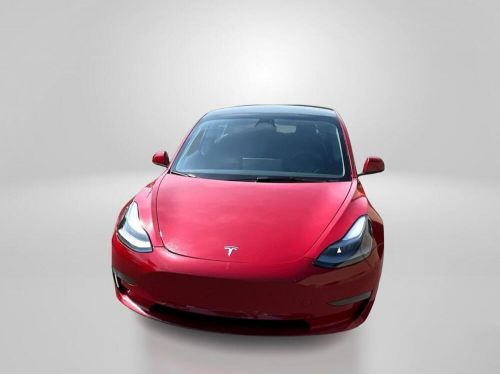

2023 Tesla Model 3 Standard Range on 2040-cars

Carlstadt, New Jersey, United States

Engine:--

Fuel Type:Electric

Body Type:--

Transmission:Automatic

For Sale By:Dealer

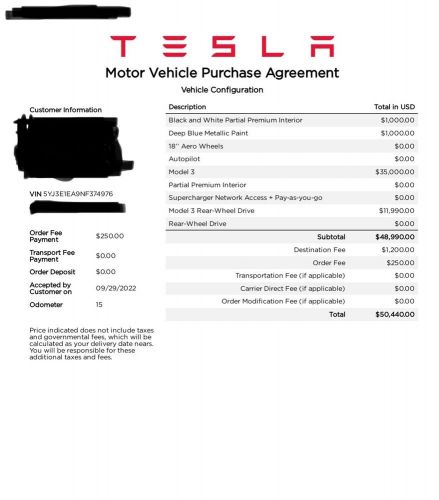

VIN (Vehicle Identification Number): 5YJ3E1EA6PF436417

Mileage: 11586

Make: Tesla

Model: Model 3

Trim: Standard Range

Features: --

Power Options: --

Exterior Color: Red

Interior Color: Black

Warranty: Unspecified

Tesla Model 3 for Sale

2019 tesla model 3 performance awd(US $21,500.00)

2019 tesla model 3 performance awd(US $21,500.00) 2019 tesla model 3(US $12,000.00)

2019 tesla model 3(US $12,000.00) 2020 tesla model 3 awd long range 4dr sedan(US $24,302.00)

2020 tesla model 3 awd long range 4dr sedan(US $24,302.00) 2023 tesla model 3 rear-wheel drive(US $19,511.10)

2023 tesla model 3 rear-wheel drive(US $19,511.10) 2022 tesla model 3(US $22,300.00)

2022 tesla model 3(US $22,300.00) 2020 tesla model 3(US $19,900.00)

2020 tesla model 3(US $19,900.00)

