2019 Model 3 2019 Long Range Autopilot Nav Pano Blind 55k on 2040-cars

Vehicle Title:Clean

Body Type:Sedan

Engine:Electric 283hp 317ft. lbs.

Transmission:Automatic

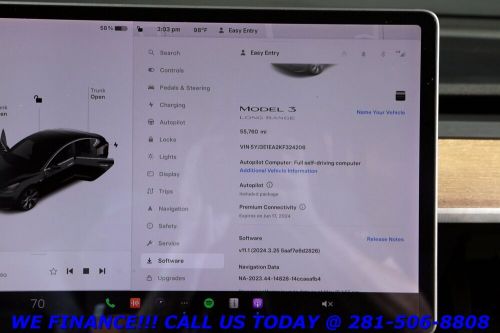

VIN (Vehicle Identification Number): 5YJ3E1EA2KF324206

Mileage: 55760

Warranty: No

Model: Model 3

Fuel: Electric

Drivetrain: RWD

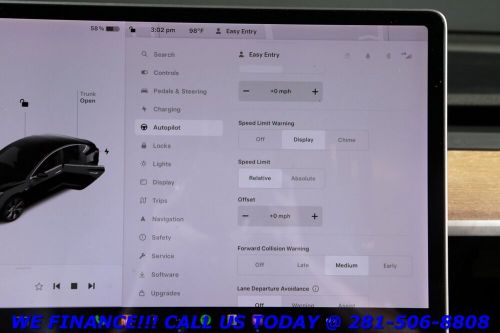

Sub Model: 2019 Long Range AUTOPILOT NAV PANO BLIND 55K

Trim: 2019 Long Range AUTOPILOT NAV PANO BLIND 55K

Doors: 4

Exterior Color: Solid Black

Interior Color: Black

Make: Tesla

Tesla Model 3 for Sale

2023 tesla model 3 rear-wheel drive(US $18,770.50)

2023 tesla model 3 rear-wheel drive(US $18,770.50) 2022 tesla model 3(US $33,995.00)

2022 tesla model 3(US $33,995.00) 2021 tesla model 3 long range dual motor all-wheel drive(US $20,580.00)

2021 tesla model 3 long range dual motor all-wheel drive(US $20,580.00) 2023 tesla model 3 rear-wheel drive(US $20,570.90)

2023 tesla model 3 rear-wheel drive(US $20,570.90) 2023 tesla model 3(US $26,900.00)

2023 tesla model 3(US $26,900.00) 2022 tesla model 3 long range(US $31,995.00)

2022 tesla model 3 long range(US $31,995.00)

Auto blog

Apple's merger chief met in secret with Tesla CEO Elon Musk

Mon, Feb 17 2014There's no lack of connections between two of the most darling Silicon Valley companies, Apple and Tesla Motors. Most recently, the electric car manufacturer hired away Apple's "Hacker Princess," Kristin Paget, but it's possible to look back as far as 2010 to see when Tesla hired the man who worked on the Apple Store experience, George Blankenship, to get the Tesla Stores in order (he left in late 2013). More recently, there's been outside calls for the two to link arms, namely from banking analyst Adnaan Ahmad who said Apple should just up and buy Tesla (some have also predicted that General Motors could do just that in 2014) in late 2013. But nothing in this list ties the two companies together as strongly as a new report in the San Francisco Chronicle: Apple's chief of mergers and acquisitions, Adrian Perica, secretly met with Tesla CEO Elon Musk last spring. Neither company is talking publicly, and the Chronicle's source is choosing to remain anonymous, but it appears that Tesla and Apple may have been at least a little bit interested in working together well ahead of Ahmad's call. He wrote that buying Tesla would bring another Steve Jobs-like figure (Musk) to the computer giant as well as give the maker of iPhones and iPads another market to explore (remember the iCar idea?). The Chronicle does admit that there's no upside for Tesla that's quite as obvious, and one analyst said a partnership would make more sense than a buy out. There could be other scenarios on the table, as well. Perhaps it was to discuss a joint giga-battery plant? Or maybe Musk's visit to Cupertino was just a courtesy call, in case Tesla ever needs access to Apple's famously deep pockets. We don't know, but the news does give us a slew of interesting possibilities to ponder. There's a lot more over in the Chronicle, including how Apple may be branching out into new medical devices. Related Gallery Tesla Model S View 24 Photos News Source: San Francisco Chronicle, 9to5MacImage Credit: Copyright 2014 Drew Phillips / AOLTip: Ellen K. Auto News Green Tesla Electric icar

Ohio Senate strips anti-Tesla amendment from bill

Thu, 05 Dec 2013Tesla's strategy to sell cars, such as the Model S, through manufacturer-owned retail stores has rubbed traditional franchise auto dealerships the wrong way. The battle between Tesla and the Ohio Auto Dealers Association heated up quickly over the past week because a proposed amendment to an Ohio road-maintenance worker safety bill (Senate Bill 137) threatened to ban Tesla stores in Ohio. The automaker asked for help from its supporters to fight the amendment, and on Tuesday all 12 members of the Ohio senate passed the bill without it, Transport Evolved reports.

After the vote, Tesla sent out an e-mail to its supporters thanking them for their help, which you can read below:

Dear Tesla Advocate,

Tesla working on snake-like auto charger

Fri, Jan 2 2015When people complain about electric cars, the gripes usually focus on range anxiety and the hassle of waiting for a charge to complete. The physical act of plugging the vehicle into the charger is seldom that big of a concern. However, for the contingent of customers who find hooking up their model to be torturous, Tesla CEO Elon Musk appears to have a rather bizarre (but potentially cool) solution on the way. In back-to-back tweets (embedded below), Musk announced his company is hard at work on a new charger that would automatically emerge from the wall of your garage and hook up to a Model S to begin charging. To make the tech just the teeniest bit more impressive, he claims the bot works with all versions of the company's electric car ͖ not just new ones. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Musk broached the idea of automatically plugging a Model S into the charger during the Tesla D unveiling and said, "we will probably do something like that." He didn't explain much more at the time, though. There still aren't many hard details on the scheme, but the idea of having a robotic snake living in the garage is both somewhat nightmarish and amazingly cool. We can't wait to see this thing in action. News Source: Twitter [1], [2]Image Credit: Tesla Green Tesla Green Automakers Ownership Technology Electric Sedan EV charging