2016 Tesla Model X on 2040-cars

Ringwood, New Jersey, United States

Transmission:Automatic

Fuel Type:Electric

For Sale By:Private Seller

Vehicle Title:Clean

Engine:EV

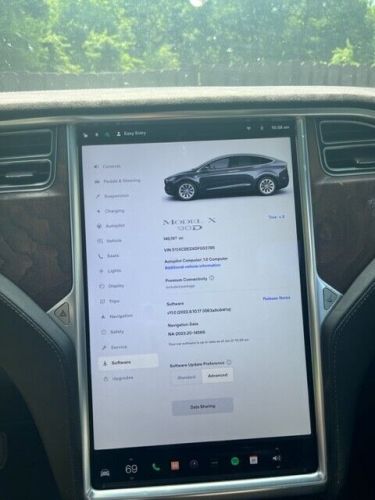

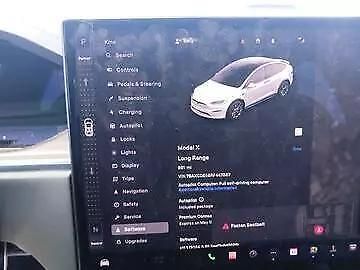

VIN (Vehicle Identification Number): 5YJXCBE2XGF003785

Mileage: 146197

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Number of Seats: 7

Number of Previous Owners: 0

Manufacturer Interior Color: Black

Service History Available: Yes

Make: Tesla

Drive Type: AWD

Drive Side: Left-Hand Drive

Exterior Color: Gray

Model: Model X

Car Type: Passenger Vehicles

Number of Doors: 4 Doors

Features: Air Conditioning, Alarm, Alloy Wheels, Automatic Headlamp Switching, Automatic Wiper, Climate Control, Cruise Control, Electric Mirrors, Electrochromic Interior Mirror, Electronic Stability Control, Folding Mirrors, Independent and Adjustable Rear Seats, Leather Interior, Leather Seats, Navigation System, Panoramic Glass Roof, Parking Assistance, Parking Sensors, Particulate Filter, Power Locks, Power Seats, Power Steering, Power Windows, Rear Spoiler, Seat Heating, Sport Seats, Tilt Steering Wheel, Tinted Rear Windows, Top Sound System, Xenon Headlights

Tesla Model X for Sale

2022 tesla model x plaid(US $74,999.00)

2022 tesla model x plaid(US $74,999.00) 2022 tesla model x(US $79,900.00)

2022 tesla model x(US $79,900.00) 2024 tesla model x standard sport utility 4d(US $77,999.00)

2024 tesla model x standard sport utility 4d(US $77,999.00) 2018 tesla model x 100d(US $38,998.00)

2018 tesla model x 100d(US $38,998.00) 2018 tesla model x 75d(US $29,998.00)

2018 tesla model x 75d(US $29,998.00) 2020 model x 2020 long range plus awd fsd autopilot(US $42,995.00)

2020 model x 2020 long range plus awd fsd autopilot(US $42,995.00)

Auto Services in New Jersey

Woodland Auto Body ★★★★★

Westchester Subaru ★★★★★

Wayne Auto Mall Hyundai ★★★★★

Two Guys Autoplex 2 ★★★★★

Toyota Universe ★★★★★

Total Automotive, Inc. ★★★★★

Auto blog

Recharge Wrap-up: Tesla hiring new sales executives, A123 focuses on starter batteries

