2021 Tesla Model 3 Standard Range Plus 4dr Sedan on 2040-cars

Engine:Electric

Fuel Type:Electric

Body Type:Sedan

Transmission:Automatic

For Sale By:Dealer

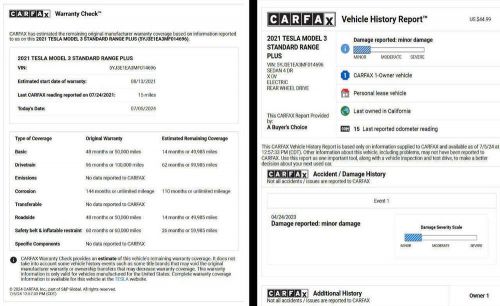

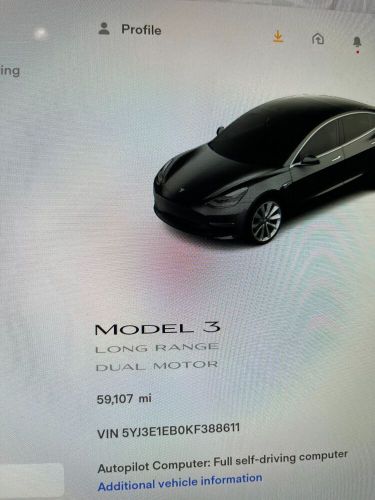

VIN (Vehicle Identification Number): 5YJ3E1EA3MF014696

Mileage: 28830

Make: Tesla

Model: Model 3

Trim: Standard Range Plus 4dr Sedan

Drive Type: --

Features: --

Power Options: --

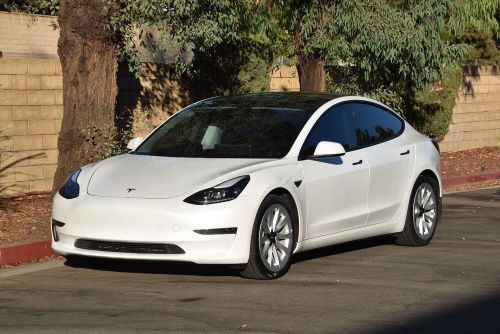

Exterior Color: White

Interior Color: Black

Warranty: Vehicle has an existing warranty

Tesla Model 3 for Sale

2019 tesla model 3(US $26,920.00)

2019 tesla model 3(US $26,920.00) 2018 tesla model 3(US $21,000.00)

2018 tesla model 3(US $21,000.00) 2020 tesla model 3 long range dual motor all-wheel drive(US $29,921.00)

2020 tesla model 3 long range dual motor all-wheel drive(US $29,921.00) 2021 tesla model 3 standard range plus 4dr sedan(US $9,100.00)

2021 tesla model 3 standard range plus 4dr sedan(US $9,100.00) 2021 tesla model 3 long range(US $32,400.00)

2021 tesla model 3 long range(US $32,400.00) 2021 tesla model 3 standard range plus 4dr sedan(US $4,963.00)

2021 tesla model 3 standard range plus 4dr sedan(US $4,963.00)

Auto blog

Tesla sold 6,892 Model S EVs in Q4, stock jumps in afterhours trading

Thu, Feb 20 2014Quarterly shareholder letters, with accompanying financial results, are an opportunity for companies to crow about their recent progress and instill excitement about future expectations. Tesla Motor's latest such release reveals it's coop is rife with roosters in full song. And for good reason. The California automaker announced today it earned $46 million in 4th quarter of 2013 on a non-GAAP basis – under generally accepted accounting principles (GAAP), which calculates leasing and stock-based employee remuneration differently, it actually lost $16 million – selling 6,892 very lovely Model S electric sedans in the process. Further, it passed its predicted 25 percent gross profit margin on its cars, hitting 25.8 percent on a non-GAAP basis. This means, for the fiscal year of 2013 it sold 22,477 vehicles in total and had over 2.5 billion in (non-GAAP) sales, which includes, of course, supply and development deals with Toyota and Daimler. TSLA has jumped to a record high in the $217 neighborhood. That's pretty durned good, and the stock market would seem to agree. With the financials results dropping just after the NASDAQ's close, the price for TSLA has jump around 12 percent – over $23 as of this writing – to a record high in the $217 neighborhood. Those share price increases aren't just based on past performance, though. The info drop also included plenty of things to indicate the future bodes well. The company expects both sales and production to continue to rise throughout 2014, with a new assembly line expected to help churn out 1,000 cars per week in the 3rd quarter and profit margins projected to hit 28 percent by the end of the year. On the demand side, Tesla's CEO Elon Musk stated during the conference call that he doesn't expect the company to be able to meet the demand that's coming from China. Its new Beijing store is now the company's biggest and busiest and deliveries don't even begin until spring. While European sales are a little slower than anticipated, the exec said he believes it will improve as soon as the company irons out a few technical difficulties that have arisen with charging amongst the different territories there. Apparently, not all power grids operate in exactly the same way. Speaking of reservations for the upcoming Model X SUV, Elon said demand is high. Quote: "If you are going fishing, fish are actually jumping in the boat." That vehicle is only expected to start reaching customers next spring.

