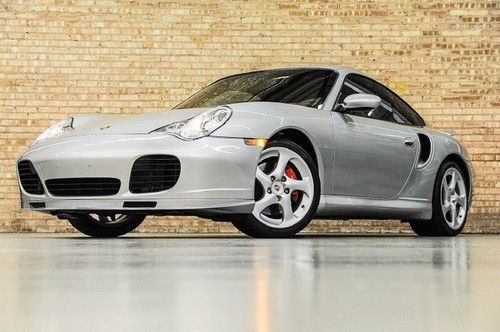

2005 Porsche 911 Turbo S Cabriolet Awd, Florida Car, Navi, 6-sp Manual, Xenon on 2040-cars

Elmhurst, Illinois, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:6

Fuel Type:Gas

For Sale By:Dealer

Make: Porsche

Model: 911

Mileage: 20,303

Sub Model: Turbo S Cabriolet AWD

Disability Equipped: No

Exterior Color: Black

Doors: 2

Interior Color: Tan

Drivetrain: All Wheel Drive

Porsche 911 for Sale

Targa top rwd air cooled engine manual transmission red low miles leather

Targa top rwd air cooled engine manual transmission red low miles leather 2002 porsche 911 carrera coupe, alcantara, sport rims, alpine, tiptronic(US $31,999.00)

2002 porsche 911 carrera coupe, alcantara, sport rims, alpine, tiptronic(US $31,999.00) 84 luxury sports car purist 90k miles 6 cylinder 3.2l manual(US $24,000.00)

84 luxury sports car purist 90k miles 6 cylinder 3.2l manual(US $24,000.00) 2008 porsche 911 turbo cabriolet! navigation! gt2 seats! tiptronic! certified!(US $81,900.00)

2008 porsche 911 turbo cabriolet! navigation! gt2 seats! tiptronic! certified!(US $81,900.00) 2002 porsche 911 turbo! rare silver/red! tiptronic! wood pkg! only 6k mi!(US $55,900.00)

2002 porsche 911 turbo! rare silver/red! tiptronic! wood pkg! only 6k mi!(US $55,900.00) 2008 porsche 911 turbo cabriolet! carbon fiber! rare two tone!(US $91,900.00)

2008 porsche 911 turbo cabriolet! carbon fiber! rare two tone!(US $91,900.00)

Auto Services in Illinois

White Eagle Auto Body Shop ★★★★★

Tremont Car Connection ★★★★★

Toyota Of Naperville ★★★★★

Today`s Technology Auto Repair ★★★★★

Suburban Tire Auto Repair Center ★★★★★

Steve`s Tire & Service Center ★★★★★

Auto blog

VW makes $23K on every Porsche sold, more than Bentley or Lamborghini

Fri, 14 Mar 2014It's a good time to be in the luxury car business. In Volkswagen Group's financial report for the 2013 fiscal year, it is revealed that that Porsche enjoyed an operating margin of 18 percent. That means the Stuttgart brand made on average about $23,200 per car sold, according to BusinessWeek. Bentley wasn't far behind, and Audi (which was combined with Lamborghini) posted a 10.1 percent margin. This compares to only around 2.9 percent for the Volkswagen brand.

"Luxury brands are on fire," said Dave Sullivan, an industry analyst at AutoPacific. He said that the average profit margin is between six and eight percent. Brands like Porsche and Bentley have the benefit of competing in rarefied markets. Buyers looking at one their vehicles have fewer models to shop against and don't care as much about price. They can also charge more for options, which further boosts income, according to BusinessWeek.

In a way, we should be more impressed by the continued success from Audi. Its models generally have direct competitors in every segment from the other premium automakers. Plus, their buyers aren't the captains of industry who are shopping for a Bentley. Still, the Four Rings is leading rivals in sales so far this year.

Porsche's former CEO Wiedeking to stand trial over VW-share manipulation

Wed, 27 Aug 2014Former Porsche CEO Wendelin Wiedeking (left in the above photo) could potentially be facing some time in the slammer after all. The last we had heard, he and former Chief Financial Officer Holger Haerter (right) had avoided a trial in April due to a lack of evidence. However, an appeals court in Stuttgart has looked at the case again and overruled the earlier decision, finding that the executives should be tried for share manipulation during Porsche's failed attempt to take over Volkswagen in 2008, Bloomberg reports.

The judges in the appeal "list numerous indications that could suggest that there was a hidden decision to increase the stake as they could suggest the opposite evaluation by the lower court," said Stefan Schueler, a spokesperson for the court, in a statement cited by Bloomberg. Wiedeking and Haerter put out their own releases saying that there was no merit to the charges.

The prosecutors allege that Wiedeking and Haerter had a plan to buy up VW stock options in 2008 to take the automotive giant over but hid it from investors. The whole thing was a massive failure and eventually allowed VW the chance to acquire Porsche and forced the two execs to step down. In addition to the criminal investigation, hedge funds have attempted to sue the company multiple times in civil court for the same reason, but they have repeatedly failed.

Porsche again staring down another $1.8B in hedge fund lawsuits

Wed, 15 May 2013The sequence of events from 2007 that began with Porsche's secret attempt to take over Volkswagen, and instead lead to Porsche being taken over by VW, continues to instigate lawsuits against the Stuttgart sports car manufacturer. A group of hedge funds that suffered over $1 billion in losses sued the car company in New York. Porsche had publicly stated it wasn't trying to buy VW, the hedge funds in question were shorting VW stock, and when Porsche's actual intentions were revealed, the stock shot up and the hedge funds took a beating.

The case was thrown out over the issue of jurisdiction, then appealed, only to see another suit filed on top of that. After that, most of the hedge funds withdrew their claims in New York and Porsche offered a 90-day window to refile in Germany where it is already fighting a number of other suits over the same issue. The hedge funds accepted the offer, refiling in Stuttgart for $1.8 billion in damages. According to Bloomberg, Porsche hasn't commented on the refiling, but as the same plaintiffs are involved, it's safe to assume that the carmaker still feels the case is "unsubstantiated and without merit." It has fared alright so far even in German courts, with two lesser cases against it thrown out last year.