2020 Model 3 2020 Long Range Awd Autopilot Nav Pano Blind 39k on 2040-cars

Vehicle Title:Clean

Body Type:Sedan

Engine:Electric 449hp 389ft. lbs.

Transmission:Automatic

VIN (Vehicle Identification Number): 5YJ3E1EB9LF798146

Mileage: 39747

Warranty: No

Model: Model 3

Fuel: Electric

Drivetrain: AWD

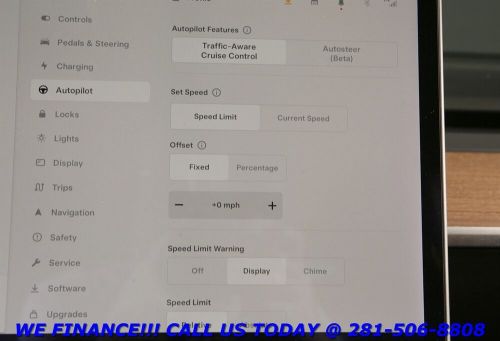

Sub Model: 2020 Long Range AWD AUTOPILOT NAV PANO BLIND 39K

Trim: 2020 Long Range AWD AUTOPILOT NAV PANO BLIND 39K

Doors: 4

Exterior Color: Deep Blue Metallic

Interior Color: Black

Make: Tesla

Tesla Model 3 for Sale

2020 model 3 2020 long range awd fsd autopilot pano blind 27k(US $26,995.00)

2020 model 3 2020 long range awd fsd autopilot pano blind 27k(US $26,995.00) 2020 model 3 2020 long range awd fsd autopilot accel pano 38k(US $24,995.00)

2020 model 3 2020 long range awd fsd autopilot accel pano 38k(US $24,995.00) 2018 model 3 2018 long range fsd autopilot nav pano blind 64k(US $22,495.00)

2018 model 3 2018 long range fsd autopilot nav pano blind 64k(US $22,495.00) 2021 tesla model 3 standard range plus sedan 4d(US $27,499.00)

2021 tesla model 3 standard range plus sedan 4d(US $27,499.00) 2023 tesla model 3(US $27,995.00)

2023 tesla model 3(US $27,995.00) 2020 tesla model 3 standard range plus(US $25,995.00)

2020 tesla model 3 standard range plus(US $25,995.00)

Auto blog

Tesla Cybertruck is here, Jeep Renegade is gone | Autoblog Podcast #810

Fri, Dec 8 2023In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Electric, John Beltz Snyder. They start the show by talking about the new cars they'd buy for $24,000 if it were 1995. In the news, Tesla delivered the first production Cybertrucks, the Jeep Renegade has been discontinued for 2024, we've received specs and pricing for the Fiat 500e, the Chevy Bolt's return is confirmed for 2025 and Honda's gona show some future EVs at CES. For reviews, our hosts have been driving the Toyota bZ4X, Kia EV9 and Audi SQ5 Sportback. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #810 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Here's $24,000. Buy something new in 1995 Tesla Cybertruck price, specs, features finally revealed — plus, Cyberbeast 2024 Fiat 500e U.S. specs and pricing revealed Chevy Bolt second generation confirmed for 2025 debut Honda will show its new global EV lineup at CES Cars we're driving: 2023 Toyota bZ4X 2024 Kia EV9 2024 Audi SQ5 Sportback Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Green Podcasts Audi Chevrolet Fiat Honda Jeep Kia Tesla Toyota

Unplugged Performance reveals Koenigsegg-made carbon fiber parts

Thu, Jan 20 2022There are a number of Tesla models that rival Koenigsegg supercars in acceleration, and now the electrified American cars can have styling parts made by the Swedish supercar company. This is possible thanks to a collaboration between Tesla aftermarket parts company Unplugged Performance. Unplugged Performance makes a variety of parts for Tesla models, from performance items such as suspension and brakes to cosmetic parts like these Koenigsegg pieces. They are all carbon fiber exterior parts produced with the same materials and processes the Swedish car company uses for its own machines. The designs of the parts are from Unplugged, though. Most of them are spoilers for each Tesla model, some for either more downforce or less drag, but there are also special wide front fenders for the Model 3. Pricing varies depending on the product, from $1,745 for many of the spoilers to $8,845 for a pair of Model 3 fenders. The parts are available now, and Unplugged Performance hints at additional Koenigsegg-made parts coming in the future. Related Video:

BMW NA president says i3 beats Tesla EVs thanks to lighter all-around footprint

Wed, Jan 29 2014Those waiting for a full-out brawl between Tesla Motors head Elon Musk and BMW North America chief Ludwig Willisch will have to wait a bit. For the bloodthirsty, there are signs of some healthy competition and a little bit of green-car sniping between the two automakers. Willisch, speaking at the Detroit Auto Show earlier this month and responding to questions about Tesla, noted (without mentioning that company by name) that the production process of the German automaker's i3 plug-in was "greener" than any other. According to Business Insider, Willisch highlighted the fully recyclable materials used to construct the i3 as well as the hydropower used at the carbon fiber plant in Moses Lake, WA. Willisch also noted that the Tesla Model S is "very heavy on the braking. Our car feels just like a normal car. That's a big difference when it comes to driving," Automotive News said in a separate report. The latter model weighs about a third less than the Tesla, though it also has an EV range about a third as big. The BMW executive did allow that the Tesla did make a good proverbial "snowplow," not for its driving characteristics but for its ability to get more people conformable with electric vehicle technology. Musk was asked about the i3 in an August conference call and laughed before noting that the i3 had "room to improve." No word on whether Musk and Willisch will be sending each other Valentine's Day cards next month.