Ford GT Mk II at Goodwood, Bentley EXP 100 GT concept EV and driving the Hyundai Veloster N | Autoblog Podcast #588

Fri, Jul 12 2019In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Consumer Editor Jeremy Korzeniewski and Associate Editor Joel Stocksdale. To kick things off, they talk about driving the Porsche Cayenne S, Hyundai Veloster N and Nissan Armada. Then they recap the Goodwood Festival of Speed, including the Ford GT Mk II that debuted there. Next up is news: the Bentley EXP 100 GT electric concept car, Ford canceling diesel for the Transit Connect and Elon Musk dismissing talk of a refresh for the Model S and Model X. Finally, they take to Reddit to help pick between a 2016 Audi S3 and a 2017 Alfa Romeo Giulia. Autoblog Podcast #588 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving: 2019 Porsche Cayenne S 2020 Hyundai Veloster N 2019 Nissan Armada Ford GT Mk II debuts at Goodwood, and other impressions from the event Bentley unveils EXP 100 GT electric concept car Ford cancels diesel engine for Transit Connect Tesla Model S and X wonÂ’t get a refresh Spend My Money: Audi or Alfa? Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:  Â

Elon Musk raises the stakes for Tesla Motors

Wed, Jan 14 2015Falling gas prices, production delays and weakened demand in a key market would send shudders through the CEOs of most automakers. None of those problems could dent the enthusiasm Tesla Motors CEO and co-founder Elon Musk has for a vision of an electric-car future. In a rare appearance Tuesday on the home turf of the Big Three automakers in Detroit, Musk said those factors wouldn't hinder Tesla Motors' growth over the next five to ten years. In fact, he revised the company's sales projections upwards, even as he said Tesla may not turn a profit for five more years. Previously, Musk had said he wanted the company to sell 500,000 vehicles by 2020. In more than an hour's worth of wide-ranging remarks at the Automotive News World Congress, he said, "I think we'll try to aim to do more cars than that. I think we'll continue past that. We probably should get to a few million cars by 2025. We could probably get to a few million cars per year." Spate Of Recent Complications Not that Tesla Motors' rise to prominence through a global economic recession hasn't already defied conventional wisdom, but the upward figures came despite recent complications that will only make that sort of sales climb more difficult. Gas prices fell to a national average of $2.11 per gallon Tuesday, and many automakers fret this plunge will make the sale of electric vehicles far more difficult. "I don't think it will affect the S or X," Musk said Tuesday. Production of the Model X – an all-electric crossover that features gullwing doors that would give Tesla Motors an immediate entrant in the fastest-growing vehicle segment – has been delayed for two years while the Fremont, CA-based company focused its limited production capabilities on its Model S and worked on complications with the X. "It's been two steps forward, one step back," Musk said. "Really, it was important to me that the doors were not just a gimmick, but a fundamental improvement to the functionality of the cars." Another hurdle for Tesla: Musk said Tuesday that sales had weakened in China during the fourth quarter of 2014. Exact sales figures were not known because Tesla does not release them, but Musk said growth slowed because customers there had overestimated the difficulty in installing and maintaining charging equipment; he said the "miscommunication" had been corrected and that the company has already seen an uptick in sales.