2021 Model 3 2021 Fsd Autopilot Nav Pano Blind on 2040-cars

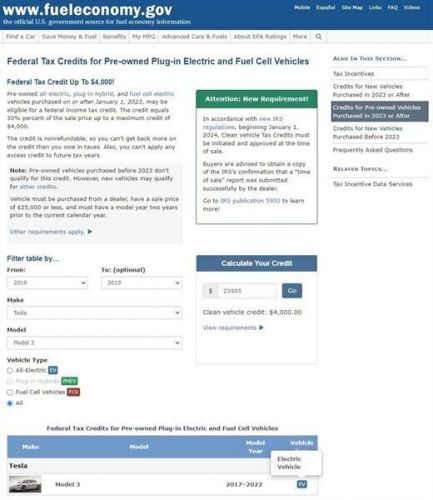

Vehicle Title:Lemon & Manufacturer Buyback

Body Type:Sedan

Engine:Electric 201hp 258ft. lbs.

Transmission:Automatic

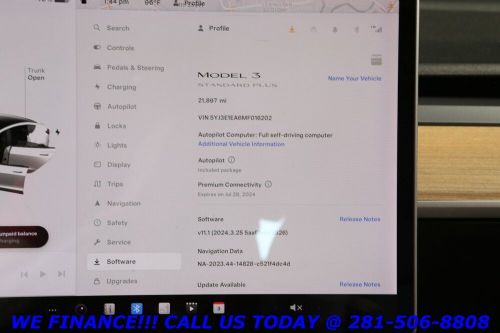

VIN (Vehicle Identification Number): 5YJ3E1EA6MF016202

Mileage: 21897

Warranty: No

Model: Model 3

Fuel: Electric

Drivetrain: RWD

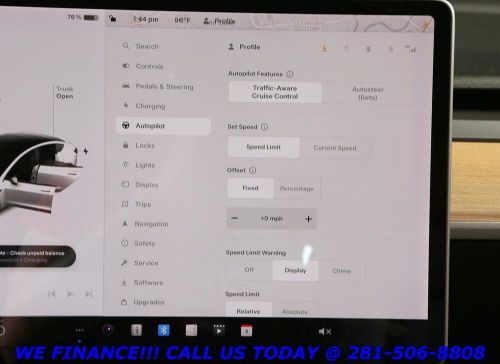

Sub Model: 2021 FSD AUTOPILOT NAV PANO BLIND

Trim: 2021 FSD AUTOPILOT NAV PANO BLIND

Doors: 4

Exterior Color: Pearl White Multi-Coat

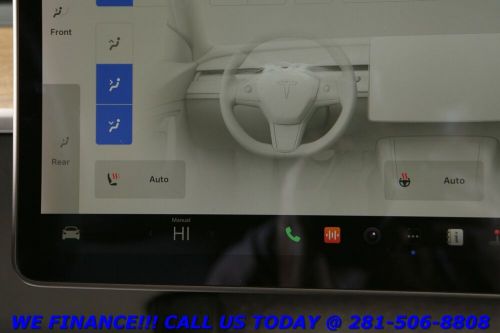

Interior Color: Black

Make: Tesla

Tesla Model 3 for Sale

2021 tesla model 3 standard range plus 4dr sedan(US $25,999.00)

2021 tesla model 3 standard range plus 4dr sedan(US $25,999.00) 2021 tesla model 3 standard range plus 4dr sedan(US $26,999.00)

2021 tesla model 3 standard range plus 4dr sedan(US $26,999.00) 2021 tesla model 3 standard range plus 4dr sedan(US $26,999.00)

2021 tesla model 3 standard range plus 4dr sedan(US $26,999.00) 2019 tesla model 3 long range(US $21,793.00)

2019 tesla model 3 long range(US $21,793.00) 2019 model 3 2019 long range autopilot nav pano blind 73k(US $22,995.00)

2019 model 3 2019 long range autopilot nav pano blind 73k(US $22,995.00) 2018 tesla model 3 long range(US $22,444.00)

2018 tesla model 3 long range(US $22,444.00)

Auto blog

Tesla gets its own Smartcar, but it's not what you think [w/video]

