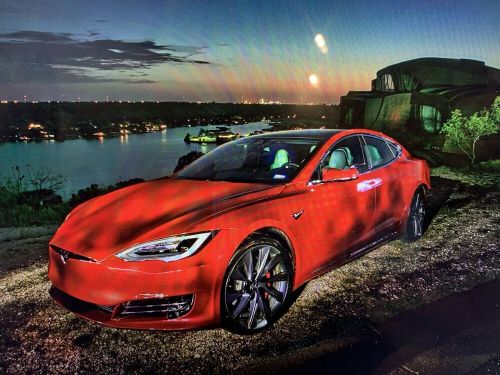

2020 Tesla Model S Performance Ludicrous on 2040-cars

Lubbock, Texas, United States

Transmission:Automatic

Fuel Type:Electric

For Sale By:Private Seller

Vehicle Title:Clean

Engine:Electric

Year: 2020

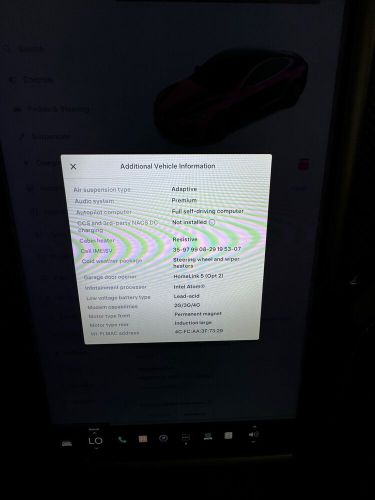

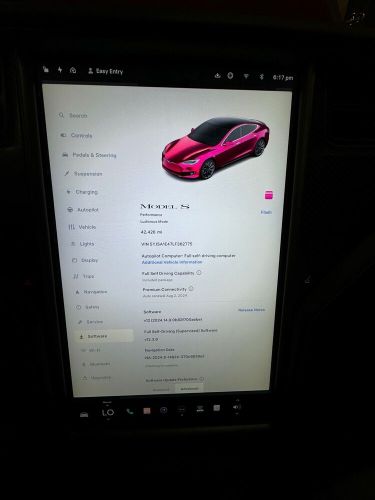

VIN (Vehicle Identification Number): 5YJSA1E47LF362775

Mileage: 42500

Trim: Performance Ludicrous

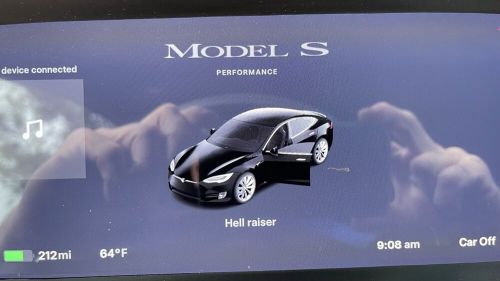

Make: Tesla

Drive Type: AWD

Model: Model S

Exterior Color: Red

Tesla Model S for Sale

2019 tesla model s long range raven performance p 100 top-of-the-line(US $21,100.00)

2019 tesla model s long range raven performance p 100 top-of-the-line(US $21,100.00) 2022 tesla model s(US $68,000.00)

2022 tesla model s(US $68,000.00) 2013 tesla model s(US $12,000.00)

2013 tesla model s(US $12,000.00) 2023 tesla model s plaid(US $78,000.00)

2023 tesla model s plaid(US $78,000.00) 2022 tesla model s plaid(US $68,000.00)

2022 tesla model s plaid(US $68,000.00) 2020 tesla model s long range(US $28,000.00)

2020 tesla model s long range(US $28,000.00)

Auto Services in Texas

Wolfe Automotive ★★★★★

Williams Transmissions ★★★★★

White And Company ★★★★★

West End Transmissions ★★★★★

Wallisville Auto Repair ★★★★★

VW Of Temple ★★★★★

Auto blog

Recharge Wrap-up: Japan supports hydrogen, Fools against fuel cells, BlueIndy controversy

