2021 Model 3 2021 Fsd Autopilot Nav Pano Blind 19k on 2040-cars

Vehicle Title:Clean

Body Type:Sedan

Engine:Electric 201hp 258ft. lbs.

Transmission:Automatic

VIN (Vehicle Identification Number): 5YJ3E1EA6MF998135

Mileage: 19812

Warranty: No

Model: Model 3

Fuel: Electric

Drivetrain: RWD

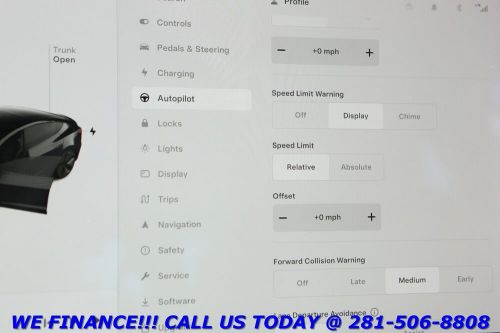

Sub Model: 2021 FSD AUTOPILOT NAV PANO BLIND 19K

Trim: 2021 FSD AUTOPILOT NAV PANO BLIND 19K

Doors: 4

Exterior Color: Solid Black

Interior Color: Black

Make: Tesla

Tesla Model 3 for Sale

2021 model 3 2021 fsd autopilot nav pano blnd 25k(US $25,995.00)

2021 model 3 2021 fsd autopilot nav pano blnd 25k(US $25,995.00) 2021 model 3 2021 long range awd autopilot nav pano blind 38k(US $28,995.00)

2021 model 3 2021 long range awd autopilot nav pano blind 38k(US $28,995.00) 2020 model 3 2020 long range awd fsd accel autopilot a pano 40k(US $25,995.00)

2020 model 3 2020 long range awd fsd accel autopilot a pano 40k(US $25,995.00) 2020 model 3 2020 long range awd autopilot nav pano blind 39k(US $26,495.00)

2020 model 3 2020 long range awd autopilot nav pano blind 39k(US $26,495.00) 2020 model 3 2020 long range awd fsd autopilot pano blind 27k(US $26,995.00)

2020 model 3 2020 long range awd fsd autopilot pano blind 27k(US $26,995.00) 2020 model 3 2020 long range awd fsd autopilot accel pano 38k(US $24,995.00)

2020 model 3 2020 long range awd fsd autopilot accel pano 38k(US $24,995.00)

Auto blog

Recharge Wrap-up: Toyota i-Road and COMS in France, Tesla tours Northeast, EV attitudes in UK

Tue, Jul 1 2014Toyota's i-ROAD and COMS teeny, tiny, city EVs are joining the Citelib carsharing fleet in Grenoble, France. The ultra-compact EVs, which will become available in October, are meant to supplement the Grenoble metropolitan area's existing public transit infrastructure, which includes trams, buses and trains. Toyota's i-ROAD and COMS will be connected to the transit systems IT infrastructure, allowing users to visualize their route on their smartphone or computer, and reserve and pay for their car before they get dropped off near the charging station (or the other way around). Then, the user finishes (or begins) their trip with one of the EVs. Surveys show that use of public transport is increasing in Europe, but most users still have to walk 15 minutes or so to reach their destination. Adding the i-ROAD and COMS carsharing service to their commute makes the trip into the city center quicker and more flexible, while keeping the air clean. See more below. Toyota is providing 70 vehicles to the Citelib program as part of a three-year test, while French energy company EDF is contributing 30 charging stations to the project. The i-ROAD is a three-wheeled EV that seats two people, and it features Active Lean technology for stability and comfort in the corners. Its footprint is about one-fourth that of a regular car. The four-wheeled COMS EV seats one, but also features a small storage compartment in the rear. The Tesla Model S is going on tour throughout the Northeastern US to give test drives to the public. Beginning July 4 in Montauk, NY, and ending August 30 in Vergennes, VT, people will get the chance to take a 15-minute spin in what many consider to be the best electric car available as part of Tesla's Fully Charged tour. If you live in New York, New Jersey, Massachusetts, Maine, Connecticut, New Hampshire or Vermont, the Model S may be coming to a town near you (check the schedule here) and you'll get the chance to drive the car with a product specialist in the passenger seat to answer your questions. You can even bring up to three guests in the back seat. So if you live in one of the states where Tesla can't sell cars or doesn't have a store, this is your chance to get to know the vehicle and decide if you want to buy one. Or you can just see what it feels like to silently go from 0-60 in 4.2 seconds (hint: it's pretty cool). A UK Survey shows five percent of people there are considering buying an electric vehicle.

Ohio Senate strips anti-Tesla amendment from bill

Thu, 05 Dec 2013Tesla's strategy to sell cars, such as the Model S, through manufacturer-owned retail stores has rubbed traditional franchise auto dealerships the wrong way. The battle between Tesla and the Ohio Auto Dealers Association heated up quickly over the past week because a proposed amendment to an Ohio road-maintenance worker safety bill (Senate Bill 137) threatened to ban Tesla stores in Ohio. The automaker asked for help from its supporters to fight the amendment, and on Tuesday all 12 members of the Ohio senate passed the bill without it, Transport Evolved reports.

After the vote, Tesla sent out an e-mail to its supporters thanking them for their help, which you can read below:

Dear Tesla Advocate,

Recharge Wrap-up: Toyota to go electric with Aygo? Renault Zoe bests BEVs in e-Rallye Monte-Carlo

Tue, Oct 18 2016Toyota could sell the Aygo hatchback as an EV. Toyota Europe CEO Johan van Zyl says that the A-segment city car could be a candidate for all-electric power. "We see a stronger growth of that type of thinking in cities where they're saying, 'We'd rather have emissions-free vehicles so it should be a plug-in or a pure-electric vehicle,'" he says. As the Aygo is produced alongside and shares most components with the Peugeot 108 and Citroen C1, it's possible those cars could see a plug-in version in the future as well. Read more at Hybrid Cars. The Renault Zoe took first and second place in the battery electric category of the 2016 e-Rallye Monte-Carlo. Defending Renault's title for a third year, two of the updated Zoes with improved range topped the category, taking second and third place overall. A hydrogen powered Toyota Mirai bested the Renaults by taking first place overall. 34 crews entered the competition, which took them from Fontainebleau, France to Monaco over four days. Read more from Renault. Teslarati talks to Youseph Tanha (AKA Yoshi) about his Tesla Transformer comic art project. Tanha, who cohosts the TransMissions podcast, commissioned artist Brendan Cahill to sketch a comic book cover featuring the Tesla Model X as a Transformer. The result is the Voltic (a name borrowed from Grand Theft Auto 5), an impressively reimagined Tesla Transformer that launches missiles from its falcon wing doors. While it doesn't necessarily fit into IDW's Transformers storyline, the commissioned piece does capture the imagination of comic fans and Tesla enthusiasts alike. Read more at Teslarati. Singapore is launching an EV carsharing program. The nation's Economic Development Board and Land Transport Authority have commissioned Bollore Group's BlueSG to operate the fleet of 1,000 EVs and 2,000 charging points by 2020, with 125 cars and 250 charging points available by the middle of next year. The program – sort of similar to the BlueIndy program in Indianapolis – is part of an effort to reduce pollution. "The future of transport in Singapore will look very different from today," says Coordinating Minister for Infrastructure and Transport Khaw Boon Wan. "Most people will not see the need to own a car." Read more at Wards Auto.