2014 Ram 1500 Tradesman/express on 2040-cars

500 Admiral Weinel Blvd, Columbia, Illinois, United States

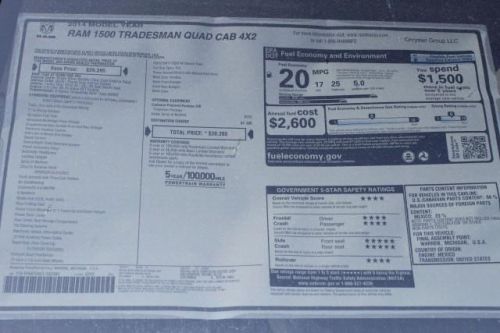

Engine:3.6L V6 24V MPFI DOHC

Transmission:8-Speed Automatic

VIN (Vehicle Identification Number): 1C6RR6FG9ES332980

Stock Num: D99148

Make: RAM

Model: 1500 Tradesman/Express

Year: 2014

Exterior Color: Bright Silver

Interior Color: Diesel Gray / Black

Options: Drive Type: RWD

Number of Doors: 4 Doors

Step into the 2014 Ram 1500! You'll appreciate its safety and technology features! The following features are included: a rear step bumper, a bedliner, and cruise control. It features an automatic transmission, rear-wheel drive, and a refined 6 cylinder engine. Our aim is to provide our customers with the best prices and service at all times. Stop by our dealership or give us a call for more information. "1ST FOR A REASON" On Price and Selection-No other dealer will beat Royal gate of Columbia on price. Give us a chance to save you some money on the car you want!

Ram 1500 for Sale

2014 ram 1500 tradesman/express(US $28,153.00)

2014 ram 1500 tradesman/express(US $28,153.00) 2014 ram 1500 tradesman/express(US $30,590.00)

2014 ram 1500 tradesman/express(US $30,590.00) 2014 ram 1500 tradesman/express(US $31,003.00)

2014 ram 1500 tradesman/express(US $31,003.00) 2014 ram 1500 tradesman/express(US $32,488.00)

2014 ram 1500 tradesman/express(US $32,488.00) 2014 ram 1500 slt(US $36,683.00)

2014 ram 1500 slt(US $36,683.00) 2014 ram 1500 slt(US $47,465.00)

2014 ram 1500 slt(US $47,465.00)

Auto Services in Illinois

Xtreme City Motorsports ★★★★★

Westchester Automotive Repair Inc ★★★★★

Warson Auto Plaza ★★★★★

Voegtle`s Auto Service Inc ★★★★★

Thom`s Four Wheel & Auto Svc ★★★★★

Thomas Toyota ★★★★★

Auto blog

Cars with the most reckless drivers are full of surprises

Wed, Oct 13 2021Insurify is a site for comparing auto insurance quotes. Because insurance shoppers need to submit information like the vehicles they're driving and the infractions they've compiled while driving those vehicles, Insurify has quite the database of correlations tying certain models to a habit of breaking certain laws. When the site's data analysts decided to compile a list of the top ten models for reckless driving citations in the decade from 2010 to 2019, the ranking contained a few wild entries. The Dodge Challenger making the countdown will surprise precisely zero people. But the Saturn L200? First, a definition: USLegal.com defines reckless driving as "driving with a willful or wanton disregard for safety. It is the operation of an automobile under such circumstances and in such a manner as to show a willful or reckless disregard of consequences." So this list is a caution about particular drivers more than the cars. For a baseline, according to Insurify data, for any random model, 15 out of 10,000 people who drive that model have picked up one citation for reckless driving. Back to that Challenger, then. No shocker for being here, but it's actually number 10, with 44 out of 10,000 Challenger drivers nabbed for a willful disregard of consequences on the road. That's better than the first surprise entry, the Saturn L200, a sedan only on sale for six years, with the least horsepower on the list, and out of production since 2005. The data set put drivers of GM's extraterrestrial sedan at 45 reckless pilots per 10,000 drivers. There are two pickups on the list, the only modern one being the Ram 1500 at eighth, with a rate of 46 in 10,000. Somehow, drivers of the third-best-selling pickup in the U.S. outrun the overwhelming numerical superiority of the best-selling vehicle in the States, the Ford F-150. The other pickup is the Chevrolet K1500 at number five, with a rate of 56 in 10,000. This is not only the oldest vehicle on the list, it went out of production in 2002, before any other vehicle on the list. Between the trucks, the Volkswagen CC slotted in at seven with 47 in 10,000 reckless driving chits, the Cadillac ATS slipped into sixth with 48 in 10,000. The top four is a bag of unexpected. The Nissan 370Z is the first hardcore sports car on the list at number four, with 61 in 10,000 Z drivers flaunting their Fairladys in the face of Johnny Law.

