Porsche 996 911 Turbo 2003 Black On Black Carbon Fiber Beautiful!!! on 2040-cars

San Diego, California, United States

Body Type:Coupe

Vehicle Title:Clear

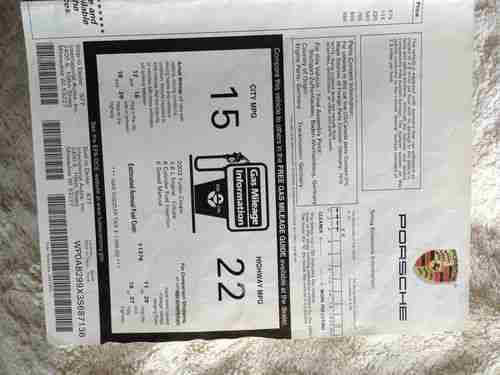

Engine:3.6L 3606CC H6 GAS DOHC Turbocharged

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Porsche

Model: 911

Trim: Turbo Coupe 2-Door

Options: Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: AWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 48,617

Sub Model: Turbo

Exterior Color: Black

Number of Doors: 2

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 8

This is my 2003 porsche 996 turbo for sale. The history was as follows:

Porsche 911 for Sale

Ruby red navigation convertible stick shift cabriolet dark manual black used dc(US $87,737.00)

Ruby red navigation convertible stick shift cabriolet dark manual black used dc(US $87,737.00) 1971 porsche 911t targa black/black

1971 porsche 911t targa black/black '04 turbo cab, black/black, 33k, original paint, nav, books & keys,(US $53,500.00)

'04 turbo cab, black/black, 33k, original paint, nav, books & keys,(US $53,500.00) 2001 porsche 911 c4 cabriolet, 59k miles(US $25,981.00)

2001 porsche 911 c4 cabriolet, 59k miles(US $25,981.00) 1990 type 964 c4 awd cabriolet 5 spd with 77k original miles ~ loaded & rare !(US $32,500.00)

1990 type 964 c4 awd cabriolet 5 spd with 77k original miles ~ loaded & rare !(US $32,500.00) 1996 porsche 911 993 carrera oil/air cooled 3.6l h6 12v manual rwd coupe

1996 porsche 911 993 carrera oil/air cooled 3.6l h6 12v manual rwd coupe

Auto Services in California

Z & H Autobody And Paint ★★★★★

Yanez RV ★★★★★

Yamaha Golf Cars Of Palm Spring ★★★★★

Wilma`s Collision Repair ★★★★★

Will`s Automotive ★★★★★

Will`s Auto Body Shop ★★★★★

Auto blog

Driving the million-mile Porsche 356

Fri, 30 Aug 2013Maybe you've seen or heard about the Porsche 356 with almost one-million miles (though it doesn't look like it), but Petrolicious finally has produced a video to show us what it's like to drive the 982,000-mile car. Guy Newmark's beautiful, dark-blue 1964 356C looks great in motion - much better than in photos - and serves to remind us not only what meticulous car care can do for old classics, but that old Porsches were built to last.

So how fastidious is Newmark about maintaining it? He takes the car to his mechanic of 40 years every 3,000 miles for an oil change and to fix anything that needs attention.

Newmark says his 356 "is everything you could want," and that he finds errands to do just to go drive it. We would, too. The next-best thing is to watch the inspiring video below of the well-traveled Porsche.

2014 Porsche 911 Turbo Cabriolet spotted testing in the nude

Tue, 16 Jul 2013The Porsche 911 wouldn't be the Porsche 911 unless there were twenty-something different models to choose from (note: we are not complaining), and the latest one was just spied by our trusty photographers out on Germany's Nürburgring. Feast your eyes on the 911 Turbo Cabriolet - the droptop version of the new Turbo wonder that debuted in May - looking all sorts of stealth in its black-on-black-on-black prototype scheme.

Mechanically, the 911 Turbo Cab should be identical to the fixed-roof version, meaning a twin-turbo 3.8-liter flat-six engine will live in the car's rump, putting out something like 520 horsepower. Of course, there's also the hotter Turbo S version of the coupe, and we expect that to get the droptop treatment, as well, with 560 horsepower on tap. The added weight of the folding top and additional structural supports will likely make for slightly slower 0-60 times for both cars, though considering the base Turbo will hit 60 miles per hour in 3.2 seconds, "slower" is a very relative term indeed. All that force will run to the ground via all-wheel drive, managed by Porsche's seven-speed PDK dual-clutch transmission.

The wide stance of the 911 Turbo Coupe carries over to the Cabriolet, no doubt fitted with the same (standard) 20-inch wheels. Inside, the usual luxury amenities will be on hand, along with nearly endless customization options.

Five cursed and haunted cars

Fri, Oct 31 2014Any kid lucky enough to grow up in Detroit is familiar with the Henry Ford Museum. It's huge, full of shiny things and a great place to take a child and let them burn off some energy. After several field trips and weekend outings however, the dusty concept vehicles and famous aircraft tend to lose their punch for youngsters. As a fifth grader, I was already gazing on the museum's many gems with glassy eyes. On yet another school trip, we made our way to John F. Kennedy's death car, a gleaming black Lincoln limo. The aging volunteer docent told our little group something I had never heard before. "You know, this car is haunted. Several employees have reported seeing a gray presence right here," he said, pointing to the back passenger side seat. I perked up. Now here was something I had never heard before. A haunted car? Sure, it happened in Goosebumps, but this was real life. It made sense, in a way. Cars can be violent, emotional places. That's certainly the case with JFK's limo, as well as the other four cars on this list. And maybe those gut-wrenching deaths can permanently doom a car. 5. Archduke Franz Ferdinand's Graf & Stift Death Limo World War I tends to be a forgotten war, despite being pretty terrible in its own right and setting the stage for the entire 20th Century. The French forces, for instance, lost more lives in the first month of WWI than the US did in the entire Civil War. Everyone who has been through a freshman world history course knows the conflict started when Archduke Franz Ferdinand and his wife were shot by a Bosnian anarchist. The crazy thing is, Ferdinand had already avoided an attempt on his life that day, and was actually on his way to the hospital to comfort those who had been injured in the crossfire. One of the would-be assassins simply walked out of a cafe and saw his intended target sitting in front of him where the open-air limo had stalled. The archduke and his wife were shot through their heads and throats. Their deaths would not be the last caused by the limo. Throughout the war and into the 1920s, the limo was owned by fifteen different people and involved in six accidents and thirteen deaths, not counting the 17 million or so killed in the war triggered by the Archduke's assassination. The first person to own the car after the Archduke was an Austrian general named Potiorek, who went insane while riding in the car through Vienna.