Engine:Electric Motor

Fuel Type:Electric

Body Type:4D Sedan

Transmission:Automatic

For Sale By:Dealer

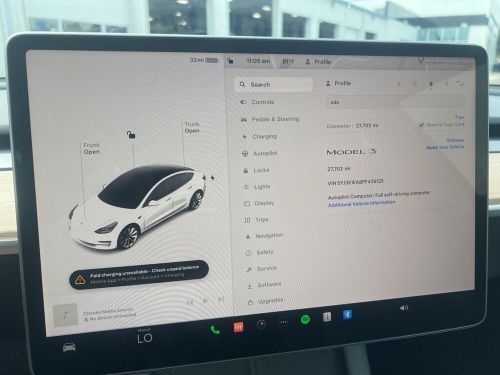

VIN (Vehicle Identification Number): 5YJ3E1EA8PF439125

Mileage: 27702

Make: Tesla

Model: Model 3

Features: --

Power Options: --

Exterior Color: Black

Interior Color: --

Warranty: Unspecified

Tesla Model 3 for Sale

2019 tesla model 3 long range(US $24,900.00)

2019 tesla model 3 long range(US $24,900.00) 2023 tesla model 3(US $25,900.00)

2023 tesla model 3(US $25,900.00) 2023 tesla model 3(US $25,900.00)

2023 tesla model 3(US $25,900.00) 2023 tesla model 3(US $25,400.00)

2023 tesla model 3(US $25,400.00) 2023 tesla model 3(US $26,900.00)

2023 tesla model 3(US $26,900.00) 2023 tesla model 3(US $26,200.00)

2023 tesla model 3(US $26,200.00)

Auto blog

Tesla about to sell 50,000th Model S

Wed, Oct 22 2014Nissan sold its 50,000th Leaf a total of two years and two months after introducing the EV to dealerships. Tesla isn't as established as Nissan, and its Model S - with its higher levels of luxury and performance - costs multiple times more than the Leaf. Consider the Tesla's starting price of $70,000-plus (and easily much more with a bigger battery and a few upgrades), and compare that to the Leaf's base MSRP of just a bit over $30,000 before its 2013 price cut. It would make sense, then, that it would take the Model S longer to hit 50,000 unit sales. But, no. The Model S could meet the 50,000 sales milestone before the end of October (in fact, it may already have done so). This is just two years and three months after it launched in late June 2012. The Model S could meet the 50,000 sales milestone before the end of October. Tesla hasn't released its sales report for the third quarter, but the Palo Alto-based automaker sold 39,128 units of the Model S through June. Previously, Tesla estimated it would have 7,800 third quarter sales (putting it at 46,928 through September), other independent estimates put Tesla at 50,000 sales in late October. The Model S may not have beat the Nissan Leaf to 50K, but it's not hard to see how this is a win for the California automaker. Arguably, this is a case where we all win. Anytime some buys an EV instead of a traditionally powered vehicle - regardless of marque - that's less energy consumed while driving, fewer emissions and an example set to others who have yet to make the switch. It's hard not to be impressed by Tesla's relative success. Furthermore, Tesla coming so close to Nissan in selling 50,000 EVs is, above all, a testament to the desirability of the Model S, despite the Leaf's clear advantage in terms of attainability.

The ugly economics of green vehicles

Sat, Sep 20 2014It's fair to say that most consumers would prefer a green vehicle, one that has a lower impact on the environment and goes easy on costly fuel (in all senses of the term). The problem is that most people can't – or won't – pay the price premium or put up with the compromises today's green cars demand. We're not all "cashed-up greenies." In 2013, the average selling price of a new vehicle was $32,086. The truth is that most Americans can't afford a new car, green or not. In 2013, the average selling price of a new vehicle was $32,086. According to a recent Federal Reserve study, the median income for American families was $46,700 in 2013, a five-percent decline from $49,000 in 2010. While $32,000 for a car may not sound like a lot to some, it's about $630 a month financing for 48 months, assuming the buyer can come up with a $6,400 down payment. And that doesn't include gas, insurance, taxes, maintenance and all the rest. It's no wonder that a recent study showed that the average family could afford a new car in only one of 25 major US cities. AutoTrader conducted a recent survey of 1,900 millennials (those born between 1980 and 2000) about their new and used car buying habits. Isabelle Helms, AutoTrader's vice president of research, said millennials are "big on small" vehicles, which tend to be more affordable. Millennials also yearn for alternative-powered vehicles, but "they generally can't afford them." When it comes to the actual behavior of consumers, the operative word is "affordable," not "green." In 2012, US new car sales rose to 14.5 million. But according to Manheim Research, at 40.5 million units, used car sales were almost three times as great. While the days of the smoke-belching beater are mostly gone, it's a safe bet that the used cars are far less green in terms of gas mileage, emissions, new technology, etc., than new ones. Who Pays the Freight? Green cars, particularly alternative-fuel green cars, cost more than their conventional gas-powered siblings. A previous article discussed how escalating costs and limited utility drove me away from leasing a hydrogen fuel cell-powered Hyundai Tucson, which at $50,000, was nearly twice the cost of the equivalent gas-powered version. In Hyundai's defense, it's fair to ask who should pay the costs of developing and implementing new technology vehicles and the infrastructure to support them.

Ed Welburn leaves a lasting legacy at GM design

Sat, Apr 9 2016General Motors design chief Ed Welburn retired July 1, and the soft-spoken stylist is leaving a lasting legacy at the automaker and on the industry. He became the first African American to lead design at a carmaker when he took over GM's top spot in 2003. Just six people have overseen the company's design, and Welburn followed in the footsteps of icons like Harley Earl and Bill Mitchell. When Welburn was given expanded global oversight in 2005, it wasn't ceremonial. He helped unite the company's sprawling design empire, and today is in charge of 2,500 people who have a hand in designing GM cars. "He nurtured a creative, inclusive, and customer-focused culture among our designers that has strengthened our global brands," Mary Barra, GM chairman and CEO, said in a statement." Welburn took the helm when GM and the industry were shaking off a general styling malaise that pervaded the 1980s and 1990s. During his 13 years in charge, he took risks, produced a wide range of styles for everything from hybrids to sports cars to big trucks, and leaves GM design in a better place. Welburn's replacement, Michael Simcoe from GM's international design unit, has big shoes to fill. News & Analysis News: Tesla attracted more than 325,000 preorders of the Model 3 in about a week. Analysis: If anything, the Model 3 is more popular than many expected. Elon Musk tweeted that surprising figure on Thursday, and he said just five percent ordered the maximum number of two. That seems to indicate actual owners rather than speculators are fueling the demand. With a starting price of $35,000 before incentives and an electric range of 215 miles, the Model 3 is the Tesla that's attainable for a lot of people. Clearly, that notion is resonating. News: Lincoln has drawn 40,000 hand-raisers for the Continental. Analysis: Okay, that's not a Tesla figure, but it's still an encouraging sign for Lincoln that one of its most famous and historic names still resonates in 2016. It also demonstrates using a real, albeit slightly dusty name, was the right call for the MKS replacement. "No other Lincoln vehicle has generated this much interest in this little time," Lincoln president Kumar Galhotra said in New York last month. The concept that debuted a year ago put Lincoln back on the map, and the production version remains true to that promise. It will stand out on the road when it arrives this fall, and ultimately, that kind of style will determine Lincoln's future.