Engine:AC Electric Motor

Fuel Type:Electric

Body Type:Car

Transmission:Single-Speed Fixed Gear

For Sale By:Dealer

VIN (Vehicle Identification Number): 5YJ3E1EA3LF634236

Mileage: 61500

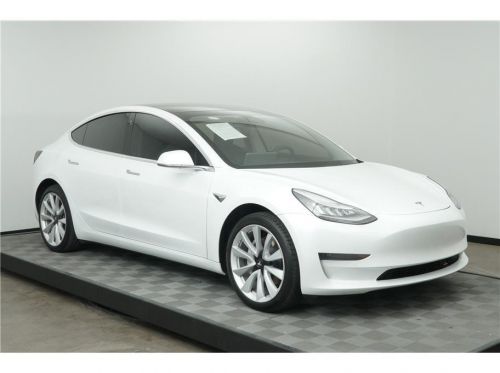

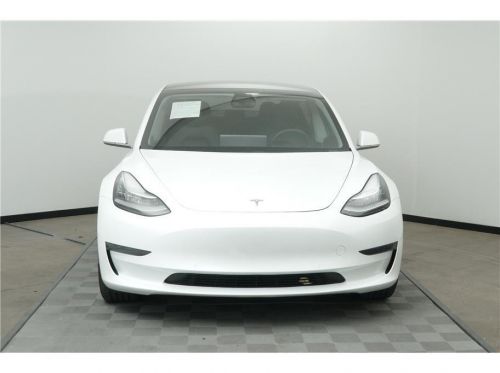

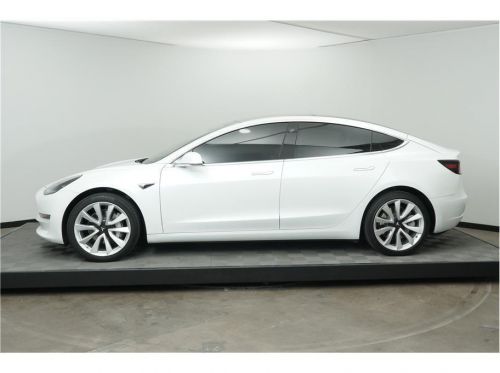

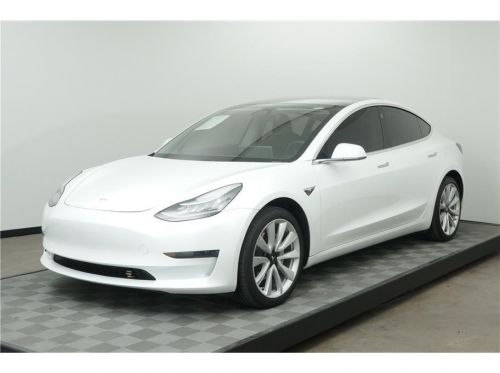

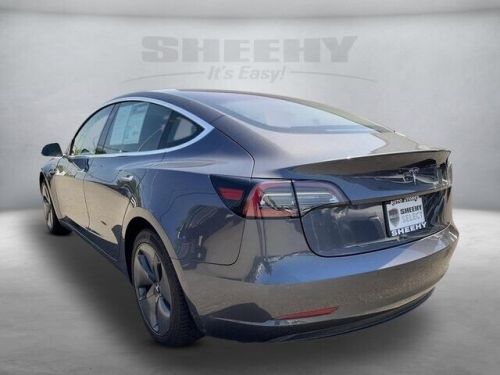

Make: Tesla

Model: Model 3

Features: --

Power Options: --

Exterior Color: White

Interior Color: --

Warranty: Unspecified

Tesla Model 3 for Sale

2022 tesla model 3 standard sedan 4d(US $30,985.00)

2022 tesla model 3 standard sedan 4d(US $30,985.00) 2020 tesla model 3 standard range plus(US $24,990.00)

2020 tesla model 3 standard range plus(US $24,990.00) 2018 tesla model 3 long range(US $24,000.00)

2018 tesla model 3 long range(US $24,000.00) 2020 tesla model 3 performance(US $29,001.00)

2020 tesla model 3 performance(US $29,001.00) 2020 model 3 2020 fsd autopilot nav pano blind 71k(US $23,495.00)

2020 model 3 2020 fsd autopilot nav pano blind 71k(US $23,495.00) 2020 model 3 2020 long range fsd autopilot awd nav pano cam 26k(US $26,495.00)

2020 model 3 2020 long range fsd autopilot awd nav pano cam 26k(US $26,495.00)

