2003 Saab 9-3 2.o Turbo,florida Car,1 Owner,warranty,54k,sunroof on 2040-cars

Fort Lauderdale, Florida, United States

Body Type:Sedan

Engine:2.0L 1985CC l4 GAS DOHC Turbocharged

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Used

Year: 2003

Number of Cylinders: 4

Make: Saab

Model: 9-3

Trim: Linear Sedan 4-Door

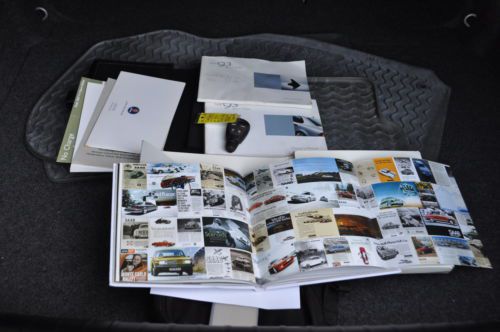

Warranty: Vehicle has an existing warranty

Drive Type: FWD

Options: CD Player

Mileage: 54,907

Power Options: Power Locks

Sub Model: 4dr Sdn Line

Exterior Color: Silver

Interior Color: Black

Saab 9-3 for Sale

Saab 9-3 aero wagon 2.8l turbo - 53,500 miles.(US $11,500.00)

Saab 9-3 aero wagon 2.8l turbo - 53,500 miles.(US $11,500.00) 2000 saab 9-3 viggen convertible - lightning blue - very rare(US $9,500.00)

2000 saab 9-3 viggen convertible - lightning blue - very rare(US $9,500.00) One owner, rare car, $45,000 msrp!(US $7,900.00)

One owner, rare car, $45,000 msrp!(US $7,900.00) 2001 saab 9-3 convertible only109,721miles 5spd 2liter4cyl turbo airconditioning

2001 saab 9-3 convertible only109,721miles 5spd 2liter4cyl turbo airconditioning No reserve 9-3 convertible coupe 328ci slk230 slk320 m5 e36 05 06 07 08 9-5

No reserve 9-3 convertible coupe 328ci slk230 slk320 m5 e36 05 06 07 08 9-5 2004 saab 9-3 convertible arc 1 owner no accidents smoke free clean no reserve!

2004 saab 9-3 convertible arc 1 owner no accidents smoke free clean no reserve!

Auto Services in Florida

Xtreme Car Installation ★★★★★

White Ford Company Inc ★★★★★

Wheel Innovations & Wheel Repair ★★★★★

West Orange Automotive ★★★★★

Wally`s Garage ★★★★★

VIP Car Wash ★★★★★

Auto blog

Best and Worst GM Cars

Thu, Apr 7 2022Oh yes, because we just love receiving angry letters from devoted Pontiac Grand Am enthusiasts, we have decided to go there. Based on a heated group Slack conversation, the topic came up about the best and worst GM cars. First of all time, and then those currently on sale, and then just mostly a rambling discussion of Oldsmobiles our parents and grandparents owned (or engineered). Eventually, three of us made the video above. Like it? Maybe we can make more. Many awesome GM cars are definitely going unmentioned here, so please let us know your bests and worsts in the comments below. Mostly, it's important to note that this post largely exists as a vehicle for delivering the above video that dives far deeper into GM's greatest hits and biggest flops, specifically those from the 1980s and 1990s. What you'll find below is a collection of our editors identifying a best current and best-of-all-time choice, plus a worst current and worst-of-all-time choice. Comprehensive it is not, but again, comments. -Senior Editor James Riswick Best Current GM Vehicle Chevrolet Corvette We were flying by the seats of our pants a bit in this first outing and my notes were similarly extemporaneous. When it came time to tie it all together on camera, I failed spectacularly. Thank the maker for text, because this gives me the opportunity to perhaps slightly better explain my convoluted reasoning. I chose the C8 Corvette because it's simply overwhelmingly good, and it's merely the baseline from which this generation of Corvette will be expanded. While the Cadillac CT5-V Blackwing (more on that in a minute) is an amazing snapshot of GM's current performance standing and its little sibling so enraptured me that I went out and bought one, their existence is fleeting. Corvette will live on; forced-induction Cadillac sport sedans, not so much. So while all three are amazing machines when viewed in a vacuum, the Corvette stands above them as both a reflection of GM's current performance credentials and a signpost of what is to come. So, given the choice between the C8 and the 5V-Blackwing right now, I'd choose the C8. In 10 years, when the Blackwing is no longer in production and Corvette is in its 9th generation? Well, that might be a different story. Now, just pretend I said something even remotely that coherent when we get to the part of the video where I try to make an argument for the 5-V Blackwing as best GM car I've ever driven. Or just laugh at me while I ramble incoherently.

