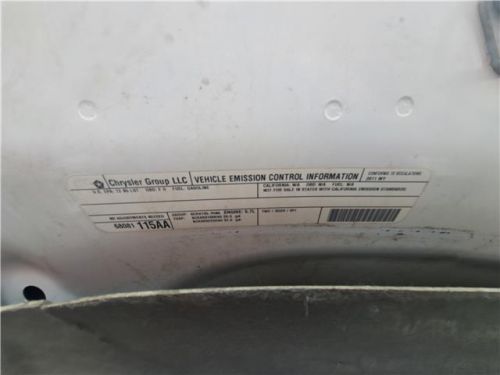

2011 Ram 1500 Sport on 2040-cars

Ogden, Utah, United States

Engine:8 Cylinder Engine

Fuel Type:Gasoline

Body Type:Crew Cab Pickup

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1D7RV1CT2BS681702

Mileage: 160736

Make: Ram

Trim: Sport

Drive Type: 4WD

Horsepower Value: 390

Horsepower RPM: 5600

Net Torque Value: 407

Net Torque RPM: 4000

Style ID: 328185

Features: 5.7L V8 HEMI MULTI-DISPLACEMENT ENGINE

Power Options: Pwr 4-wheel anti-lock (ABS) disc brakes, Pwr rack & pinion steering

Exterior Color: White

Interior Color: --

Warranty: Unspecified

Model: 1500

Ram 1500 for Sale

2012 ram 1500 sport r/t 5.7l v8 hemi(US $19,900.00)

2012 ram 1500 sport r/t 5.7l v8 hemi(US $19,900.00) 1993 ram 1500(US $30,000.00)

1993 ram 1500(US $30,000.00) 2023 ram 1500 trx hennessey mammoth 1000(US $159,950.00)

2023 ram 1500 trx hennessey mammoth 1000(US $159,950.00) 2023 ram 1500 trx(US $102,000.00)

2023 ram 1500 trx(US $102,000.00) 2022 ram 1500 limited longhorn crew cab 4x4 5'7" box(US $37,355.50)

2022 ram 1500 limited longhorn crew cab 4x4 5'7" box(US $37,355.50) 2022 ram 1500 big horn quad cab 4x2 6'4" box(US $24,481.10)

2022 ram 1500 big horn quad cab 4x2 6'4" box(US $24,481.10)

Auto Services in Utah

Westech Equipment ★★★★★

Tony Divino Toyota ★★★★★

Tony Divino Toyota ★★★★★

Secor Motors Inc ★★★★★

Rogers Automotive ★★★★★

Leavitt Automotive of Saint George ★★★★★

Auto blog

FCA's SEMA vans: A Ram ProMaster bar and a Mopar'd Pacifica

Tue, Nov 1 2016For this year's SEMA show, FCA created six machines that range from mild to wild, and what we have here are the two mildest examples: a custom Ram ProMaster and an accessorized Chrysler Pacifica. Of the two, the ProMaster is easily the more interesting. It's called the BrewMaster and it's a rolling bar. Get it? View 11 Photos The pub-themed interior has a variety of custom touches, including Mopar neon signs and beer taps with shift-knob handles. The outside gets some conceptual parts as well. The grille loses the crosshair design in favor of a large-font "RAM" badge in the center, similar to the one on the Ram Rebel. It also gets some custom 20-inch wheels and large fender flares to accommodate the wider rubber. The message here: Don't drink and drive, but definitely drive somewhere and drink. The Pacifica has far fewer custom goodies, and, sadly, no Hellcat powertrain, but that means what you see is something you could realistically replicate at a dealer. Called the Pacifica Cadence, this van is a rolling showcase of Mopar accessories. The newest piece is a running board that is designed to look like part of the sheetmetal, as opposed to a tacked-on aftermarket accessory. We'd say it's fairly successful if not super-exciting. View 7 Photos The Pacifica also features loads of other Mopar bits including the roof rack, dog kennel, all-weather floor mats, and wireless charging pad. Aside from the custom wrap and painted wheels, you could outfit your own Pacifica identically using a Mopar catalog. As for the BrewMaster, that might require a bit more custom work. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Image Credit: FCA, Joel Stocksdale SEMA Show Chrysler RAM Minivan/Van Concept Cars chrysler pacifica ram promaster SEMA 2016

