takes? See the listing for yourself, here, or read more at Silicon Valley Business Journal. Tesla has appointed Robyn Denholm of Juniper Networks to its board of directors. Denholm is Executive Vice President, Chief Financial and Operations Officer at Juniper Networks. Denholm replaces Brad Buss as chair of Tesla's Audit Committee and a member of the company's Compensation and Nominating and Corporate Governance committees. Buss will remain a member of Tesla's board as he joins SolarCity as CFO. Denholm is Tesla's first female director. Read more at Bloomberg, or in the press release below. Uber, the company behind the now famous ride-hailing app, is introducing its carpooling service, UberPool. The service matches drivers with (hopefully multiple) passengers going to similar destinations, with users paying just a fraction of the cost of a normal taxi, or even an Uber ride. If a rider can't get matched with a driver, they can enjoy a discounted Uber ride. As the company points out in its blog, "At these price points, Uber really is cost-competitive with owning a car, which is a game-changer for consumers." UberPool is currently running a private beta program, which it plans to expand on August 15. Read more in-depth about the UberPool at Forbes, or learn more at Uber's blog. For a few reasons why this new expansion might run afoul of archaic laws (put there to keep entrenched interests in play), check out Engadget. Plug-in hybrids are encouraging an evolution of transmission technology. Companies like Schaeffler and ZF Friedrichshafen are adapting their transmissions to include electric motors within them for use in plug-in hybrids. For example, the electric motor in ZF's eight-speed powers the transmission when the internal combustion engine is shut off.

Tesla loses top communicator Simon Sproule to Aston Martin

Wed, Oct 8 2014Looking for a new job? Have experience working in a frenetic environment, promoting cutting-edge mobility products for a demanding boss determined to change the way we travel on this planet, as well as how we trek to others? We hear Tesla Motors just might have an opening for such a person. Again. Simon Sproule, the electric automaker's vice-president of communications and marketing is vacating his cubicle after a mere six months in order to become the chief marketing officer (CMO) over at Aston Martin. That position had gone begging for a year until this appointment. Once he's settled into his new digs, Sproule will again be breaking rock with former Nissan associate Andy Palmer who himself recently took the top spot at the British luxury marque. The move comes at what seems like an inopportune time for Tesla. It has a big D product announcement – suspected to be an all-wheel-drive update of the Model S – scheduled just two days from now and the reveal of its "mass market" Model ? early next year. The company declined our offer to comment on the situation. Aston Martin, on the other hand, should be happy to finally have someone at the marketing helm, what with the recent dropping of the veil from its Lagonda sedan and what's likely to be a bevy of new product built on its forthcoming platform. News Source: PR WeekImage Credit: Haruyoshi Yamaguchi / Bloomberg via Getty Images Green Marketing/Advertising Aston Martin Tesla simon sproule

The ugly economics of green vehicles

Sat, Sep 20 2014It's fair to say that most consumers would prefer a green vehicle, one that has a lower impact on the environment and goes easy on costly fuel (in all senses of the term). The problem is that most people can't – or won't – pay the price premium or put up with the compromises today's green cars demand. We're not all "cashed-up greenies." In 2013, the average selling price of a new vehicle was $32,086. The truth is that most Americans can't afford a new car, green or not. In 2013, the average selling price of a new vehicle was $32,086. According to a recent Federal Reserve study, the median income for American families was $46,700 in 2013, a five-percent decline from $49,000 in 2010. While $32,000 for a car may not sound like a lot to some, it's about $630 a month financing for 48 months, assuming the buyer can come up with a $6,400 down payment. And that doesn't include gas, insurance, taxes, maintenance and all the rest. It's no wonder that a recent study showed that the average family could afford a new car in only one of 25 major US cities. AutoTrader conducted a recent survey of 1,900 millennials (those born between 1980 and 2000) about their new and used car buying habits. Isabelle Helms, AutoTrader's vice president of research, said millennials are "big on small" vehicles, which tend to be more affordable. Millennials also yearn for alternative-powered vehicles, but "they generally can't afford them." When it comes to the actual behavior of consumers, the operative word is "affordable," not "green." In 2012, US new car sales rose to 14.5 million. But according to Manheim Research, at 40.5 million units, used car sales were almost three times as great. While the days of the smoke-belching beater are mostly gone, it's a safe bet that the used cars are far less green in terms of gas mileage, emissions, new technology, etc., than new ones. Who Pays the Freight? Green cars, particularly alternative-fuel green cars, cost more than their conventional gas-powered siblings. A previous article discussed how escalating costs and limited utility drove me away from leasing a hydrogen fuel cell-powered Hyundai Tucson, which at $50,000, was nearly twice the cost of the equivalent gas-powered version. In Hyundai's defense, it's fair to ask who should pay the costs of developing and implementing new technology vehicles and the infrastructure to support them.