Mon, Mar 16 2015A123 Systems is shifting more of its focus to lithium-ion starter batteries for cars with stop-start systems. The company sees the smaller batteries as a safer, more viable way to bounce back from its recent bankruptcy than by providing battery packs to power EVs. A123 still provides EV batteries to China, and hopes to provide them to Fisker, which is now owned by a mutual parent company, Wanxiang. A123's Detroit facility is currently building starter batteries for Mercedes-Benz, with microhybrid battery production expected in within the next few years. Read more at Automotive News. Tesla Motors Vice President of Worldwide Sales and Service Jerome Guillen is being reassigned to a role in customer satisfaction. After struggling sales in California and China, Tesla is also seeking sales executives for its three major sales regions: North America, Europe and Asia. "Once they are on board, Jerome's focus will be on post- sales activity from delivery to long-term customer care, where he has done an incredible job," says Tesla. For 2014, North America made up about 55 percent of Tesla's sales, while Europe and Asia made up 30 and 15 percent, respectively. Tesla expects those numbers to eventually be distributed evenly, and aims to increase sales by 74 percent this year. Read more at Automotive News. David Noland of Green Car Reports wants Tesla to address a double-pedal problem in the Model S. Noland says that when both the accelerator and brake pedal are pressed at the same time, it can increase the stopping distance, creating unsafe situations. Noland, along with other drivers with large feet, are having problems with this due to the narrow spacing between the pedals. Elon Musk has stated that the Model S limits torque in a double-pedal situation, but Noland's own tests find some inconsistencies. Noland would like to see a change to the firmware to address this problem. Read more at Green Car Reports. Featured Gallery Tesla Model S View 10 Photos Related Gallery 2012 Fisker Karma: Second Drive View 30 Photos News Source: Automotive News, Automotive News, Green Car ReportsImage Credit: Tesla Motors Green Fisker Tesla Green Automakers Safety Electric recharge wrapup

Recharge Wrap-up: BMW i3 goes against Mercedes B-Class ED, Tesla good for business

Wed, Sep 17 2014Car and Driver has published a comparison test pitting the 2014 BMW i3 against the 2014 Mercedes-Benz B-class Electric Drive. The test not only measured the quality of the driving experience, but also all the quantitative details that are especially important when looking at electric vehicles. For instance, the Benz's real-world MPGe surpassed its own rating, but it still couldn't match the BMW. The B-Class, though, won in the range department. We won't spoil all the results, or Car and Driver's overall pick, but you can head over to the article to find out for yourself. Tesla's expanding business, including the Gigafactory being built in Reno, NV, is encouraging growth in the locales and associated businesses. Some of Tesla's suppliers are talking of relocation, wanting to be close to the action stirred up by the electric automaker's expansion. It makes good business sense to be in the same neighborhood as Tesla. "We can react quickly, and our engineers are constantly working with Tesla," says Futuris General Manager Sam Coughlin. Brookings Institute fellow Jennifer Vey says, "The land around Tesla is being redeveloped and reimagined. It's a mash-up of an anchor campus, startups, housing and transit, in a physically compact area where companies can cluster and connect." Read more at San Jose Mercury News. EVs are doing even more to reduce energy use clean up the air, according to new analysis from the Union of Concerned Scientists. According to findings, 60 percent of Americans now live in areas where EVs do more to reduce emissions than hybrids, up from 45 percent in 2012. Average electricity use is now 0.325 kWh per mile, down five percent from 2011. EV performance - in terms of mileage and emissions - is improving compared to traditional fuel vehicles, based on the sources of electricity in various regions. Read more from the Union of Concerned Scientists. Zipcar's carsharing network has launched in Paris. Zipcar is expanding across Europe, and has already established itself in Austria, Spain and the UK. According to Zipcar France's General Manager Etienne Hermite, "In a highly populated city, Zipcar's model has been proven to remove up to 15 personally owned vehicles from the road for each Zipcar in service, reducing parking demand, congestion and emissions." Zipcar European President Massimo Marsili hopes that most Parisians will eventually be just a short walk from a Zipcar.

Ford files trademark application for 'Model E'

Fri, 27 Dec 2013In early December, Ford filed an application with the US Patent and Trademark Office for the name "Model E." Historically, Ford never produced a Model E, and while automakers are known to file for trademarks they never use, some have wondered if the application might be used for a concept car.

Based on other recent events, though, it could be a legal move. In 2000 Ford sued an online start-up called Model E over the similarity of that name to Ford's industry-shaping Model T, but the judge dismissed the case citing lack of proper grounds. In August 2013, Tesla applied for trademark registration for Model E, and at the time, Ford said it would review the application. Tesla actually made two applications for Model E, one for automobiles and structural parts therefore, the other for "providing maintenance and repair services for automobiles," and there are plenty of theories about what the name could be applied to.

The Published for Opposition date for Tesla's applications is December 31, 2013, after which anyone who thinks they'd be harmed by Tesla being granted the trademark gets 30 days to register their issues. This is just speculation, but Ford's application - which was filed for automobiles only - might be about protecting what it sees as unwelcome encroachment on the name Model T, protection it wasn't able to enforce before when the stakes were only online and much smaller.