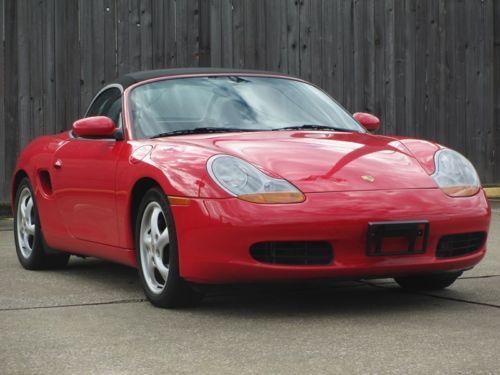

1997 Porsche Boxster Convertible 23k Org Miles Carfax 5spd Mint No Reserve!!! on 2040-cars

Body Type:Convertible

Vehicle Title:Clear

Engine:2.5L 2480CC H6 GAS DOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Dealer

Make: Porsche

Number of Cylinders: 6

Model: Boxster

Year: 1997

Trim: Base Convertible 2-Door

Options: Cassette Player, Leather Seats, Convertible

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 23,990

Power Options: Air Conditioning, Power Locks, Power Windows, Power Seats

Exterior Color: Red

Interior Color: Gray

|

UP FOR SALE IS A 1997 PORSCHE BOXSTER WITH ONLY 23K ORIGINAL MILES ON IT, 2 PREVIOUS OWNERS, AND PERHAPS ONE OF THE CLEANEST/FLAWLESS OLDER BOXSTER IN THE MARKET.

K-40 BUILT-IN RADAR DETECTOR $1350 (SEE THE PICTURE OF THE INVOICE) WAS DONE BACK IN 1997 BY THE FIRST OWNER. THERE IS NO PAINTWORK, NO ACCIDENT, CLEAN CARFAX(SEE THE FULL CARFAX REPORT) FOUR MATCHING TIRES KUMHO 255/40/17 AR AT 85% THREAD(SEE PICTURES OF EACH TIRE) PLEASE CALL 281-830-0301 FOR ANY QUESTIONS YOU MIGHT HAVE!

|

Porsche Boxster for Sale

2001 porsche boxster tiptronic auto convertible leather cd alloy roadster 01

2001 porsche boxster tiptronic auto convertible leather cd alloy roadster 01 2004 porsche boxster s special edition convertible 2-door 3.2l

2004 porsche boxster s special edition convertible 2-door 3.2l 2014 porsche boxster

2014 porsche boxster S convertible 6 speed manual only 32k miles ipod leather like 00 01 02 04 05 06(US $21,950.00)

S convertible 6 speed manual only 32k miles ipod leather like 00 01 02 04 05 06(US $21,950.00) 2003 porsche boxster 2.7l, tiptronic, champagne silver paint, navy blue int.(US $13,500.00)

2003 porsche boxster 2.7l, tiptronic, champagne silver paint, navy blue int.(US $13,500.00) 1-owner~boxster s~pdk~sport chrono~navi~xenon~20" carrera wheels~5,598 miles!!(US $54,550.00)

1-owner~boxster s~pdk~sport chrono~navi~xenon~20" carrera wheels~5,598 miles!!(US $54,550.00)

Auto blog

Leno, Seinfeld and a Porsche 356/2 featured in latest CICGC

Sun, 19 Jan 2014In the latest kaffeeklatsch known as Comedians in Cars Getting Coffee, Jerry Seinfeld pulls Jay Leno out of his garage for a trip to Jones Coffee in Pasadena, CA. The NBC funnyman we've lately seen driving two guest Porsches in his eponymous garage this time takes the passenger seat in a 1949 Porsche 356/2, one of early all-aluminum, hand-built coupes - still in 100-percent original condition - built in Gmund, Austria and nicknamed "Gmunds."

The comedy veterans have known one another for 35 years, so the episode is rich with stories of The Good Old Days. Leno says it is also the first time he's ever had a cup of coffee, and for obvious comedic reasons they start with the civet-stained beans made famous in The Bucket List. You can watch Leno take his first sip below, and have you haven't heard the joke about the goat and the anvil, scroll on down for a listen to that and one or two more jokes besides.