Auto Services in New Jersey

Xclusive Auto Tunez ★★★★★

Volkswagen Manhattan ★★★★★

Vito`s Towing Inc ★★★★★

Vito`s Towing Inc ★★★★★

Singh Auto World ★★★★★

Reese`s Garage ★★★★★

Auto blog

Elon Musk: Teslas will already know where we’re going

Tue, Oct 31 2017In the future, cars will drive us. And probably not surprisingly, they'll often know where to go without us even needing to tell them. That's the theme of a short back-and-forth conversation on Twitter recently between Tesla founder and CEO Elon Musk and a user who tagged him in a comment suggesting that "it would be cool" to be able to tell a car where to go. Responding to user James Harvey, Musk replied, "It won't even need to ask you most of the time." Later, after Harvey asked how the car would know where he wants to go, another user suggested that the car would know what time you go to work. "Yeah, don't exactly need to be Sherlock Holmes," Musk tweeted. It won't even need to ask you most of the time — Elon Musk (@elonmusk) October 21, 2017 Yeah, don't exactly need to be Sherlock Holmes. — Elon Musk (@elonmusk) October 21, 2017 That the ability to know where we're going will be part of our future driving experience shouldn't be surprising. After all, the smartphones we carry around already possess the ability to predict what we want — think Google's cleverness in tailoring search results or providing traffic information just before your commute, Facebook's highly customized News Feed content or even auto-fill technology, which can predict the words you're typing. And plenty of automakers have been touting their own work in developing in-car artificial intelligence systems. Like Audi's Elaine concept, which will be able to learn, think and even empathize with drivers. Or Mitsubishi's e-Evolution concept, which can not only assist your driving, but also assess your skills and teach you how to improve them. Tesla's vehicles, of course, are being outfitted with all the latest autonomous driver-assist technology, with the automaker eager to one day reach full Level 5 self-driving capability. According to Inc., Teslas will be able to listen and respond to directional commands, and they'll even have access to your calendar to comb for information about where you need to go. Tesla has also said it's developing an update to its Autopilot hardware and remains on track to achieve full Level 5 autonomous driving by the end of this year, which strikes a lot of people as wildly unrealistic. At any rate, the promise of cars knowing what time we're sneaking out to get donuts or picking up the kids is interesting, coming from the man who has warned that AI presents "a fundamental risk to the existence of human civilization."Related Video:

Tesla Model S will get price increase

Wed, 21 Nov 2012Tesla has confirmed the Model S will soon see a price increase. The company has yet to release details on how much more the critically acclaimed electric vehicle will cost moving forward, but has released a few details about how the shift will affect buyers with existing reservations. Tesla says the increase will not apply to anyone who has a reservation so long as they configure and finalize their order "within a fair and predefined timeframe." Likewise, those buyers who deferred their reservations will be able to keep the original pricing by finalizing their order within the same timeframe.

Tesla says the price shift will also include changes to the Model S option package structure, and that some features currently considered standard equipment will become added cost options in the future. As with the overall price increase, these changes will not impact those with current orders, reservations or deferred reservations. Expect to hear more about the price increase as information becomes available, and in the meantime you can read the brief press release below for more information.

Sun and wind could power Tesla Gigafactory for EV batteries in Nevada

Fri, Feb 21 2014Next week is Tesla Gigafactory week. The California automaker has a major announcement planned, and it's all about its intention to build a battery factory so large, the company is pulling out the giga prefix. At some point in the next seven days, we expect to hear where Tesla will build the plant, who it will partner with, how it will pay for it and lots of other details. The production volume is expected to be at least 30 gigawatt-hours-worth per year. The Gigafactory will take in the raw materials for lithium batteries and put out finished packs, not only for the electric vehicles made by Tesla and its automotive customers, but also for massive amounts of renewable energy storage – that's a niche the company plans to begin to occupy sometime early next year with residential-sized products. The production volume is expected to be at least 30 gigawatt-hours-worth per year. That's more storage than all the lithium battery factories in the world combined produce now. Color us impressed. Now, you might be thinking, "Is it really necessary to go that big at this point in time?" In a word: yes. Tesla CEO Elon Musk has said its upcoming, more-affordable vehicle – widely expected to be called the Model E – will wear a $35,000 price tag and boast a battery big enough to take it 200 miles on a charge. To achieve this, the cost of the cells needs to come down dramatically, and so it's no coincidence that the time frame for the new facility will parallel that of this car. According to Musk, the benefits from the economies of scale will see a cost drop between 30 and 40 percent. Of course, historically high prices are one of the main reasons why battery storage has not been widely used in the renewable energy sector, so this development could help drive more demand for cleaner, affordable energy, which, in turn, will drive demand for more storage. That's the kind of vicious cycle we like to see. Musk said the Gigafactory will be "heavily powered" by wind and solar energy. Speaking of renewables, that is where the Gigafactory will get much of its needed energy. During the call with financial analysts that accompanied the release of its 2013 fourth quarter earnings report, Musk mentioned that the new plant will be "heavily powered" by wind and solar energy, and will also use older Tesla packs for storage. These will help deflect the traditional arguments against wind and solar, that the sun doesn't shine at night and the wind doesn't always blow.