Auto blog

Nissan edges out Tesla for most ZEV credits sold in California

Wed, Oct 22 2014When it comes to California zero-emissions vehicle (ZEV) credits last year, Nissan was selling and Mercedes-Benz was buying. The California Air Resources Board (CARB) put out its ZEV-credits numbers for the year that ended September 30, which is why we now know that Nissan, maker of the battery-electric Leaf, transferred 663.6 ZEV credits out of its account last year. That just edged out the 650.195 credits that Tesla sold. Chrysler's Fiat affiliate was a distant third, but its limited-production Fiat 500E was still able to generate some ZEV credits and then transfer out 235.2 of them. We don't know how much the buyers paid for these credits, since those details are kept private. It's an ever-changing rulebook over at CARB, anyway. On the flip side, Mercedes-Benz had to buy 663.6 ZEV credits in order to comply with clean vehicle-sales mandates in the most populous US state, indicative of the German automaker's gas-guzzling tendencies. Honda has cars that get better fuel economy than your average Benz, but its plug-in vehicles represent just a fraction of total sales and so it had to shell out for 542.5 ZEV credits. Chrysler-Fiat basically tread water, since the 237.8 ZEV credits it required for compliance canceled out gains on the other side of the ledger. Those Dodge Ram pickup trucks don't exactly help matters. Last year, Tesla sold the most ZEV credits while GM purchased the most. Overall, Californians bought about 3.5 million vehicles for the year that ended September 30, including 38,000 battery-electric vehicles, 30,000 plug-in hybrids and 570,000 conventional hybrids. The longstanding ZEV program means that California now has more than 100,000 ZEVs on its roads. Read this for more details on ZEV credit transfers in California. Featured Gallery 2013 Nissan Leaf View 55 Photos News Source: California Air Resources Board via Green Car Congress Government/Legal Green Mercedes-Benz Nissan Tesla Electric California zev credits

Will Bob Lutz's VL Automotive really offer V8 conversions for Tesla Model S?

Fri, Jan 17 2014VL Automotive is closely tied up with Fisker. The company's first product, the Destino, is a converted Karma and the Destino Red Concept, just unveiled at the Detroit Auto Show, is the same hardtop Karma convertible that Fisker showed in 2009. So, what a surprise it was to see that Bob Lutz, who owns half of VL Automotive, is ready to convert a brand new electric vehicle: the Tesla Model S. A gas-powered Tesla? Say what? A gas-powered Tesla? Say what? That's at least one way to read this short article in The Detroit News. There's not a lot of context and a distinct lack of details, so we're left wondering if maybe Lutz just meant that Model S owners can buy a Destino. You can read the exchange for yourself here. What we do know is that Lutz said that VL Automotive has already sold nine Destino conversions. The cars cost $200,000, up from the previous estimate of $180,000, and well above the $116,000 max price tag on the original Karma. For your money, you get a 6.2-liter V8 taken from a Chevrolet Corvette that puts out 636 horsepower and can beat the 135-mile-per-hour top speed that the Karma has. Lutz said that all could add up to sales of around 200 or 300 Destinos each year. Featured Gallery VL Destino Red Concept: Detroit 2014 View 21 Photos News Source: The Detroit News via Green Car ReportsImage Credit: Copyright 2014 Drew Phillips / AOL Green Detroit Auto Show Fisker Tesla Electric Hybrid PHEV vl automotive destino

Drive eO Tesla Roadster is going to race up Pikes Peak [w/video]

Thu, Jun 19 2014Last year, Drive eO sent its PP01 electric supercar up Pikes Peak in the Pikes Peak International Hill Climb - well, part-way up. Driver Janis Horeliks wasn't injured in the crash that ended his run near the Halfway Picnic Grounds. This year, the Latvian team will return to Colorado race again with a Tesla Roadster chassis in the Electric Modified division on Sunday, June 29. The PP02 is not quite as rowdy as the PP01, with a twin motor system putting about 482 horsepower and 590 pound-feet of torque to the rear wheels compared to last year's car all-wheel-drive setup making about 536 hp. The PP02's liquid-cooled electric motor will get its electrons from a 40-kWh battery pack. The total weight of the car is about 2,337 pounds. Drive eO's return to Pikes Peak isn't just about getting back in the saddle and winning a single race. The group is using the experience to test new components that it intends to eventually put into later electric supercars. These, according to the press release, are "already on the drawing board." As interesting as it will be to see the PP02 Tesla Roadster 360 attempt to tackle the famous hill again, it should be equally interesting to see what Drive eO is up to next. See what happened in last year's race in the video below (it's not in English), or read on for the official press release from Drive eO. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Drive eO Returns to Pikes Peak with Bespoke Tesla Roadster Riga, Latvia - Electric motorsport specialists Drive eO are returning to the Pikes Peak International Hill Climb on June 29 to test and develop their latest electric drive train system. The team has packaged it into a Tesla Roadster chassis, making the competitive debut in motorsport for Tesla. Drive eO has dubbed the project PP02 as it builds upon the team's initial attempt at the iconic hill climb competition in 2013 with a prototype supercar eO PP01. The new car features a more modest specification with rear axle powered by 360 kW (peak) twin-motor system and a 40 kWh lithium-ion battery pack. The team is aiming to validate the new components ahead of scaling them up for successive electric supercar projects which are already on the drawing board. The 2014 edition of the Pikes Peak International Hill Climb will see 72 drivers attempting the treacherous 20 km course to the summit at 4300 m.