2021 Tesla Model 3 Standard Range Plus 4dr Sedan on 2040-cars

Engine:Electric

Fuel Type:Electric

Body Type:Sedan

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 5YJ3E1EA1MF053562

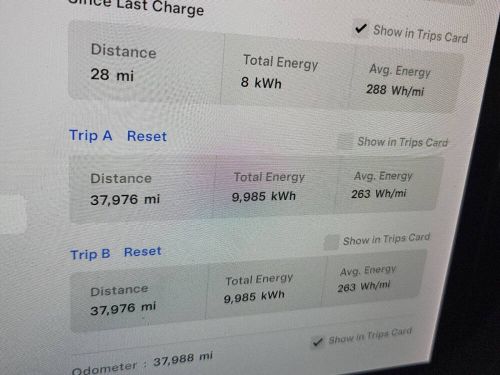

Mileage: 37987

Make: Tesla

Model: Model 3

Trim: Standard Range Plus 4dr Sedan

Drive Type: --

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

Warranty: Vehicle has an existing warranty

Tesla Model 3 for Sale

2020 tesla model 3 long range dual motor all-wheel drive(US $26,419.00)

2020 tesla model 3 long range dual motor all-wheel drive(US $26,419.00) 2022 tesla model 3(US $25,000.00)

2022 tesla model 3(US $25,000.00) 2022 tesla model 3(US $36,900.00)

2022 tesla model 3(US $36,900.00) 2019 tesla model 3 long range(US $22,991.00)

2019 tesla model 3 long range(US $22,991.00) 2022 tesla model 3(US $28,591.00)

2022 tesla model 3(US $28,591.00) 2018 model 3 2018 long range fsd autopilot nav pano blind 33k(US $23,995.00)

2018 model 3 2018 long range fsd autopilot nav pano blind 33k(US $23,995.00)

Auto blog

Investigators Find No Defect Trend With Tesla Motors' Model S

Fri, Mar 28 2014Federal safety investigators said Friday they have found no apparent defect trends in the Tesla Model S, an electric luxury car that has its share of fans and critics. The National Highway Traffic Safety Administration closed a four-month investigation into whether the car's batteries were at heightened risk for underbody strikes and subsequent fires. Even though no defect trend was found, Tesla Motors said in a written statement it would further protect the bottom of its cars with a reinforced underbody shield. The California-based automaker started adding the shields on March 6 and will retrofit older models free of charge. It will also increase the ground clearance of new cars. "This fix should eliminate the potential of a battery-pack fire under all but the most extreme circumstances," said Karl Brauer, a senior analyst at Kelley Blue Book. Although there are more than 194,000 car fires in the United States every year, NHTSA investigators began a preliminary investigation into potential trouble on Nov. 15, 2013 following two Model S fires, one in Tennessee and one in Washington. No one was injured or killed in either fire. Roadway debris punctured the battery pack near the front of the compartments in both cases, damaging the batteries' lithium ion cells that then began "thermal runaway" events. The opposite ends of the debris had dug into the pavement and jutted upward. Tesla called this a "piking effect." The company said it has conducted 152 vehicle level tests, and that the new shields prevented any damage or penetration of the new shields. The first is a rounded, hollow aluminum bar that's followed by a titanium plate. The third layer of protection is made of solid aluminum. (There's video of the new plates in action on the Tesla Motors website). "We have tried every worst-case debris impact we can think of, including hardened steel structures set in the ideal position for a piking event," Tesla Motors founder Elon Musk wrote on the company's blog," essentially equivalent to driving a car at highway speed, into a steel spear braced on the tarmac." Approximately 15,805 vehicles are eligible for the upgrades, which NHTSA says should reduce the frequency of underbody strikes and subsequent fire risks. But the agency did note that the closing of the investigation did not necessarily constitute a finding that a defect does not exist. "The agency reserves the right to take further action if warranted by new circumstances," it said.

That time Elon Musk got a speeding ticket showing off the Tesla Model S to Johnny Depp

Wed, Apr 16 2014Transcendence is a Johnny Depp vehicle that opens at movie theaters this weekend. The Tesla Model S is a Elon Musk vehicle that easily transcends the speed limits. What do these two seemingly unassociated facts share in common? A speeding ticket. It seems a few cast members of the sci-fi film – which is not at all remotely anything like The Lawnmower Man – including the aforementioned Depp, were being given an on-road demonstration of the all-electric sedan by the automaker's CEO when they were pulled over for speeding. According to a report in the Sun tabloid, Musk visited the set where he was introduced to Depp by director Wally Pfister. This led to the trio, along with co-stars Rebecca Hall and Paul Bettany, all piling into the car for a bit of a joy ride. Apparently, Musk got a little too joyous with the accelerator and they were soon pulled over by an officer of the law, who was neither star-struck nor amused by the antics of the assembled celebrities. Depp is quoted as saying, "Elon had a good sense of humour about it. The cop did not. He needed a humor chip. But it was a good time, nonetheless." We don't know if the excursion led to any Model S sales, but we can say that the prolific movie star definitely enjoyed the adventure. "I had one of the best experiences I've ever had," Depp said. While we (sadly) don't have footage from the incident to share, you can scroll below for the official trailer from Transcendence. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Recharge Wrap-up: EV charging at IKEA, Tesla Model M just rendering

Sat, Jul 18 2015Despite rumors, Tesla will not be producing a "Model M" electric motorcycle. After a rendering of a Tesla motorcycle concept by a designer named Jans Slapins began circulating online, some folks mistakenly thought it was something Tesla intends to build. Slapins, though, has no relationship with Tesla, nor has he claimed to. As cool as it could be, Tesla hasn't stated an interest in producing an electric two-wheeler, and, as Green Car Reports explains, Tesla's batteries don't lend themselves to the size and shape of a motorcycle the way, say, Zero's do. Read more at Green Car Reports. Piaggio and KTM are partnering to develop an affordable electric commuter vehicle. The EU is funding the project in the hopes that commuters would choose such a vehicle over polluting, traditionally powered vehicles for their daily drives. The initial plan is to create two four-wheeled tilting vehicles for demonstration purposes. The two manufacturers will also receive support from Bosch and several universities. Read more at Visor Down. Total has opened a hydrogen filling station in Munich, Germany with both standard compressed and BMW cryo-compressed hydrogen (CCH2) technology. CCH2 involves storing the fuel on board at low temperatures and just 350 bar pressure. It allows for up to 50 percent more storage than standard 700 bar systems (and, subsequently, a greater driving range). Having CCH2 hydrogen available at a public station allows BMW to further its fuel cell research and development with real-world testing. Read more at Green Car Congress. IKEA will install free EV charging stations at all of its Canadian stores. Each of the 12 stores will offer, initially, two 60-amp chargers available on a first-come-first-served basis. Sun Country Highway will install the chargers by the end of this summer (that's right, you don't have to assemble them yourself). IKEA sees itself as a prime location for EV charging as most of its stores are located near major highways. All of Canada's IKEA stores get their energy from renewable sources. "Electric vehicle charging stations are an important step on IKEA Canada's continuing journey towards sustainability," says IKEA's sustainability manager, Brendan Seale. Read more from Sun Country Highway. Related Gallery News Source: Green Car Reports, Visor Down, Green Car Congress, Sun Country Highway Green BMW Automakers Tesla Alternative Fuels Motorcycle Electric Hydrogen Cars recharge wrapup