2020 Tesla Model S on 2040-cars

Delafield, Wisconsin, United States

Body Type:Sedan

Vehicle Title:Rebuilt, Rebuildable & Reconstructed

Engine:Electric

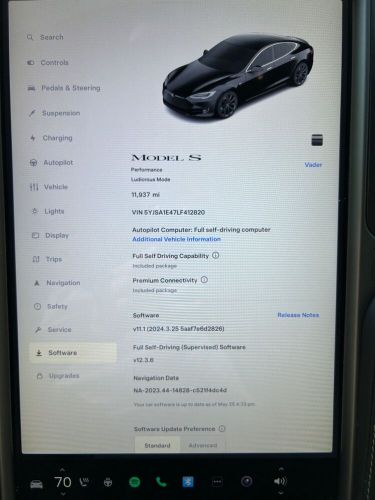

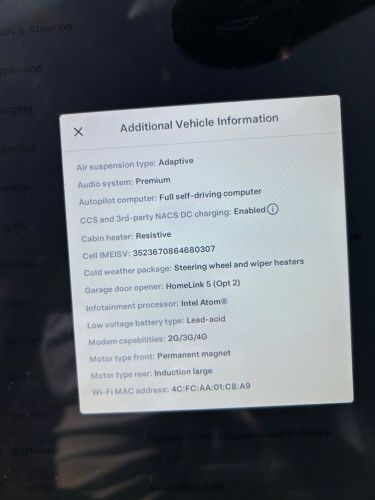

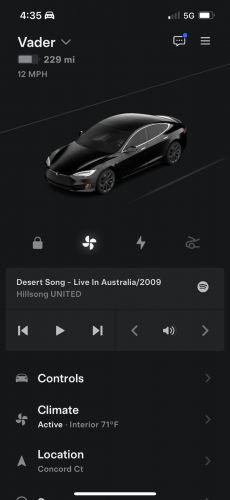

Year: 2020

VIN (Vehicle Identification Number): 5YJSA1E47LF412820

Mileage: 11945

Interior Color: Black

Fuel: electric

Model: Model S

Exterior Color: Black

Make: Tesla

Drive Type: AWD

Tesla Model S for Sale

2021 tesla model s plaid(US $67,900.00)

2021 tesla model s plaid(US $67,900.00) 2018 tesla model s 75d(US $18,352.00)

2018 tesla model s 75d(US $18,352.00) 2020 tesla model s awd long range 4dr liftback(US $21,100.00)

2020 tesla model s awd long range 4dr liftback(US $21,100.00) 2018 tesla model s p100d sedan 4d(US $36,990.00)

2018 tesla model s p100d sedan 4d(US $36,990.00) 2024 tesla model s(US $81,900.00)

2024 tesla model s(US $81,900.00) 2013 tesla model s(US $12,900.00)

2013 tesla model s(US $12,900.00)

Auto Services in Wisconsin

Whitewater Glass Co. ★★★★★

Ultimate Rides ★★★★★

Taylor Made Repairs ★★★★★

Sheboygan Chevrolet Buick GMC Cadillac ★★★★★

Russ Darrow Toyota ★★★★★

Russ Darrow Chrysler ★★★★★

Auto blog

Analyst predicts GM will buy Tesla in 2014

Mon, 30 Dec 2013There's little question that Tesla has come at the automotive industry as an outsider. But will it last as an outsider for much longer? Not if you ask Yra Harris of Praxis Trading. According to USA Today, the veteran financial analyst recently predicted on CNBC that General Motors will try to buy Tesla in 2014.

It certainly wouldn't be the first time that GM acquired another automaker. It did just that when it purchased the rights to the Hummer brand from AM General in 1999 and completed its takeover of Saab the year after. But, of course, The General has since divested from both, shutting down its Pontiac and Saturn brands in the process. Daewoo and Oldsmobile are gone too, as is Geo. Chevrolet is to be withdrawn from Europe, and over the past few years, GM has sold its minority stake in Isuzu, Subaru, Suzuki and PSA Peugeot-Citroën as well.

Of course, none of these are dedicated electric carmakers like Tesla is, and the Volt may not be doing as well as Detroit had initially hoped. But does that mean it's ready to start expanding its brand portfolio again? With all due respect to Mr. Harris, somehow we doubt it - especially with Tesla currently enjoying sky-high market valuation. The company's market capitalization stands at over $18 billion - more than 100-plus times its earnings. That would make mounting a Tesla takeover a hugely risky and costly endeavor unless Wall Street tempers its stock value greatly.

Tesla loses fight to set up its own dealers in Texas

Tue, 04 Jun 2013For a while there, it seemed like Tesla could do no wrong. But despite repaying its Department of Energy loans early, surging stock prices and even announcing a vast network of proposed Superchargers, Tesla is still in the fight of its life for how to get its cars sold.

According to Automotive News, the startup EV-maker lost its second straight battle to sell cars in dealerships that don't conform to state franchise laws restricting factory-owned dealerships. Earlier in the year, Tesla failed to get a dealer license in Virginia, and this time around, it will have to wait until at least 2015 to fight for an exemption in Texas. This means that Tesla's Houston and Austin showrooms are not actually allowed to sell vehicles. The report also adds that Tesla CEO Elon Musk could end up taking his case to the federal courts.

Tesla dropped to 'junk bond' status by S&P

Thu, May 29 2014While Tesla Motors' Model S is a piece of pristine, well-designed metal, the company's bonds have now been rated as "junk." But maybe that's better than the other way around. We'll let the investors decide. Standard & Poor's gave Tesla's bonds a 'B-' rating this week, indicating so-called "junk status," Automotive News says. That means investors are saying the company has a relatively high chance of defaulting on its loans. S&P cites Tesla's short history, competition from some very large companies and relatively narrow product line (none of which are new facts), and estimates that investors would be able to recover 30 to 50 cents on the dollar should the company default. Tesla has been issuing billions of dollars in bonds this year to raise funds for its planned gigafactory somewhere in the southwestern US, a project that Tesla estimated will cost $5 billion ($2 billion from Tesla, $3 billion from partners). Tesla said earlier this month that it took a first-quarter loss of $49.8 million, compared to year-earlier net income of $11.2 million. While revenue rose 10 percent to $620.5 million, selling and administrative costs more than doubled while research and development costs jumped 48 percent. And while Tesla's share price has doubled during the past 12 months (it's at around $209 today), the company's liabilities doubled to $3.52 billion from the beginning of the year to the end of the first quarter. There's a short video on the situation from CNN Money below.