Wed, Jun 25 2014Japan hopes to expand the use of hydrogen energy by subsidizing fuel cell vehicles, according to The Japan News. The trade ministry plans to include the subsidies in its 2015 budget to coincide with the expected launch of Toyota's Fuel Cell Vehicle and the Honda FCEV hydrogen car. By jump-starting purchases of hydrogen cars, Japan hopes that innovation and mass-production will get a boost and the cost of fuel cell vehicles will be competitive with gasoline-powered models by the year 2025. Japan plans to have 100 hydrogen fueling locations operating by March 2016, and wants to halve the cost of building those stations by 2020. The amount of the subsidies has not yet been set. Investing website The Motley Fool isn't quite as optimistic as Japan about hydrogen cars, and is instead bullish about Tesla Motors. The Fool points to Tesla's strong stock performance, and predicts future growth will come from more car models in the future - starting with the Model X - as well as the company's proposed Gigafactory for manufacturing batteries. If Tesla's charging technology continues to catch on, that only improves its financial prospects. The article has some harsh words, however, for hydrogen: "Fuel cells are an inferior automotive technology and for fundamental efficiency, cost, and infrastructure reasons always will be mere compliance gimmicks." Yeesh. As part of a program to build charging stations for the Indianapolis EV carsharing service BlueIndy, utility company Indianapolis Power & Light (IPL) wants to raise its electricity rates an average of 44 cents a month per residential customer to help pay for its share of the project. State consumer advocacy agency Indiana Office of Utility Consumer Counselor and consumer watchdog group Citizens Action Coalition oppose the plan, according to Greenfield, Indiana's Daily Reporter. The BlueIndy program, which is a partnership between the city of Indianapolis and battery manufacturer Bollore Group, will provide up to 500 cars for rent at 25 charging sites around the city. Those who oppose the rate hike call IPL a monopoly and say the amount of the increase is not allowed under state law and that the program wouldn't benefit working class and low-income citizens. A hearing regarding IPL's proposal is scheduled for July 23. A Mitsubishi Outlander PHEV will run the 2014 Asia Cross Country Rally, Hybrid Cars reports. The rally covers 1,367 miles of woods, swamps and mountains from Thailand to Cambodia.

1 in 7 Americans say they might buy an EV next, as sales of electrics surge

Wed, Apr 26 2017About one in seven driving Americans may likely purchase an electric vehicle as their next car, according to an AAA poll, meaning that as many as 30 million Americans may pony up for an EV within the next three to five years. While some of the motivation is environmental, survey recipients say that lower maintenance expenses and solo access to high-occupancy-vehicle lanes are also among the factors behind potentially going electric. Take a look at the AAA press release on the study here. The poll indicates that about as many people are planning to buy an EV for their next car as are looking to buy a pickup, which is impressive given that the best-selling US vehicle is the Ford F-150. And things should only improve, as about 20 percent of millennials polled said that their next car would probably be an EV. The results are all the more encouraging, at least among green-car advocates, because gas prices have fallen about 40 percent within the past five years, meaning that there's less of an incentive to go electric from a purely economic perspective. Through the first quarter of this year, US plug-in vehicle sales were up about 63 percent from a year earlier to about 39,000 vehicles. Meanwhile, when it came to AAA's annual green-vehicle awards for this year, Tesla's Model S and Model X took the large car and SUV categories, respectively, while the Chevrolet Bolt and Volkswagen e-Golf were listed atop the subcompact and compact lists. The Lexus GS 450h hybrid and the Ford F-150 took home AAA's best green vehicle in the midsize and pickup truck categories. Related Video:

Superchargers power Tesla Model S EVs for over 8M miles [UPDATE]

Tue, Jan 14 2014Ahead of the company's press conference at the Detroit Auto Show tomorrow, Tesla is talking up its Supercharger network with some impressive numbers. Tesla's Alexis Georgeson told AutoblogGreen that Tesla Model S EVs have driven more than eight million miles on Supercharger fill-ups. That's the equivalent of 33-and-a-half trips to the moon and back. We can see how quickly the free Superchargers are getting popular by comparing this milestone to where we were four short months ago. At the end of September, after the Superchargers had been installed for a year, Tesla drivers had hit 3.2 million miles. The rapid increase since then is due mostly to there simply being a lot more chargers being available now. Tesla representatives told us that there are over 70 Supercharger stations in the world today (58 in North America and 14 in Europe) and that six were installed in the past week. Georgeson didn't have numbers on hand to say which stations were the most popular or other details, but did say that it's safe to assume that the Supercharger in Lusk, WY (pictured), part of a sweeping 'S' shape from Los Angeles through the northern US and on to Chicago and the East Coast, is not the most frequently visited. The next target for expansion is finishing the Boston-to-Miami corridor, which means putting in more Superchargers in North Florida and South Carolina. At CES last week, the Supercharger network won our AOL Technology of the Year award. *UPDATE: Tesla just let us know that 8 million is a little premature. The current number is actually closer to 7.5 million, but the total should crest the 8-million mark soon.