2015 Ram Laramie Limited brings more luxury, tweaked style to Chicago

Thu, Feb 12 2015Once upon a time, the Chicago Auto Show was where truck manufacturers chose to introduce their wares. New HD truck? Go to Chicago. Entry level, midsize pickup? Chicago. Flagship dually? Chicago. While that's far from a rule nowadays, Ram still looked to the Windy City to introduce the new version of its flagship trim – the Laramie Limited. Featured in light-duty 1500, heavy-duty 2500 and I-need-to-tow-Australia 3500 bodies, the Laramie Limited is the latest proof that pickups are no longer limited to work, but are proper luxury vehicles in their own right. To reflect this, Ram has upholstered the Laramie Limited's cabin in gorgeous black Natura Plus leather. We're pretty fond of the Graystone piping on the seats, while the pinstripe theme found throughout on the Black Argento wood and contrast stitching certainly ups the styling ante. The center stack is home to most of the cabin's brightwork, with K-black Dark Metallic paint, while LED accent lighting is found throughout. Ram was liberal with the application of Liquid Graphite finishes, adding it to the center stack's bezels and the gauges and needles in the handsome instrument cluster. For the exterior, Ram has thrown the whole idea of subtlety out the window. There's plenty of inspiration from the Ram Rebel that was shown at the 2015 Detroit Auto Show, only instead of the dark finishes of that vehicle, the Laramie Limited features lots, and lots of chrome. Like the Rebel, the flagship truck gets a restyled grille, complete with a domineering "RAM" badge, although the nose of the Laramie Limited is nothing compared to its tailgate. The rear of the truck is home to an enormous, 20-inch wide "RAM" badge that the company hilariously explains away in its press release, saying it's there "so onlookers can clearly identify the truck." Okay. Beyond the borderline obnoxious badges, Ram has finished the front and rear bumpers and mirror caps in chrome, and opted for a stylish dark housing for the halogen-only headlights. Those units crown LED turn signals, while the taillamps are straight LED throughout. We have an extensive gallery of images detailing the new Laramie Limited, and you can bet that we'll be complementing the official shots with live images from the floor of the 2015 Chicago Auto Show. Until then, head into Comments and let us know what you think of Ram's not-so-subtle flagship.

2015 Ram ProMaster City Tradesman First Drive [w/video]

Tue, Dec 23 2014From the perspective of a reviewer, there's a refreshing clarity to be hand when approaching a vehicle like a small commercial van. Where the inherent value equation for most vehicles is composed of both objective facts (price, fuel economy), and subjective opinions (looks, emotional response while driving), the reckoning of something like the new Ram ProMaster City is more straightforward. The light commercial van segment in the US has seen a remodel over the last half-decade, moving from paneled-over minivans to the versatile, economical, European-style boxes on wheels you see with increasing frequency today. Ford, Nissan and Chevrolet are all players here (though Chevy's City Express is essentially a rebadged version of Nissan's NV200), and though Ram's entry could be seen as late to the party, it also matches up very nicely in many of those straightforward areas of measure. Kindly, Ram brought along both the Nissan and the Ford for us to test alongside its new product, so we could get firsthand comparative impressions. The 2015 ProMaster City is roomier, more powerful and more maneuverable than its competition, though it trades those advantages for a higher price and a thirstier engine around town. We headed down to Texas where, between breaks for tacos and Topo Chicos, our goal was to see if Ram had created the new best box van in the US. Based on the already successful Fiat Doblo van from Europe, the baby ProMaster's visual transformation after its continental hop isn't radical. Ram has fitted a crosshair grille, new headlights and taillights, but largely the curvaceous, nose-forward styling remains the same. As we mentioned at the top: style is going to be very low on this list of priorities for a buyer of light commercial vans. Still, we'd rate the City as mid-pack for the options in the US; more attractive than the Nissan/Chevy twins and less so than the crisp Ford Transit Connect. (Though the optional five-spoke wheels of our test vehicle make it seem downright sporty in this group). Open the driver's side door and slide into the almost totally flat front seat, and any notion of "style" goes right out the window. Surfaces are almost exclusively black and gray, with workaday textures and frustratingly easy-to-scratch-plastics. This is a functional space though; trays, cubbies, cupholders and bins are far more numerous than you'd expect from a compact, two-seat cabin.