2008 Porsche Boxster on 2040-cars

Walnut Creek, California, United States

Porsche Boxster for Sale

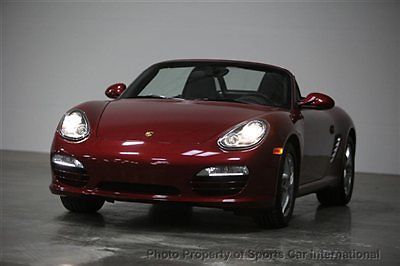

2009 porsche boxster - ^ speed manual - no nav - ruby red over black - 10,600 mi(US $34,200.00)

2009 porsche boxster - ^ speed manual - no nav - ruby red over black - 10,600 mi(US $34,200.00) 08 3k mi 18" preferred pkg plus cayman s wheels heated seats bose sound

08 3k mi 18" preferred pkg plus cayman s wheels heated seats bose sound 2002 porsche boxster 48862 mi, excellent condition, no reserve, nice options

2002 porsche boxster 48862 mi, excellent condition, no reserve, nice options 2001 porsche boxster convertible tiptronic(US $12,200.00)

2001 porsche boxster convertible tiptronic(US $12,200.00) 2000 porsche boxster automatic 2-door convertible

2000 porsche boxster automatic 2-door convertible 2003 porsche boxster(US $22,700.00)

2003 porsche boxster(US $22,700.00)

Auto Services in California

Zoll Inc ★★★★★

Zeller`s Auto Repair ★★★★★

Your Choice Car ★★★★★

Young`s Automotive ★★★★★

Xact Window Tinting ★★★★★

Whitaker Brake & Chassis Specialists ★★★★★

Auto blog

Audi will submit emissions fix for 3.0 TDI V6 to EPA and CARB

Tue, Nov 24 2015Audi will develop a software update for the emissions control system on Volkswagen Group's 3.0 TDI V6 and will submit the changes to the Environmental Protection Agency and California Air Resources Board for approval. If the government regulators accept it, the tweaks could end the emissions problems for an estimated 85,000 of these engines in the US in Audi, Porsche, and VW models. However, the stop-sale still covers these vehicles until further notice. Audi admits in its statement to failing to disclose three "auxiliary emission control devices" on the V6 to regulators, and US law considers one of these systems a defeat device. VW Group offered the engine in the US on the Audi A6, A7, A8, Q5, and Q7 since the 2009 model year. The mill was also available on the VW Touareg and Porsche Cayenne. The EPA filed a violation against the 3.0 TDI on November 2 because the agency reported that the engine's software contained a defeat device to circumvent emissions tests. The regulator recently extended that notice to cover these powerplants in the US from the 2009 to 2016 model years. Audi's statement vaguely estimates the price of this problem to be in the "mid-double-digit millions of euros," and the automaker could face financial punishment by regulators. "Determinations regarding potential penalties and other remedies will be assessed as part of the investigation EPA has opened in conjunction with the US Department of Justice," an EPA spokesperson told Automotive News. Related Video: Statement on Audi's discussions with the US environmental authorities EPA and CARB Auxiliary emission control devices (AECD) for US version of V6 TDI 3 liter engine to be revised, documented and submitted for approval Technical solution for North America versions from 2009 model year onwards to be worked out in conjunction with the authorities Audi will revise, document in detail, and resubmit for US approval certain parameters of the engine-management software used in the V6 TDI 3 liter diesel engine. That is the result of the discussions held between a delegation from AUDI AG and the US Environmental Protection Agency (EPA) and the California Air Resources Board (CARB). The updated software will be installed as soon as it is approved by the authorities. The three brands Audi, Porsche and Volkswagen are affected. Audi estimates that the related expense will be in the mid-double-digit millions of euros.

Autoblog Podcast #344

Tue, 06 Aug 2013Doug DeMuro from Plays With Cars, Infiniti Q50, Subaru BRZ STI, Porsche Macan

Episode #344 of the Autoblog podcast is here, and this week, Dan Roth and Executive Editor Chris Paukert are joined by Doug DeMuro, author of Plays With Cars and prolific internet autowriting presence. Topics include the latest spy shots of the Porsche Macan, the 2014 Infiniti Q50, and the teaser images we've recently seen of a Subaru BRZ wearing STI badges. As always, we start with what's in the garage and finish up with some of your questions. For those of you who hung with us live on our UStream channel, thanks for taking the time. You can follow along after the jump with our Q&A. Thanks for listening!

Autoblog Podcast #344:

Porsche Panamera Turbo S vs Ariel Atom Supercharged in unlikely drag battle

Thu, 01 May 2014David versus Goliath battles are always an enticing proposition, because they offer the chance to watch scrappy underdogs take on their bigger rivals. Evo has set up just such a battle with its latest drag race between the minimalist Ariel Atom 3.5 Supercharged (Ariel Atom 3 pictured below) and the plush Porsche Panamera Turbo S.

The two cars couldn't be more different. The Atom personifies Lotus founder Colin Chapman's well-known axiom: "Simplify, then add lightness." Most of the car doesn't even have a body; it's just an exposed frame with a 310 horsepower supercharged Honda four-cylinder mounted behind the driver. On the other side, there's the Panamera Turbo S. In the latest version, it packs 570 hp and 553 pound-feet from its 4.8-liter twin-turbo V8 and it features all-wheel drive. Of course, all of that comes with a significant weight penalty.

Off the line, the differences are even more apparent. The Atom doesn't have any of the Porsche's technological wizardry, so launching it challenges the driver to build the revs and let out the clutch just right. The car screams like a banshee as it goes, though. The Porsche is the exact opposite. Its launch control system lets the driver hold down the brake, get on the throttle and accelerate away in just the right way.