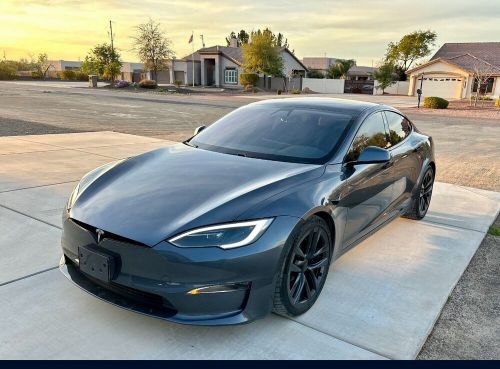

2022 Tesla Model S on 2040-cars

Peoria, Arizona, United States

Transmission:Automatic

Vehicle Title:Clean

Engine:Electric

Fuel Type:Electric

VIN (Vehicle Identification Number): 5YJSA1E5XNF482825

Mileage: 32000

Model: Model S

Exterior Color: Grey

Make: Tesla

Drive Type: AWD

Tesla Model S for Sale

2020 tesla model s long range plus(US $42,880.00)

2020 tesla model s long range plus(US $42,880.00) 2012 tesla model s(US $18,500.00)

2012 tesla model s(US $18,500.00) 2022 tesla model s(US $41,000.00)

2022 tesla model s(US $41,000.00) 2022 tesla model s(US $67,500.00)

2022 tesla model s(US $67,500.00) 2017 tesla model s 75d(US $26,720.00)

2017 tesla model s 75d(US $26,720.00) 2013 tesla model s(US $33,000.00)

2013 tesla model s(US $33,000.00)

Auto Services in Arizona

yourcarguyaz.com ★★★★★

VW & Audi Independent Service and Repair Specialist ★★★★★

USA Auto Glass Repair ★★★★★

Truck And Trailer Parts Incorporated ★★★★★

Tony`s Auto Repair ★★★★★

TintAZ.com Mobile Window Tinting ★★★★★

Auto blog

Tesla Model S successfully hacked by Zhejiang University team

Fri, 18 Jul 2014The $10,000 prize for successfully hacking a Tesla Model S has been claimed. A team from Zhejiang University in China claimed victory at the Symposium on Security for Asia Network (SyScan360) event in Beijing by exploiting a "flow design flaw," whatever that means, to gain access to vital systems including the door locks, horn and window controls, while the vehicle was moving.

The group that was able to hack a Tesla reported its findings to the electric car automaker, so this security breach will hopefully be fixed in short order. The event was welcomed by Tesla, which said it "[supported] the idea of providing an environment in which responsible security researchers can help identify potential vulnerabilities."

Last year, potential security pitfalls of high-tech electric and hybrid cars came to light when the US Defense Department's Defense Advanced Research Projects Agency (better known as DARPA) successfully hacked into hybrids from Ford and Toyota. Questions about the security of the Tesla Model S have been raised before. If you're wondering why all this might be such a big deal, we suggest you watch this.

Buick tops in Consumer Reports' annual brand rankings

Wed, Feb 25 2015Buick is the first US-based automotive brand to crack the top 10 in Consumer Reports magazine's annual brand report cards. US automakers also placed three vehicles on the magazine's list of "top picks" for vehicles, the first time that's happened in 17 years. The rankings were unveiled Tuesday in the magazine's annual auto issue. Buick placed seventh in the brand rankings. But the brand rankings and top picks still were dominated by Japanese and German manufacturers, with Lexus, Mazda, Toyota, Audi and Subaru taking the top five brand spots. The magazine calculates each brand's overall score with a composite of its vehicles' road-test scores and reliability scores for each model in its annual survey of subscribers. It's the third year for the brand rankings. Porsche placed just ahead of Buick at number six, while Honda, Kia and BMW rounded out the top 10 brands. Mercedes-Benz, Acura and Infiniti all suffered precipitous declines in their rankings due to unreliable new models or poor road test scores. Mercedes fell out of the top 10 to 21st, while Acura dropped from number two to 11 with an unimpressive test of the new RLX sedan, the magazine said. In the model rankings, the top overall finisher was California-based Tesla's Model S electric car, for the second year in a row. The Model S, which cost the magazine $89,650, finished first due to its performance and technical innovations, the magazine said. Buick's Regal midsize car beat the BMW 328i as the top sports sedan, and the Chevrolet Impala was named the top large car. The model rankings show Consumer Reports' favorite among the 270 vehicles its team has recently tested. The rankings are closely watched in the auto industry, since shoppers consistently cite Consumer Reports as a main source of car-buying advice. Other top picks included the Subaru Impreza in the compact car category, Subaru Legacy in midsize cars, Toyota Prius as the best green car, Audi A6 luxury car, Subaru Forester small SUV, Toyota Highlander midsize SUV and the Honda Odyssey minivan. Japanese vehicles won six of 10 top pick categories, but that was the smallest number in the 19-year history of Consumer Reports top picks. "For years domestic automakers built lower-priced and lower-quality alternatives to imports, but those days are behind us," said Jake Fisher, the magazine's director of automotive testing. But other U.S.-based automakers still had problems.

Watch Wired go hands-on with Tesla Model S 4.0

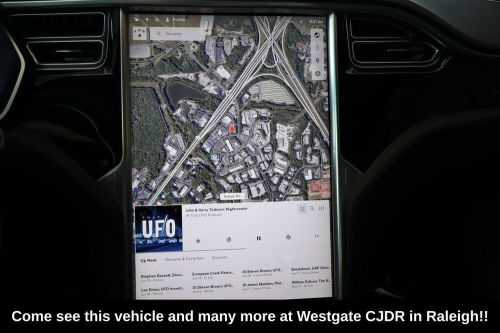

Mon, 17 Dec 2012Our friends at Wired recently got their hands on the latest software release for the Tesla Model S. The 4.0 release adds a few interesting bits of functionality to the EV, including voice control for the navigation and telephone systems as well as Slacker Radio. Tesla employed Google voice-recognition software for the Model S, and Wired says the system is "far easier and more intuitive than most." High praise.

The update also adds another level of customization to the EV's steering wheel controls. The right knob now offers finer audio volume control while the left knob can be configured to handle everything from temperature setting to fan speed or even the opening and closing of the sunroof.

Wired also reports the 17-inch touch screen on the Model S now seems more responsive and that the update includes new graphical displays for the vehicle's range. Other nice tricks include revised throttle response and an adjustment to the vehicle's door handles - now owners need only approach their Model S for the door handles to pop out from their hiding places. You can check out the video below for a closer look.