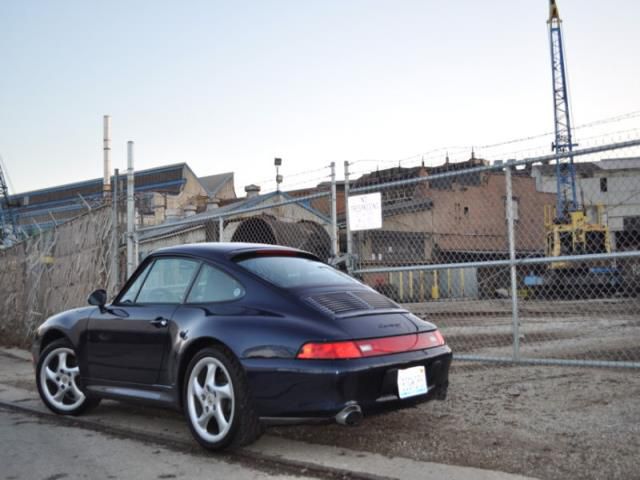

Porsche 911 Sc Coupe 2-door on 2040-cars

Kernville, California, United States

Great Condition. Porsche 911 SC Coupe 2-Door

Porsche 911 for Sale

Porsche 911 carrera 4 convertible 2-door(US $21,000.00)

Porsche 911 carrera 4 convertible 2-door(US $21,000.00) 1997 - porsche 911(US $44,000.00)

1997 - porsche 911(US $44,000.00) 1999 - porsche 911(US $16,000.00)

1999 - porsche 911(US $16,000.00) 2003 - porsche 911(US $14,000.00)

2003 - porsche 911(US $14,000.00) Porsche 911 x51(US $18,000.00)

Porsche 911 x51(US $18,000.00) Porsche 911 turbo s convertible 2-door(US $22,000.00)

Porsche 911 turbo s convertible 2-door(US $22,000.00)

Auto Services in California

Zip Auto Glass Repair ★★★★★

Z D Motorsports ★★★★★

Young Automotive ★★★★★

XACT WINDOW TINTING & 3M CLEAR BRA PAINT PROTECTION ★★★★★

Woodland Hills Honda ★★★★★

West Valley Machine Shop ★★★★★

Auto blog

2014 Porsche 911 Targa

Tue, 15 Apr 2014I've watched the electro-hydraulic roof panel open and close about 73 times in the past hour, but its fascinatingly complicated operation still has me mesmerized. I've concluded that only a German automaker - Porsche, to be more specific - would go through the trouble of engineering a roof system that essentially lifts the entire greenhouse off a vehicle, rearranges its components like a sliding-tile puzzle, and then reassembles all of them seamlessly (sans roof panel) to accurately recreate one of its most famed bodystyles.

The 2014 Porsche 911 Targa is a near-perfect modern interpretation of the automaker's 1965 911 Targa, a semi-convertible bodystyle that represents nearly 13 percent of all 911 models sold since production started 50 years ago. While the early car's roof was purely manual in operation - that's the period-correct way of saying that the driver did all of the muscle work - today's Targa is a completely automated transformation that requires only that the driver hold down a cabin-mounted switch for a mere 19 seconds to let the captivating show run its course.

After studying the Targa's elaborate roof operation at its launch at the Detroit Auto Show earlier this year, I was sufficiently intrigued. To that end, I traveled one-third of the way around the planet to southern Italy, hoping that the Mediterranean climate would reveal a bit more about the reintroduction of the automaker's iconic sports car.

Porsche Macan Turbo vs Cayman GTS in track battle

Fri, 19 Sep 2014"Well this is stupid." On the surface, that was our reaction to this video, as well. Why would you compare the hottest Porsche Cayman with a crossover of any kind, even if it is the 400-horsepower Macan Turbo?

We're guessing because it'd be bloody good fun, as evidenced Auto Express's latest track battle. To be fair, there is some interesting stuff here. The two do have a similar starting price, separated by less than $3,000 here in the US market. And, factoring in the Macan's hefty horsepower and torque advantages - 60 horsepower and 126 pound-feet - does make for a slightly interesting comparison.

We won't spoil the verdict, so check out the full video from Auto Express, and then let us know what you think in Comments.

'Latest production version' of Porsche 918 shown off on Twitter

Fri, 16 Aug 2013Porsche posted a picture of what it is calling "the latest production version" of the 2015 Porsche 918 Spyder on Twitter. It looks like the gasoline-hybrid supercar is being driven sportively on some California back roads during Monterey Speed Week.

Whatever updates were made to this version aren't visual (except for the paint), as the one Chris Harris drove last spring and another seen hot-weather testing in Nevada both had production bodies. We presume the changes are relatively minor and more than skin deep - perhaps brake calibration, suspension tuning or tweaks to the powertrain - but Porsche didn't release any more information.

The 918 Spyder is Porsche's latest supercar, which will compete with the LaFerrari and the McLaren P1 hybrid supercars. The Porsche may be the underdog of the group when considering horsepower, acceleration, top speed and price, but the 887-horsepower brute has the most advanced hybrid drivetrain of the three.