Sport Chrono..sport Exhaust..park Assist W/ Reverse Camera..factory Aerokit on 2040-cars

Plano, Texas, United States

Vehicle Title:Clear

Engine:4.8L 4806CC V8 GAS DOHC Turbocharged

For Sale By:Dealer

Body Type:Hatchback

Fuel Type:GAS

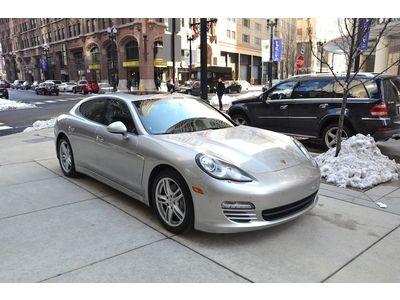

Make: Porsche

Warranty: Vehicle has an existing warranty

Model: Panamera

Trim: Turbo Hatchback 4-Door

Safety Features: Passenger Airbag

Power Options: Power Windows

Drive Type: AWD

Mileage: 13,778

Number of Doors: 4

Sub Model: Turbo

Exterior Color: Black

Number of Cylinders: 8

Interior Color: Black

Porsche Panamera for Sale

2010 porsche panamera 4s automatic 4-door hatchback(US $79,995.00)

2010 porsche panamera 4s automatic 4-door hatchback(US $79,995.00) 2011 porsche panamera 4s automatic 4-door hatchback(US $84,995.00)

2011 porsche panamera 4s automatic 4-door hatchback(US $84,995.00) 2010 porsche panamera turbo, 13,308 miles, msrp $, only $94,888.00!!(US $94,888.00)

2010 porsche panamera turbo, 13,308 miles, msrp $, only $94,888.00!!(US $94,888.00) Low miles! must see! extra clean! call rudy@7734073227(US $64,995.00)

Low miles! must see! extra clean! call rudy@7734073227(US $64,995.00) 2010 porsche panamera s

2010 porsche panamera s 2013 porsche panamera turbo - same as new!

2013 porsche panamera turbo - same as new!

Auto Services in Texas

Yos Auto Repair ★★★★★

Yarubb Enterprise ★★★★★

WEW Auto Repair Inc ★★★★★

Welsh Collision Center ★★★★★

Ward`s Mobile Auto Repair ★★★★★

Walnut Automotive ★★★★★

Auto blog

Porsche tops JD Power APEAL study for 12th time

Wed, Jul 27 2016JD Power's 2016 Automotive Performance, Execution, and Layout (APEAL) study hasn't changed much this time around with Porsche coming in at No.1 for the 12th consecutive year, while BMW was close behind in second. Jaguar and Mercedes-Benz tied for third with Land Rover, Lexus, and Lincoln tied for No.5. The APEAL Study, according to JD Power, measures owners' level of excitement and emotional attachment across 77 parameters. Brands and cars are rated on a 1,000-point scale. The study found that new cars with modern safety features including low speed collision avoidance and blind spot monitoring have higher APEAL scores than vehicles without the features. The overall industry score increased from 798 to 801, which JD Power claims was helped by the launch of a variety of new vehicles. This year, 22 out of 30 new or redesigned cars received a higher score than the vehicle's respective segment average. Porsche is once again at the top of the list as the automaker's score increased by three points to 877. BMW outscored Jaguar to take second place with a score of 859, while the British automaker dropped three points from last year with 852 points. Volkswagen overtook Mini to become the top-ranked non-premium brand with 809 points, while the latter automaker trailed behind by one point. At the end of the scale, Smart came in at the very bottom for the second year in a row with a score of 745 points, which represents an increase of 62 points over last year. Fiat's score increased by six points to 755, but still confined the automaker to second-to-worst place for a consecutive year. Mitsubishi's score increased to 770, up from 755, to become the fourth-worst brand, while Jeep fell to third-worst with a decrease in seven points to 756. General Motors received six segment-level awards, followed by Hyundai with five, and BMW and VW earning four apiece. Surprise segment victories include the Chevrolet Camaro, which outscored the Dodge Challenger, and the Lexus RC which ranked above the BMW 4 and 3 Series. For more information on how the automakers ranked, check out the official release on the 2016 APEAL Study below or visit JD Power's website to analyze the graphs. Related Video: Porsche Ranks Highest in APEAL for 12th Consecutive Year; General Motors Receives Six Segment-Level Awards, Hyundai Motor Company Receives Five DETROIT: 27 July 2016 — Popular driver-assist technologies help make vehicles considerably more appealing to their owners, according to the J.D.

