2007 Porsche 997 S Cab In Speed Yellow With Black Tiptronic Only 8800 Miles on 2040-cars

Cleveland, Ohio, United States

Vehicle Title:Clear

Fuel Type:Gasoline

Engine:6

For Sale By:Dealer

Transmission:Automatic

Make: Porsche

Model: 911

Mileage: 8,854

Disability Equipped: No

Exterior Color: Yellow

Doors: 2

Interior Color: Black

Drive Train: Rear Wheel Drive

Porsche 911 for Sale

2007 porsche 997 s cab in silver /black leather 6 speed only 19900 miles(US $54,800.00)

2007 porsche 997 s cab in silver /black leather 6 speed only 19900 miles(US $54,800.00) 2008 porsche 997 coupe guards red black leather aero kit manual 10,200 miles(US $55,500.00)

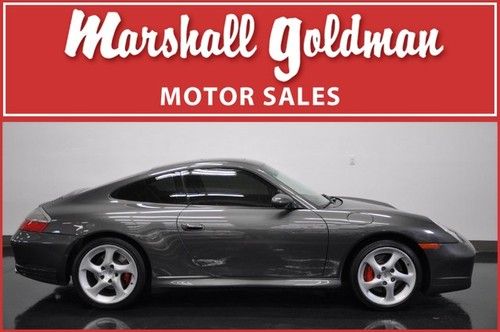

2008 porsche 997 coupe guards red black leather aero kit manual 10,200 miles(US $55,500.00) 2003 porsche c4s coupe slate grey/black only 44000 miles(US $36,500.00)

2003 porsche c4s coupe slate grey/black only 44000 miles(US $36,500.00) 2003 porsche 911 c4s coupe basalt black metallic only 27000 miles 18 wheels(US $41,500.00)

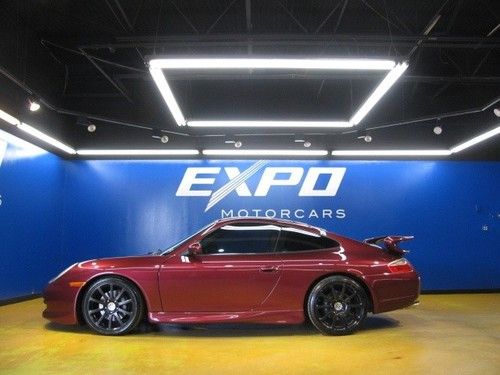

2003 porsche 911 c4s coupe basalt black metallic only 27000 miles 18 wheels(US $41,500.00) Porsche 911 carrera coupe aero kit 18 inch victor equipment wheels power seat(US $22,995.00)

Porsche 911 carrera coupe aero kit 18 inch victor equipment wheels power seat(US $22,995.00) Low miles - showroom condition - one owner - mint - 888-319-1643(US $80,900.00)

Low miles - showroom condition - one owner - mint - 888-319-1643(US $80,900.00)

Auto Services in Ohio

Williams Auto Parts Inc ★★★★★

Wagner Subaru ★★★★★

USA Tire & Auto Service Center ★★★★★

Toyota-Metro Toyota ★★★★★

Top Value Car & Truck Service ★★★★★

Tire Discounters Inc ★★★★★

Auto blog

Porsche, Jaguar continue dominance in 2015 JD Power APEAL study

Wed, Jul 22 2015The top of JD Power's 2015 APEAL Study has not changed much in the last year. Porsche remains No. 1 with Jaguar nipping at its heels, although both premium brands saw their overall score fall compared to 2014. For those that need a refresher, the APEAL Study looks at how "gratifying" a vehicle is to own and drive, rating cars and brands on a 1,000-point scale. The industry average for 2015 has increased from 794 to 798, while the total number of automakers that finished above the curve increased from 16 to 20. While Porsche and Jaguar finished at the top, their scores dropped eight and seven points, respectively, to 874 and 855. The top "non-premium" brand was Mini, which scored an impressive 825, up from 795. If the BMW-owned British marque is still a bit too premium for your tastes, last year's non-premium winner, Hyundai, did climb five points and is this year's runner up. At the opposite end of the scale, Smart sits at the very bottom of the rankings, with a score of 683 (it didn't appear on the 2014 rankings). Fiat also dropped, from fourth worst in 2014 to second worst in 2015, despite the 500 being named most appealing city car. Subaru made an impressive climb, from third worst to seventh, falling just 10 points shy of the industry average and two points south of the non-premium average. In the individual vehicle segments, eight brands earned multiple awards, with Ford, Chevrolet, and Porsche earning three apiece. Surprise segment victories included the new Ford Expedition, which beat out Chevy's popular Suburban. The Infiniti QX80 bested the likes of the Cadillac Escalade and Range Rover for best large luxury SUV, and the Dodge Challenger beat its muscle car rivals from Ford and Chevy. Most of the victories, though, were quite predictable. The Mazda6 and CX-5 took wins for the midsize sedan and compact SUV categories respectively, while the Volkswagen Golf captured the compact car win. The Ford F-150 won the large pickup category, while the Porsche Cayman was named most appealing compact premium sporty car. Check out the official release on the 2015 APEAL Study, available below, from JD Power. 2015 U.S. APEAL Study Results The latest safety-related technologies are among the drivers of customer satisfaction with new vehicles, according to the J.D. Power 2015 U.S.

Porsche's latest Driver's Selection keeps enthusiasts happy at home

Wed, 25 Sep 2013Porsche fans - and there are certainly plenty of them out there, even in here on the Autoblog editorial staff - can be pretty emphatic about their enthusiasm, insisting that the 911 is the very definition of the sportscar. And for some, merely admiring one from afar or even leaving theirs parked outside isn't enough. For just such enthusiats, Porsche Design has expanded its Driver's Selection with some tantalizing additions for the home and office.

First up is a desk chair made from the bucket seat in a 911 Carrera, which we have to admit we'd rather be sitting in right now over this blasted, rather unexciting ergonomic office chair. It's covered in black leather (the same you'd find inside an actual 911) embossed with the Porsche emblem and features electronic backrest adjustment.

There's also a wall shelf made from the carbon-fiber rear spoiler a 911 GT3 Cup racecar that can support up to 264 pounds of downforce in the form of books, trinkets and whathaveyou. And there's a limited-edition resin model of the 918 Spyder in 1:8 scale. The items haven't hit the Porsche shop just yet, so we don't have pricing information, but if they tickle your fancy, the online store has plenty more to offer.

Porsche Cayman S and Caterham 7 go head to head on the drag strip

Fri, 27 Jun 2014We recently saw the standard Porsche Cayman go up against a Subaru WRX STI in a one-mile drag race with surprising results. Apparently, Evo had a similar idea of evaluating the Cayman's quickness. However, it opted for the more powerful S model and chose a flyweight Caterham Roadsport 140 as the challenger. Will the results of this battle be as close at the end of the kilometer-long (0.62-mile) drag?

Neither of these are cars you'd usually associate with drag racing, but they are nearly evenly matched. Evo selected them based on power-to-weight ratio, with the Caterham offering a scant 140 horsepower in a lithe 1,213-pound package. The Porsche is a quite svelte 2,910 pounds but has 325 hp to haul it around.

Of course, power-to-weight ratio isn't everything. There are a ton of other variables like aerodynamics and gearing that play a huge role, as well. Can the little Caterham's weight advantage overcome the better aero and additional power of the Porsche? Scroll down watch the video and find out.