Porsche 911 going all-turbo this year save for GT3 and GT3 RS

Fri, Jan 23 2015The coming Porsche 911 GT3 RS will represent another high-water mark for the brand, and another milestone. Its 500-or-so horsepower and extreme aero are predicted to lop more than five seconds off the 7:20 Nurburgring lap time of the current GT3, making it "comfortably less" than 7:20. Beyond that, its naturally-aspirated 3.8-liter will form the basis of the turbocharged engines going into the standard range of 911s later this year as 2016 models. That's right – if you're looking for a sub-GT3 911 that gulps its air without compressed assistance, then you've only got a few months to get a new one into your garage. Emissions regulations are the reason, of course, with Porsche's R&D chief Wolfgang Hatz saying that, "Every new model will have lower CO2 than before," and "if you look at euro per g/km, then it's turbo." We don't know what the engine lineup will look like, however; a few months ago Car reported that the base 911 would get a smaller-displacement version of the engine, while the S would stick with 3.8-liter displacement and jump to 520 horsepower, which is the same as the current Turbo. After that, Hatz said, "at the end of the decade electrification has to be the next huge step." That means a hybrid 911 is being cooked up somewhere. Yet even as the brand leaps into the new, there's a chance it could dip a toe back into the old: the 911 GT3 RS will launch with a PDK, but Hatz's team is considering adding the option of a seven-speed manual. Elsewhere in the range, the Cayman GT4 is being engineered by Porsche Motorsport as an entry-level racer, with more power than the current Cayman GTS to go with some serious weight loss. They are also developing a track-only model for privateers. The standard Boxster and Cayman will get turbocharged flat-four engines, but there'll be a sporty Boxster that also loses weight and gets more power than the 325-hp Boxster GTS. And that mid-level supercar that's been floating in the ether for years and supposedly sent to purgatory again just last November? It's on the way by 2020 "at the latest," and will use a version of the new V8 that will eventually go into the Cayenne and Panamera. Featured Gallery 2015 Porsche 911 GT3 RS: Winter Testing Spy Shots View 13 Photos News Source: Top Gear, AutocarImage Credit: CarPix Green Porsche Emissions Convertible Coupe Hybrid Luxury Performance Supercars porsche 911 gt3 wolfgang hatz porsche supercar

Editors’ Picks July 2022 | Volvo XC60, 911 GT3 and a hot Hyundai

Tue, Aug 16 2022This latest rendition of Editors’ Picks sees us recognize some enthusiast-focused vehicles on both sides of the price spectrum and a luxury SUV. The 911 GT3 was an easy shoo-in, but the Hyundai Elantra N is what surprised us the most. WeÂ’re sad to see the Veloster N bow out after this year, but at least the N model in its place is a worthy one. In case you missed our previous Editors' Picks posts, hereÂ’s a quick refresher on whatÂ’s going on here. We rate all the new cars we drive with a 1-10 score. Cars that are exemplary in their respective segments get EditorsÂ’ Pick status. Those are the ones weÂ’d recommend to our friends, family and anybody whoÂ’s curious and asks the question. The list that youÂ’ll find below consists of every car we rated in July that earned an EditorsÂ’ Pick. 2022 Volvo XC60 2022 Volvo XC60 Recharge View 36 Photos Quick take: The Volvo XC60 is one of our favorite luxury crossovers, and the PHEV option is a killer setup. We dig the interior design, and the exterior is attractively Swedish, too. Score: 7.5 What it competes with: Alfa Romeo Stelvio, Genesis GV70, Jaguar F-Pace, BMW X3, Mercedes-Benz GLC-Class, Audi Q5, Lexus NX, Acura RDX, Volvo XC60, Lincoln Corsair, Infiniti QX50, Porsche Macan Pros: Great design, epic PHEV option, intriguing interior design options Cons: Tech can be cumbersome, big wheels lead to a stiff ride From the editors: Road Test Editor Zac Palmer — "When it comes to plug-in hybrids, there's no better compact crossover option than the XC60 Recharge. I really dig the extra-powerful electric motor and larger battery Volvo added this year. The interior wool option is my pick of the bunch, but I am a little disappointed that there aren't as many physical buttons throughout the interior as there were before." News Editor Joel Stocksdale — "Although it's got some age, the Volvo XC60 is still an excellent premium SUV. It's as handsome as ever with its clean, modern design inside and out, and feels genuinely luxurious. But what really sets the XC60 apart is its available plug-in hybrid powertrain. It's smooth and refined, and best of all, it's still great in electric mode.