We Finance One Owner Clean White Slt 5.7l 4x4 Power Alloy Am/fm Bluetooth Aux on 2040-cars

Temple Hills, Maryland, United States

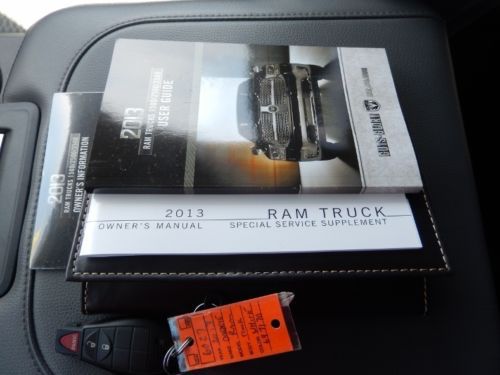

Ram 1500 for Sale

5.7l hemi 4x4 big horn remote start tow hitch running boards cpo dual exhaust

5.7l hemi 4x4 big horn remote start tow hitch running boards cpo dual exhaust 13 regular cab short box rear wheel drive satellite radio keyless entry tow

13 regular cab short box rear wheel drive satellite radio keyless entry tow 12 4x4 4wd orange 5.7l v8 hemi automatic miles:11k regular cab certified

12 4x4 4wd orange 5.7l v8 hemi automatic miles:11k regular cab certified 2013 ram 1500 2wd quad cab slt 2wd 140.5 silver

2013 ram 1500 2wd quad cab slt 2wd 140.5 silver Dodge big horn gold 1 owner chrome 20's bucket seats remote start bed cover

Dodge big horn gold 1 owner chrome 20's bucket seats remote start bed cover 2014 ram 1500 laramie crew cab navigation sunroof only 2,587 miles

2014 ram 1500 laramie crew cab navigation sunroof only 2,587 miles

Auto Services in Maryland

Wes Greenway`s Waldorf VW ★★★★★

Virginia Tire & Auto of Ashburn/Dulles ★★★★★

The Body Works of VA INC ★★★★★

Streavig`s Service Center ★★★★★

Southern Stables Automotive ★★★★★

Sedlak Automotive, LLC ★★★★★

Auto blog

These are the 'Greenest' and 'Meanest' cars in 2015

Fri, Feb 6 2015As has become tradition, the American Council for an Energy-Efficient Economy (ACEEE) has come up with a ranking of what it refers to as the "greenest" cars of 2015, and, by way of contrast, a list of the so-called "meanest" cars, so those who value eco-friendliness over all else can choose which vehicles they should or should not consider buying. As you may expect, electric cars make up the majority of the greenest cars on the list, but, perhaps surprisingly to many, the Tesla Model S didn't make the cut. It's worth noting, too, that where the electricity an owner uses to charge their electric vehicle has a big impact on its overall environmental impact. "A car that is charged using electricity generated from natural gas or renewables is going to have significantly less impact on the environment than one charged on a coal-heavy grid," says ACEEE lead vehicle analyst Shruti Vaidyanathan. The ACEEE's list for 2015 looks very different than it did in 2014. It's an interesting collection, though – and we're sure this goes without saying, really – we'd recommend doing a bit more research into each vehicle and how it might fit into your daily life before making any purchase decisions. Click here to see the ACEEE's list of the Greenest and Meanest vehicles sold in the United States in 2015. Green Bugatti Chevrolet Fiat GM GMC Mercedes-Benz Nissan RAM smart Toyota greenest greenest cars

Ford, Ram in heavy-duty towing spat

Mon, 28 Jul 2014Every pickup truck commercial has the brand trying to convince us that its model is the biggest, brawniest vehicle on the block. But Ford and Ram appear ready to really throw down the gauntlet and scrap over the towing figures for their heavy-duty models, and it could potentially end up in court.

The issue revolves around what it means to be best in class. Ford claims that its 2015 F-450 (pictured above) has a max tow rating of 31,200 pounds, compared to 30,000 pounds for the Ram 3500 (right). However, both companies market these heavy haulers as having the top towing in their class. According to Automotive News, Ford is threatening legal action if Ram doesn't back down.

The situation isn't as simple as just comparing the numbers, though. First, the two companies calculate their towing capacities differently. Ram adheres to the SAE J2807 rating, while Ford uses its own internal system. Although, as the company introduces new models, they are certified using the SAE standard. "When an all-new F-Series Super Duty is introduced, it also will use SAE J2807," said Ford to Autoblog in an emailed statement.

Why 2015 is going to be a huge year for trucks

Thu, Jan 22 2015Nissan chief executive Carlos Ghosn took center stage to introduce the 2016 Titan last week at the Detroit Auto Show. He spoke of the truck's new features, impressive Cummins V8 diesel engine and the extensive amount of time and money required to build a modern, competitive pickup truck. "We have done all of this because we see opportunity – an opportunity in the unmet needs of today's American truck customers," Ghosn said. He was speaking about the Titan, but his thoughts echo the industry's mindset: When it comes to trucks, find an opportunity and attack. Even with CAFE regulations looming and fickle consumer preferences, investing in trucks is a no-brainer for automakers. Some consumers will always need a truck for their job or lifestyle. And some people will always want one, whether they need it or not. With that in mind, here are four reasons why the pickup-truck sector is more important than ever and poised for growth in 2015. View 24 Photos The Nissan Titan Is Back Okay, it never left, but the Titan hadn't been redesigned since its launch in 2003, and Nissan sold more NV200s than Titans in 2014. It's an understatement to say the truck was languishing. That all changes with the 2016 model. The Titan will come in two variants, a traditional fullsize competitor and the Titan XD. The XD will lead the market launch, and it arrives late this year. It's pitched as a "whitespace" offering, Nissan sales and marketing vice president Fred Diaz said. The idea is to offer something in the general size and price range of a fullsize truck, but also have some of the capability of a heavy-duty truck. The XD uses a fully boxed ladder frame, the chassis design from Nissan's commercial division, and the wheelbase is about 20 inches longer than other Titan models. The XD, which Nissan is calling the flagship of the line, will be the only model with the 5.0-liter Cummins turbodiesel V8. It produces 310 horsepower and 555 pound-feet of torque, while being able to tow 12,000 pounds. V6 and V8 gasoline models will also be offered on the Titan XD and the standard, non-XD model. When production ramps up, the Titan will be sold with several cabs, beds and trims. New features include trailer sway control, an integrated trailer brake controller, more storage options in the cabin and even laminated front and rear side glass to reduce outside noise. All of this has given Nissan fresh confidence in an area where it admittedly has been lacking. "We can compete," Diaz told Autoblog.