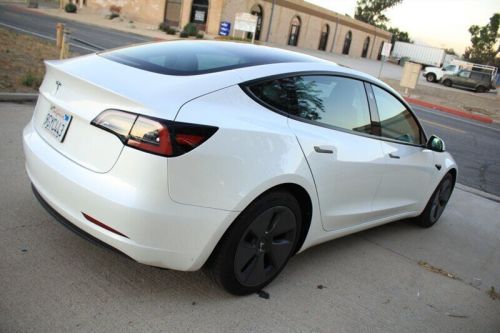

2022 Tesla Model 3 Standard Sedan 4d on 2040-cars

Engine:AC Electric Motor

Fuel Type:Gasoline

Body Type:Sedan

Transmission:Single-Speed Fixed Gear

For Sale By:Dealer

VIN (Vehicle Identification Number): 5YJ3E1EA2NF186655

Mileage: 41096

Make: Tesla

Model: Model 3

Trim: Standard Sedan 4D

Features: --

Power Options: --

Exterior Color: Blue

Interior Color: Black

Warranty: Unspecified

Tesla Model 3 for Sale

2023 tesla model 3(US $25,135.00)

2023 tesla model 3(US $25,135.00) 2018 tesla model 3(US $19,995.00)

2018 tesla model 3(US $19,995.00) 2023 tesla model 3 model 3 $4000 tax credit red/black 1 owner(US $25,890.00)

2023 tesla model 3 model 3 $4000 tax credit red/black 1 owner(US $25,890.00) 2023 tesla model 3(US $24,500.00)

2023 tesla model 3(US $24,500.00) 2018 tesla model 3 long range(US $24,966.00)

2018 tesla model 3 long range(US $24,966.00) 2023 tesla model 3(US $24,500.00)

2023 tesla model 3(US $24,500.00)

Auto blog

Recharge Wrap-up: Musk sees solar future, Uber sued for tips

Mon, Sep 22 2014Elon Musk and his cousin, Lyndon Rive, spoke about their ideas for solar power and energy storage at a private conference in New York. Musk, the Tesla CEO and Rive, CEO of SolarCity, said that within 10 years, every solar system SolarCity sells will come with battery storage, and that it will be cheaper than getting energy from a utility company. Tesla, which provides battery packs for SolarCity, will set aside a portion of its Gigafactory's production capacity for grid-scale energy storage. Rive says his company will be able to produce the most efficient solar panels available, while Tesla has plans for in-home energy storage that not only saves power for nighttime and cloudy days, but also looks good. Read more at The Wall Street Journal and head over to Treehugger for more commentary. Proper deployment of bike lanes could help improve the flow of traffic while making cycling safer in urban settings. In New York City, adding bike lanes improved automotive traffic according to a study. What seems to work well is putting the bike lane closest to the curb on the left side of a one-way street, with a small buffer zone and a parking lane separating it from car traffic. The addition of turning lanes, with their own traffic signals for vehicles turning left, also allows car and bike traffic to continue smoothly. Read more at Core77. Uber is facing a lawsuit over its included gratuity. The ride-hailing app charges a 20 percent tip, included in the price of the ride. The Illinois plaintiff claims, however, that Uber keeps "a substantial portion" of that gratuity for itself, rather than paying it out to the driver. The lawsuit, which is seeking group status, looks to make Uber give up any of the gratuity funds it has kept. The plaintiff is also seeking an unspecified amount of cash in damages. Read more at Bloomberg. A new study breaks down the demographics of the users of public transit. The study, called "Who's On Board 2014," Finds that ridership is mostly inverse from income, with people making over $150,000 per year bucking the trend by riding as much as those in lower brackets. Regardless of region, younger people are more likely to use public transportation, while older people prefer to drive more. African Americans are more likely to ride, with 39 percent using public transit once a week, and 22 percent commuting by transit. Whites use public transit less, with only 10 percent riding once a week, and just five percent using public transit to commute.

Tesla exec calls rival EVs 'little more than appliances'

Wed, Aug 3 2016Tesla's Vice President of Business Development Diarmuid O'Connell called the company's competition "little more than appliances" at the Center for Automotive Research's Management Briefing Seminars in Traverse City, MI yesterday. "In essence, [mainstream automakers] delivered little more than appliances," O' Connell said. "Now, appliances are useful. But they tend to be white. They tend to be unemotional." According to Automotive News, O'Connell's main critique is that vehicles like the Nissan Leaf and BMW i3 don't deliver enough performance or range to draw the attention of consumers outside of a small group. The solution, in O'Connell's mind, is more power, more range, more excitement and a lower price – that last point is particularly rich coming from an automaker whose cheapest current offering, the Model S 60, costs $66,000 – although the cheaper Model 3 is on the horizon, way out there, somewhere. But some EVs are better than none, O'Connell added. "On balance, I'm happier that [traditional automakers are] doing these cars than not," O'Connell said. "I just wish they would do them better and faster." O'Connell also used his appearance at the Management Briefing Seminars to launch a volley at the Michigan legislature, blaming its opposition to Tesla's direct-sales model for the lack of available EVs in the Wolverine State. "I think if the Michigan Legislature would allow Tesla to sell cars in Michigan, we could probably address [the lack of available electric cars]," O'Connell said. Related Video:

Fan-made Tesla commercial imagines a Model S that's out of this world

Thu, Mar 13 2014When you're a kid, anything is possible. With a bit of crayon, cardboard boxes can become helmets, or even space ships. All it takes is a bit of imagination. Replace that crude packaging with something as refined a Tesla Model S and that fantasy world can kick into overdrive. That's the premise behind a new 'ad' featuring Mace Coronel and his dad Marc, and co-starring our favorite all-electric road rocket. Although not commissioned by Tesla Motors (which did tweet about it), the minute-long spot is a great commercial for the company and its battery-powered sedan. It also serves as a excellent advertisement for Everdream Pictures, the minds behind the fancy editing and camera work, as it aptly demonstrates that outfit's "Imagination in Motion" tagline. It's not the first promotional film put together by fans of the sedan – see also: Gallons of Light – but this footage certainly captured our imaginations. Scroll below to see if you are equally as impressed. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. )