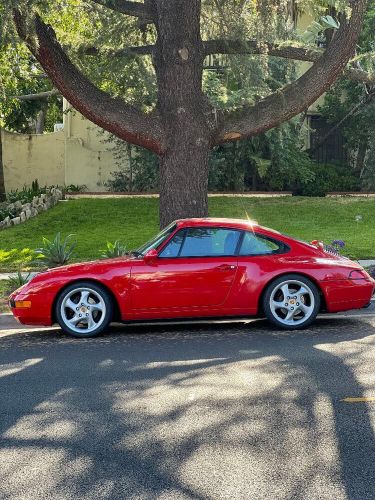

1995 Porsche 911 Carrera 993 (manual) on 2040-cars

Burbank, California, United States

Transmission:Manual

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

VIN (Vehicle Identification Number): wp0aa2996ss320428

Mileage: 123800

Model: 911

Interior Color: Black

Trim: Carrera 993 (manual)

Number of Cylinders: 6

Make: Porsche

Drive Type: RWD

Service History Available: Yes

Drive Side: Left-Hand Drive

Engine Size: 3.6 L

Exterior Color: Red

Features: Air Conditioning, Alloy Wheels, AM/FM Stereo, CD Player, Leather Seats, Power Windows

Porsche 911 for Sale

2014 porsche 911 carrera(US $51,300.00)

2014 porsche 911 carrera(US $51,300.00) 2024 porsche 911 gt3 rs(US $469,000.00)

2024 porsche 911 gt3 rs(US $469,000.00) 2007 porsche 911 turbo(US $78,500.00)

2007 porsche 911 turbo(US $78,500.00) 2021 porsche 911(US $189,500.00)

2021 porsche 911(US $189,500.00) 2024 porsche 911 targa 4 gts(US $249,888.00)

2024 porsche 911 targa 4 gts(US $249,888.00) 2008 porsche 911 997.1 turbo(US $127,500.00)

2008 porsche 911 997.1 turbo(US $127,500.00)

Auto Services in California

Zube`s Import Auto Sales ★★★★★

Yosemite Machine ★★★★★

Woodland Smog ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Service ★★★★★

Western Brake & Tire ★★★★★

Auto blog

The List: Best of Scenic Drives

Sat, Aug 15 2015The List hosts Jessi Combs and Patrick McIntyre have gone on some incredible scenic drives throughout the series, including a drive through the Italian Alps, a cruise on the Pacific Coast Highway, and winding their way across the Tail of the Dragon. Here's a look back at some of our favorite moments of scenic driving. If you like what you see, stay tuned to watch the full episodes, or click here to go directly to our episode archive and pick out some of your own favorite moments of The List to revisit. The List #0100: Drive the Italian Alps The List #0567: Drive The PCH The List #0011: Drive the Tail of the Dragon Have an RSS feed? Click here to add The List. Click here to subscribe to The List in iTunes. Click here to learn more about our hosts, Jessi and Patrick. Bentley Maserati Porsche Driving Convertible The List Videos Original Video

Porsche reveals new 911 Turbo Cabriolets, starting from $160,700*

Mon, 23 Sep 2013Porsche has come a long way from the days when its entire model line revolved essentially around the 911, but its prototypical rear-engined sports car is still what it's known for best, and still keeps the German automaker pretty busy. With a seemingly endless array of variations on the theme, the 911s just keep on coming until a new generation arrives and then it starts all over again. And what we have here is the new king of the hill (for now, anyway).

Set to debut at the Los Angeles Auto Show a little less than two months from now are the new Porsche 911 Turbo Cabriolets. And no, that's not a typo: that's cabriolets, plural, because what you're looking at are two new models. First up is the 911 Turbo Cabriolet, whose 3.8-liter twin-turbo flat-six develops 520 horsepower, driving the droptop to 60 miles per hour in 3.3 seconds. That's Porsche's claim, and we have a feeling it's a bit conservative. But if that's still not enough, the 911 Turbo S Cabriolet adds an extra 40 hp for a total of 560 to drop the benchmark acceleration run down to 3.1 seconds.

That makes the new topless Turbos 30 horses stronger and 0.2 seconds quicker than the respective models they replace, but the weight penalty involved with replacing a fixed roof with a folding one (and the necessary structural reinforcement) does make the new 911 Turbo Cabs a smidgen more lethargic than their contemporary coupe counterparts, which run the gauntlet in 3.2 and 2.9 seconds in standard Turbo and upgraded Turbo S specs, respectively. They only lose a single tick on the top speed, though, which clocks in at a follicle-tickling 195 mph in either spec. Otherwise the specifications are as identical as you might expect.

2015 Porsche Cayenne S E-Hybrid

Mon, 03 Nov 2014Think of the electric motor in the facelifted 2015 Porsche Cayenne S E-Hybrid as the cream filling in an Oreo cookie. Under the hood of this plug-in hybrid crossover is a 333-horsepower, supercharged 3.0-liter V6 with a 95-hp synchronous electric motor sandwiched between it and an eight-speed Tiptronic automatic transmission. The clutched powertrain allows pure combustion, pure electric or a combination of both to drive all four wheels through Porsche's permanent all-wheel-drive system.

Differentiating itself from the Panamera S E-Hybrid sedan, which shares the same basic powertrain and stores energy in a 9.4-kWh battery, the Cayenne crossover is fit with a more robust 10.8-kWh lithium-ion battery that delivers an estimated pure-electric driving range of up to 22 miles at speeds of up to 78 miles per hour.

To be one of the very first US media members to sample Porsche's latest fuel-efficient crossover, the automaker flew us to Frankfurt, Germany, to test the five-passenger Cayenne S E-Hybrid on its home turf.