The EPA has alleged that FCA installed undisclosed emissions software in about 100k Ram and Jeep diesel models [UPDATE]

Thu, Jan 12 2017Update: The text has been updated with official information from the EPA given in a press release and a conference call. Although an initial report from Reuters said the EPA will accuse Ram and Jeep of using emissions defeat devices today, that isn't quite the case. In a press release and a conference call, the EPA stated that the notice of violation sent to FCA is for the installation of eight undisclosed auxiliary emissions control devices on 2014 to 2016 Jeep Grand Cherokee and Ram 1500 models with the 3.0-liter turbodiesel V6. The violation applies to about 104,000 vehicles in total. The agency also explained that auxiliary emissions controls on vehicles are not necessarily illegal, but installing them without disclosing them to the EPA when having the vehicle certified is. Though this initial notice of violation is for installing undisclosed software, the EPA may soon also classify these emissions devices as defeat devices, as it did with the software Volkswagen used. Depending on the outcome of the investigation, there could be fines of up nearly $45,000 per vehicle involved in the notice of violation. The agency revealed that the software alters how the emissions system performs in certain situations. In controlled testing, the vehicles are compliant, but in conditions such as high speed operation, the EPA found the vehicles would produce much higher levels of NOx emissions. The EPA is continuing to investigate, and is waiting for FCA to explain why these emissions control devices are not cheating or defeat devices. In an official statement, FCA stated it is looking forward to explaining that the software does not constitute a defeat device, and has also proposed software updates to achieve compliance. During the conference call, EPA representatives also noted that the vehicles are still safe and legal to be driven, and that owners do not need to take any action yet regarding their cars. It should be noted there is no stop-sale on current models at this time. Additionally, 2017 versions of the 3.0-liter diesel FCA vehicles have not been emissions certified yet. Related Video: News Source: Reuters, Environmental Protection Agency Government/Legal RAM

Auto Mergers and Acquisitions: Suicide or salvation?

Tue, Sep 8 2015We love the Moses figure. A savior riding in from stage right with the ideas, the smarts, and the scrappiness to put things right. Alan Mullaly. Carroll Shelby. Lee Iacocca. Andrew Carnegie. Steve Jobs. Elon Musk. Bart Simpson. Sergio Marchionne does not likely view himself with Moses-like optics, but the CEO of Fiat Chrysler Automobiles recently gave a remarkable, perhaps prophetic interview with Automotive News about his interest and the inevitability of merging with a potential automotive partner like General Motors. Marchionne has been overtly public about his notion that GM must merge with FCA. For a bit of context, GM sold 9.9 million vehicles in 2014, posting $2.8 billion in net income, while FCA sold 4.75 million units and earned $2.4 billion in net income, painting a very rosy FCA earnings-to-sales picture. But that's not the entire picture. Most people in the auto industry still remember the trainwreck that was the DaimlerChrysler "merger" written in what turned out to be sand in 1998. It proved to be a master class in how not to fuse two companies, two cultures, two continents, and two management teams. Oh, it worked for the two individuals at both helms pre-merger. They got silly rich. And the industry itself was in a misty romance at the time with mergers and acquisitions. BMW bought Rolls-Royce. Volkswagen Group bought Bentley, Bugatti, and Lamborghini, putting all three brands into their rightful place in both products and positioning. No marriages there, so no false pretense. Finally, Nissan and Renault got married in 1999. A successful marriage requires several rare elements in this atmosphere of gas fumes and power lust. But a successful marriage requires several rare elements in this atmosphere of gas fumes and power lust, the principle part being honesty. Daimler and Chrysler lied to each other. The heads of each unit, the product planners, and finance all presented their then-current and long-range forecasts to each other with less-than-forthright accuracy. Daimler was the far greater equal and no one from the Chrysler side enjoyed that. The cultures were entirely different, too, and little was done to bridge that gap. Which brings me back to the present overtures by Marchionne to GM. "There are varying degrees of hugs," Marchionne stated in the Automotive News piece. "I can hug you nicely, I can hug you tightly, I can hug you like a bear, I can really hug you." Seriously?