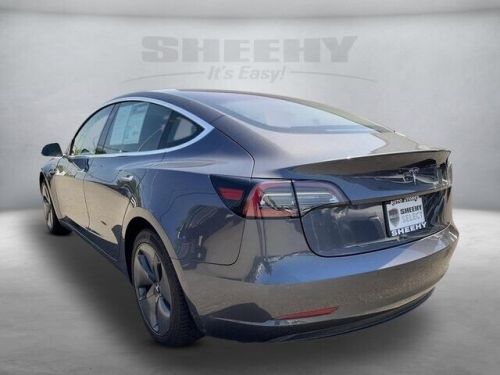

2019 Tesla Model 3 on 2040-cars

Engine:Electric

Fuel Type:Gasoline

Body Type:4dr Car

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 5YJ3E1EA9KF483319

Mileage: 45583

Make: Tesla

Model: Model 3

Drive Type: RWD

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Tesla Model 3 for Sale

2021 tesla model 3 standard range plus(US $26,500.00)

2021 tesla model 3 standard range plus(US $26,500.00) 2023 tesla model 3(US $27,000.00)

2023 tesla model 3(US $27,000.00) 2020 tesla model 3(US $26,999.00)

2020 tesla model 3(US $26,999.00) 2022 tesla model 3 standard sedan 4d(US $30,985.00)

2022 tesla model 3 standard sedan 4d(US $30,985.00) 2020 tesla model 3 standard range plus(US $24,990.00)

2020 tesla model 3 standard range plus(US $24,990.00) 2018 tesla model 3 long range(US $24,000.00)

2018 tesla model 3 long range(US $24,000.00)

Auto blog

Elon Musk says 'right on' to letter asking for new Model S features

Wed, Aug 27 2014If you want to get Tesla CEO Elon Musk's attention, taking out a full-page ad in his local newspaper will apparently do the trick. That's what two self-proclaimed "very highly satisfied" Model S owners did, asking for a few small changes in the popular EV. In response, Musk Tweeted a picture of the ad and wrote, "Ad taken out in Palo Alto Daily [News] by two Model S owners is right. Many of the suggestions will be implemented soon." The ad also appeared in the Palo Alto Weekly. You can see all of the requests by clicking the image above, but we'll mention some of them here. Improved voice-activated phone dialing, better sensors (like blind-spot monitors), redesigned sun visor, automatically closing charging port door and then the big one: Tesla ads. Tesla isn't talking about when the new features will be available, but if any of those items are unlikely in the near future, it's Tesla advertisements. After all, why pay for media attention when a simple Tweet about other people paying for your ad can get tremendous amounts of attention?

Tesla stock drops on fear that comes with low gas prices [w/video]

Wed, Dec 10 2014Tesla's stock price was down to around $206 earlier today, but it's back up to over $216 now. Friday, it closed at over $223. Some stock blogs are saying the price could go as low as $165 in the not-too-distant future. What's behind these wild swings that CNBC's Phil LeBeau calls, "the worst seven-day trading period ever for shares of Tesla"? One potential culprit is today's low gas prices. Those prices – currently hovering at around $2.65 a gallon in the US, the lowest in about four years – are affecting the cars people buy (sorry, hybrids), so it's not a huge leap to think they'll affect high-end electric cars, as well. A $50 drop in share price is pretty dramatic, and Bloomberg and others point the finger at gas prices. Ben Kallo, an analyst with Robert W. Baird & Co., wrote that, "We believe the recent decline in TSLA shares is largely driven by the concern low gasoline prices could impact demand if sustained for the long term." But there are other ideas, too. Since we don't always comprehend analyst-ese, we're not sure if Zev Spiro at Orips Research thinks gas prices are to blame, but it doesn't sound like it: A negative signal developed yesterday as a high volume break occurred below the slightly upward slanted neckline of the topping pattern, in the $219.20 area. The break below the neckline signaled a trigger of the bearish pattern and indicated a downtrend with a minimum expected price objective in the $165 area. In addition, yesterday's bearish trigger may result in downward momentum in the near term. Indicators are generally negative, adding to the overall bearish tone. Kallo remains positive, though, saying that, "We believe demand for TSLA's vehicles will remain strong." This makes sense to us, since TSLA has weathered drops before, only to climb to record highs afterwards. Watch a CNBC video report on all of this below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Recharge Wrap-up: Georgia gets E15, new PSA EVs will be cheaper and offer more range

Fri, May 8 2015What would it be like to test drive a gasoline-powered car in an EV-dominated world? A post by Tibor Blomhall at Tesla Club Sweden gives a glimpse into this alternate universe. The review begins by noticing the pushiness of the dealer at the "repair shop" that sells the car, which is cause for suspicion - a clear nod to Tesla's lack of such franchise dealerships. Of course, the author mentions the noise, vibration and the smell of the exhaust. He notes the inefficiency of the idling vehicle and its less-than-smooth operation, particularly when it comes to changing gears. The one plus: refueling is quick. The downsides, though, are that the fuel is toxic, dangerous and expensive, and you can't refuel at home. "Imagine if you could charge your electric car only at the power companies' most expensive fast chargers - and nowhere else!" Read more at Tesla Club Sweden. Georgia's first E15 station opens Friday, May 8. The Gulf Quick Stop Food Store at 855 S Cobb Drive SE in Marietta, Georgia will offer the 88-octane E15 ethanol blend. Two other Gulf locations in Madison and Greensboro will also offer E15 in Georgia. Customers at the Marietta location can enjoy "Happy Hour" pricing from 4 to 5 pm on May 8, and festivities include music, a concert ticket giveaway, face painting and a moon walk. State officials will be present for the celebration. Read more at Domestic Fuel. PSA/Peugeot-Citroen says its second-generation EVs will be less expensive and offer more range (surprise). The company is also planning to launch a plug-in hybrid in 2019 using the company's EMP2 platform, shared by the Peugeot 308 and Citroen C4 Picasso. "PSA will make pure electric cars from the bottom of the market upwards based on the new platform by the end of the decade," says a PSA spokesman. As for the plug-in hybrid, PSA CEO Carlos Tavares says, "We have completed the architectural aspects and are currently deciding on the battery technology." Read more from Automotive News Europe. Related Gallery 2014 Peugeot 308: Frankfurt 2013 View 23 Photos News Source: Domestic Fuel, Automotive News Europe, Tesla Club SwedenImage Credit: Citroen Green Tesla Citroen Peugeot Alternative Fuels Ethanol Electric recharge wrapup