Engine:Electric Motor

Fuel Type:Electric

Body Type:4D Hatchback

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 5YJSA1E5XRF538784

Mileage: 6792

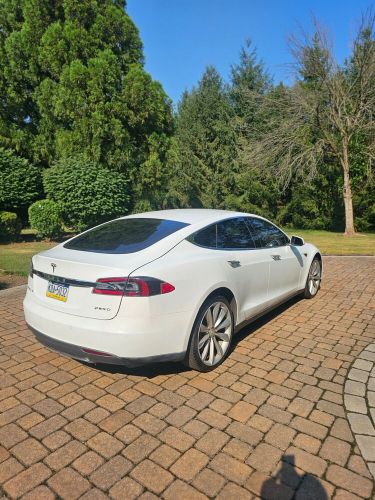

Make: Tesla

Features: --

Power Options: --

Exterior Color: Black

Interior Color: --

Warranty: Unspecified

Model: Model S

Tesla Model S for Sale

2023 tesla model s plaid yoke steering wheel 21"s - fsd ready(US $79,990.00)

2023 tesla model s plaid yoke steering wheel 21"s - fsd ready(US $79,990.00) 2021 tesla model s long range dual motor all-wheel drive(US $49,851.00)

2021 tesla model s long range dual motor all-wheel drive(US $49,851.00) 2021 tesla model s long range dual motor all-wheel drive(US $53,373.00)

2021 tesla model s long range dual motor all-wheel drive(US $53,373.00) 2014 tesla model s(US $305.00)

2014 tesla model s(US $305.00) 2015 tesla model s(US $5,215.00)

2015 tesla model s(US $5,215.00) 2016 tesla model s 75d(US $18,900.00)

2016 tesla model s 75d(US $18,900.00)

Auto blog

Tesla Model 3: Finding perspective

Sat, Apr 2 2016The reveal of the Tesla Model 3 this week was one of the biggest automotive events of the year. The car attracted 180,000 pre-orders in just 24 hours, gave the company's stock a jolt, and set Tesla on a more ambitious growth path for the rest of the decade. It's a staggering feat considering the Model 3 is one car, from one company that's just 13 years old. It begs the question: Is all of this attention warranted? Barclays analyst Brian Johnson urged investors to "take a deep breath," and be mindful that the Model 3 won't likely arrive in "significant volume" until possibly 2019. Though Tesla promises the car will launch in 2017, Johnson points to the slow rollouts of the Model S sedan and Model X crossover as cautionary notes. The potential extended wait didn't temper the enthusiasm of Tesla's faithful, and many put down deposits before they had even seen the car. Johnson compared the hype to a "Black Friday atmosphere," saying the social media buzz went from "insane mode to ludicrous mode," in a riff on Tesla's driving features. Still, the Barclays analyst was admittedly "curmudgeonly" when it came to Tesla's stock price. In comparison, Morgan Stanley called Tesla's shares undervalued, and expects the Model 3 to be the start of cataclysmic changes in the industry. "We have said for some time that, despite its many worthy accomplishments, Tesla had not yet truly disrupted the auto industry," according to a report led by Adam Jonas. "We are now getting a feeling that this may be starting to change." The Model 3 offers a range of 215 miles on a single charge, can sprint to 60 miles per hour in less than six seconds, and has room for five. It will also be capable of charging on Tesla's supercharging network and features the company's autonomous technology. With a starting price of $35,000 before incentives, it's arguably the most futuristic car that's attainable for a wide swatch of American buyers, though the Chevy Bolt EV is comparable (200-plus-mile range, $37,500 MSRP before incentives) in many ways. The Model 3's attainability is what partially drove the hype. It was like Elon was whispering: Y ou can own the future. The question is now: Can Tesla deliver? If it does, this early fanfare will be richly deserved. News & Analysis News: Top Gear appears to be in turmoil as Chris Evans works four hours a day. Analysis: Is this a soap opera or a car show?

Consumer Reports scores Tesla Model S 99 out of 100 [w/video]

Thu, 09 May 2013Consumer Reports is awfully fond of the Tesla Model S. The EV managed to pull down an impressive score of 99 out of 100 in the organization's evaluation, besting the Porsche Panamera Hybrid by a full 16 points. CR calls the battery-operated sedan "the most practical electric car we've ever tested" thanks to its 200 mile range and blistering 5.6-second dash to 60 miles per hour. Testers also had praise for the vehicle's excellent handling characteristics and clever packaging, but found issue with the large touch screen mounted in the center of the dash. According to CR, the screen requires too much time looking down and away from the road.

The publication also called out the car for skipping the spare tire, compressor and run flat tires, but those issues weren't enough to keep the machine from earning a top nod. You can head over to Consumer Reports to read the full review for yourself, and be sure to check out the video below for a better picture of the machine's highlights, including some EV drifting (even CR likes to have some fun).

Autoblog Minute: Finalists announced for 2016 Tech of the Year award

Thu, Oct 29 2015Here are the finalists for Autoblog's 2016 Technology of the Year award. Autoblog's Chris McGraw reports on this edition of Autoblog Minute, with commentary from Autoblog executive producer Adam Morath, AutoblogGreen editor-in-chief Sebastian Blanco, and Autoblog senior editor Alex Kierstein. Show full video transcript text [00:00:00] It's Fall here in Detroit and for us that means it's time for football, autumn beers, and the fourth annual Autoblog Tech of the Year awards. I'm Chris McGraw and this is your Autoblog Minute. Tech of the Year is one of our favorite things here at Autoblog. It's a time when we get celebrate all the best tech from the industry we love most. [00:00:30] - [00:01:00] [Commentary form Adam Morath, Sebastian Blanco, Alex Kierstein] Past winners include, Tesla's Supercharger network, FCA's Uconnect system and the BMW i8. In 2016 we're doing something a little different for Tech of the Year. We've separated our award into two categories. One award for best tech car, and a second award for best technology of the year. The nominees for best car in 2016 are: [00:01:30] the Tesla Model S, the Chevrolet Volt, and the BMW 7 series. The nominees for best tech in 2016 are: Apple CarPlay, Android Auto, Volkswagen's MiB II with AppConnect, Ford Sync 3, Audi's Virtual Cockpit, the Smart Cross Connect App, and Volvo Sensus. [00:02:00] We're going to announce Autoblog's Tech of the Year winners in January at the 2016 North American International Auto Show, in Detroit. For Autoblog, I'm Chris McGraw. Autoblog Minute is a short-form video news series reporting on all things automotive. Each segment offers a quick and clear picture of what's happening in the automotive industry from the perspective of Autoblog's expert editorial staff, auto executives, and industry professionals. Green BMW Chevrolet Ford Hummer smart Tesla Volkswagen Volvo Technology Infotainment Autoblog Minute Videos Original Video