Tue, Mar 4 2014The idea may be a good one, but to call your new car-based predictive technology "Smartcar" seems like you're asking for a lawsuit from Daimler, the makers of the Smart car. But dig a little deeper and you realize that the plan could work, and whether or not Daimler bites is something we'll let the lawyers decide. In the meantime, here are the details on what the Smartcar for the Tesla Model S is all about. "Whenever you can automate something, that's where the value comes in" - Smartcar CEO Sahas Katta The idea is that your car, using the Internet and a Smartcar subscription, should be able to figure out what time you head off to work each day. Once it does, it can have the cabin at the right temperature (heated in the winter, cooled in the summer) and the battery charged for the drive by the time you're headed out the door. The automated system can also tell the charger to only slurp electrons when lower-cost nighttime electricity rates are in effect. The slightly confusing part is that the Model S already has the capability to program nighttime charging built-in and it can also be pre-conditioned remotely without the Smartcar system, you just have to tell it to do so with your smart phone (see one happy driver doing just this in frigid temperatures in the second video below). The difference with Smartcar is that your Tesla will soon be able to do all this stuff automatically. For example, the system "predicts the required range for your next journey" and "will only delay charging to off-peak hours when it can confidently determine your vehicle will have enough range available for the rest of the day." Smartcar is being designed for the Model S and the upcoming Model X, but the developers say "we're working to bring support to connected vehicles from other manufacturers in the near future." The lead developer behind Smartcar is Sahas Katta, who readers might remember from his GlassTesla project, which integrated Google Glass with a Model S. We called him up to ask why it makes sense to pay $100 a year for a Smartcar subscription when the features it offers are available in the car's default settings. Katta had obviously thought the arguments through, and told AutoblogGreen that he knows plenty of Model S owners who don't remember to set these triggers every day. "Whenever you can automate something, that's where the value comes in," he said.

Aston Martin CEO calls Tesla Model S 'Ludicrous' mode stupid

Sat, Aug 22 2015To be fair, some would say paying as much as a quarter-million dollars for a car in itself qualifies as "ludicrous." But the CEO of Aston Martin, a company that is readying a pricier electric-vehicle competitor to the Tesla Model S, didn't mince words in discussing Tesla's newest gizmo that can propel the sedan from 0 to 60 miles per hour in less than three seconds. In fact, Andy Palmer, Aston's CEO, prefers a slightly more balanced approach. Palmer was quoted in Automotive News as saying that Tesla's Ludicrous Mode was "stupid." He added that he'd rather have an electric vehicle that could last "a few laps of a decent race course" instead of one that does its best imitation of a Dodge Challenger Hellcat. Palmer also took to his Twitter account to note, among other things, that the Aston's "insane mode comes as standard - no button required." Aston Martin said earlier this week that it planned to make a battery-electric variant of its Rapide Sedan. That model will have 800 horsepower as well as a 200-mile single-charge range. The car will also cost between $200,000 and $250,000, or about twice the cost of a top-of-the-line Model S. As for the Tesla, its Ludicrous mode was announced last month for the Model S and it will eventually be added to the Model X for those who are big on flipping SUVs. Tesla said that the feature cuts the sedan's 0-60 mpg time to a tidy 2.8 seconds, though the option does cost about $10,000. Which is probably about the price of an Aston Martin door handle. Featured Gallery 2015 Aston Martin Rapide S View 32 Photos News Source: Automotive News (subs req'd) Green Aston Martin Tesla Electric ludicrous mode

CARB scrapping plan for $60,000 limit on EV rebates

Wed, May 21 2014In April, we heard about a discussion within the California Air Resources Board (CARB) that would have put a $60,000 MSRP limit on plug-in vehicles that would qualify for CARB's $2,500 rebates. A new report in Silicon Beat says that CARB is once again ready to give EV money to everyone, no matter what expensive car they buy. There's no question that the CARB proposal would have had an inordinate effect on Tesla Motors, the only company selling a EV expensive enough to cost more than $60,000, the Tesla Model S. Okay, the Cadillac ELR plug-in hybrid would also have been affected, but that only would have applied to a small handful of people. According to Silicon Beat, the updated CARB proposal says clearly that, "at this time staff is not proposing any significant changes to the Clean Vehicle Rebate Project as part of this year's Initial Funding Plan." CARB spokesman David Clegern told Silicon Beat that, "It's fair to say [the $60,000 limit] been removed. I never say anything is dead until after the vote, but I'm not aware of any plans to revisit it." In other words, Tesla, you're good to go. We've asked CARB for confirmation of this, but have not yet heard back.