Why won't automakers slap on a turbo badge anymore?

Thu, Sep 10 2015Where have all the turbos gone? Not the actual pieces that go in the engine, mind you, those are everywhere these days as automakers downsize cylinder counts and boost efficiency and CO2 claims. But the turbo badges and fanfare are missing. Back when turbos were something to get excited about there was "turbo-driven," "turbonium," and "The Turbo Zone," among other silly lines. But now that basically every car is getting some sort of boost even on the lowliest trims, automakers are almost sliding in the turbos under the radar. Or if you look at some of the nomenclature, pretending they don't exist at all. The 911 Turbo badge shows where the car goes from being sane to lunatic. It's an important border. The latest automaker to hide that it has boosted the turbo presence is Porsche with the 2017 911 lineup. Even the standard Carrera models now get turbocharged flat-six engines, meaning the 911 Turbo models aren't quite as special as they once were. Porsche is in a sticky situation with this. The 911 Turbo, after all, signifies where the 911 family takes off from being a sports car and becomes the Ferrari fighter. The 911 Turbo badge shows where the car goes from being sane to lunatic. It's an important border, but now Porsche has crossed it and is trying to downplay the fact. There are a lot of exaggerations with displacement badges today, with claims the 2.0-liter turbo four in a Mercedes C Class equates to a naturally aspirated 3.0-liter six to make a C300. Volvo is pretty far up there, too, saying an XC90 T8 means V8 power, even though it's a 2.0-liter turbocharged and supercharged four with electric assist. I don't know why BMW can't just call the car a 330i Turbo, rather than inflating the numbers up to 340i. Saab tried all of this back in the '90s when it decided to turbocharge its entire lineup, from light pressure units all the way up to models actually called "Saab 9-3 HOT" (for high-output turbo). But then the brand deleted any external reference to the turbo under the hood and people wondered why they were buying a $42,000 four-cylinder convertible. And that didn't turn out well. Even though these turbo replacements often make more power than their naturally aspirated predecessors, they're very different engines. People knew something changed when they exchanged their leased 328i with a 3.0-liter six for a 328i with a 2.0-liter turbo four.

First test drive shows promise of Saab 9-3 EV

Tue, Sep 16 2014We can't read Swedish, so when it comes to a first-drive review of a Saab 9-3 electric-vehicle prototype, we'll trust Inside EVs' translation of a write-up from Swedish automotive publication Elbilen i Sverige. And it's a decent one. The write-up, that is. The translation, too, we hope. Taken to the test track, the Saab was found to be quieter than a Tesla Model S and had the stability commensurate for a car that tipped the scales at about 4,000 pounds. The sedan accelerated from 0 to 62 miles per hour in 10 seconds, though the goal is to bring that time down to 8.5 seconds. The prototype also uses a 37-kWh prototype battery made by China-based Kai Johan Jiang Annual National Modern Energy Holdings that should be good for over 180 miles (and there's room for a bigger pack in the car, apparently). The 9-3's electric motor will be able to deliver 200 horsepower but, for testing purposes, it was limited to about 140 horsepower. The overall impression was that the car is not yet ready for prime time, but has a lot of promise. When prototype becomes production is the real question, given the financial condition of Saab parent National Electric Vehicle Sweden (NEVS). The company acquired the brand in 2012 and started making cars at Saab's Trollhattan plant in Sweden last year, but production stopped in May because of cash-flow issues. Late last month, Swedish courts denied NEVS protection from its creditors, so the company is now looking to restructure.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.042 s, 7891 u