Supercar 'Holy Trinity' raced at the track, drag strip, and to 186 mph

Thu, Dec 3 2015There was a time when we weren't sure if we'd ever get the Ferrari LaFerrari, McLaren P1, and Porsche 918 Spyder on the track together. Now, we've have a multi-part series dissecting how each supercar approaches all kinds of go-fast tasks. Supercar Driver (SCD) looks at their performances around the track, on the drag strip, and on a runway. SCD didn't get any help from the automakers, it used three cars all owned by one British gentleman, Paul Bailey. The first video has British Touring Car Championship driver Mat Jackson running all three around Silverstone. The second video takes the coupes to Santa Pod Raceway to run the quarter-mile. The third video runs them out to Bruntingthorpe Airfield for a drag race to 300 kilometers per hour (186 mph). We found that latter video especially interesting because SCD shows a graph of how fast each car hit speed marks, and it's interesting to see where the winner made up all of its time and the where the third-place getter lost its time. Nota bene, the McLaren is using its fly-paper sticky Pirelli P Zero Trofeo R tires. You'll find the first video in the series above, the second two videos below. If you still haven't had enough, then check out the Hyper 5 three-part series by Alejandro Solomon filmed at California's Thermal Raceway, starting with the Holy Trinity and adding the Bugatti Veyron Super Sport and Pagani Huayra. Chris Harris also did fantastic work around Portimao with the help of Marino Franchitti and Tiff Needell, with assistance from the factories. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Ferrari McLaren Porsche Convertible Coupe Hybrid Luxury Special and Limited Editions Performance Supercars Videos porsche 918 spyder mclaren p1 ferrari laferrari

The 2017 Porsche 911 RSR goes mid-engine, purists be damned

Wed, Nov 16 2016Porsche unveiled its World Endurance Championship and IMSA WeatherTech Championship competitor with the 2017 911 RSR. And this 911 is different from the rest, as the 4.0-liter flat-six engine powering this beast is in front of the rear axle, not behind it. That's right, this 24 Hours of Le Mans competitor ditches the iconic rear-engine layout. Porsche isn't talking specifics on how exactly things are arranged back there. The engine is new, now based on the 991 911's block instead of the previous Mezger motor that's been used for years. The transmission design is new as well – it would have to be to accommodate the new location relative to the engine. The racecar has been engineered to meet the LM-GTE class, where it will go up against other mid-engine cars like the Ford GT and Ferrari 488 GTE. Moving the engine to the middle has given Porsche the ability to fit the 911 RSR with massive bits of aero, like the humongous rear diffuser that looks like it would be more at home on a machine of war. The only thing that can compete with the diffuser for size is the top-mounted rear wing, which shares a similar design to the one found on the 919 Hybrid. Going back to the engine, the direct-injected boxer motor, depending on the size of the restrictor, generates as much as 510 horsepower and sends all of its fury to the rear wheels. The engine is paired to a six-speed sequential gearbox, which drivers can employ through paddles on the steering wheel. The new engine doesn't have a lot of weight to push around as the 911 RSR, as required by regulations, weighs 2,740 pounds. Speaking of weight, the engine layout isn't the only change for the 911 RSR. For 2017, the car ditches its steel body for one that's made out of carbon fiber. The body attaches to the chassis via quick-release fasteners, making the vehicle easier to service as exterior elements can be removed with minimal effort. The racecar also gets a radar-based collision system – aptly named the "Collision Avoid System" – which is meant to limit the 911 RSR's encounters with faster LMP prototypes. Only time will tell if the new layout and aerodynamic components help the 911 RSR beat its competition. But there will be plenty of opportunities to see the racecar in action as Porsche plans to run the 911 RSR in 19 races during the 2017 season, the first of which will take place at the IMSA opener on January 28th at Daytona, where the racecar will make its track day debut.