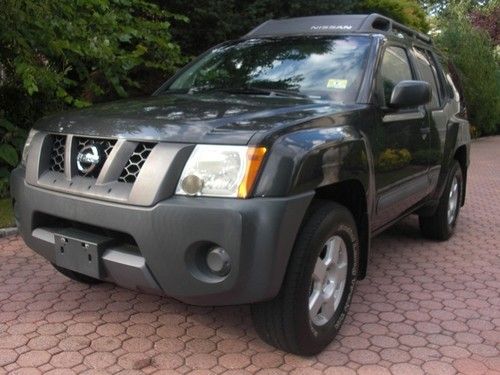

2002 Nissan Xterra Se No Reserve on 2040-cars

Troutman, North Carolina, United States

Body Type:SUV

Engine:V6 3.3L

Vehicle Title:Clear

For Sale By:Dealer

Make: Nissan

Model: Xterra

Warranty: No

Mileage: 181,098

Sub Model: SE

Doors: 4

Exterior Color: Green

Fuel: Gasoline

Interior Color: Black

Drivetrain: RWD

Nissan Xterra for Sale

2008 nissan s(US $10,995.00)

2008 nissan s(US $10,995.00) 2001 nissan xe(US $5,995.00)

2001 nissan xe(US $5,995.00) 2005 nissan xterra off-road sport utilily 4x4 clean carfax fully loaded luxury(US $8,390.00)

2005 nissan xterra off-road sport utilily 4x4 clean carfax fully loaded luxury(US $8,390.00) 5 speed manual - low mileage - this x- terra is like new all around!!(US $9,500.00)

5 speed manual - low mileage - this x- terra is like new all around!!(US $9,500.00) 2004 xe used 3.3l v6 12v automatic rwd suv(US $8,491.00)

2004 xe used 3.3l v6 12v automatic rwd suv(US $8,491.00) 2000 nissan xterra xe sport utility 4-door 3.3l(US $2,700.00)

2000 nissan xterra xe sport utility 4-door 3.3l(US $2,700.00)

Auto Services in North Carolina

Willmon Auto Sales ★★★★★

Westend Auto Service ★★★★★

West Ridge Auto Sales Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Automotive ★★★★★

Triangle Window Tinting ★★★★★

Auto blog

Renault keeps 15% stake in Nissan, transfers majority of shares to French trust

Wed, Nov 8 2023Renault and Nissan completed a landmark deal to rebalance their 24-year-long alliance, paving the way for a new relationship after years of acrimony between the two partners. The automakers on Wednesday announced the creation of a French trust to which Renault transferred 28.4% of Nissan shares. The companies first disclosed plans for the trust in January. Renault Group and Nissan now have a cross-shareholding of 15% with lock-up and standstill obligations, the companies and junior alliance partner Mitsubishi Motors Corp. said in a statement. Renault managers in recent weeks have reiterated that staff should no longer share information with their Nissan counterparts, according to people familiar with the situation, after the French carmaker announced in September that aspects of the alliance would be unwound by year-end. Taken together with the deal to equalize their cross-shareholdings at 15%, the developments are the clearest indications yet that members of one of the world’s biggest automotive tie-ups are increasingly going their separate ways. Renault told employees in September it was moving away from common structures with Nissan in favor of a new, project-by-project approach to working together. The dissolution of the companiesÂ’ joint purchasing organization means the two will no longer pool information on a regular basis due to antitrust concerns. The sell-down of shares held by the trustee will be coordinated with Nissan, which will have the right of first offer to purchase the stock. The trust will have no obligation to sell the shares within a specific or pre-determined period of time. The new alliance deal presented to investors in London in February followed months of tense negotiations that nearly collapsed late last year due to sticking points on intellectual property and disagreement over the valuation of RenaultÂ’s electric-vehicle and software arm Ampere, in which Nissan has agreed to invest. The alliance dates back to 1999, when Renault rescued Nissan with a cash injection and the two formed one of the biggest auto partnerships in the industry. Rivalries and mutual suspicion mounted over the years and came to a head when former leader Carlos Ghosn openly contemplated merging the two companies, contributing to his downfall.

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.

Nissan, Mitsubishi confirm plans to invest in Renault EV unit Ampere

Wed, Dec 6 2023PARIS — Renault's longstanding alliance partners Nissan and Mitsubishi confirmed plans to invest in the French car maker's electric vehicle unit Ampere and use it to develop EVs for the European market, the companies said on Wednesday. After years of contentious partnership, the announcement on Wednesday confirms that the new alliance between the three automakers is smaller and more pragmatic, focusing on regional cooperation. Nissan and Mitsubishi confirmed they would invest respectively up to 600 million euros ($647.46 million) and 200 million euros in Ampere, which has been carved out from the rest of Renault and is due for a public listing next year. Nissan will become "a strategic investor" in Ampere, Makoto Uchida, CEO of the Japanese car marker told reporters, adding the company may use the EV unit's software and connectivity innovations in other markets outside Europe. "Developing electric vehicles all over the world alone would be very challenging," he said. Ampere will develop and manufacture an electric version of the compact Nissan Micra for the European market and a medium-sized electric SUV for Mitsubishi. Renault CEO Luca de Meo said Ampere will cut the costs for the Micra for Nissan by 50%. The alliance partners also confirmed their joint projects in Latin America and India. In September, Renault, Nissan and Mitsubishi ended their common purchasing agreement, which they said would allow them to focus on individual projects and adapt more quickly to regional differences in automotive markets. At the end of July, Renault and Nissan finalised the terms of a restructured alliance after months of negotiations. Talks dragged on for months longer than expected due in part to Nissan, which was concerned about protecting its intellectual property in future collaborations. Related video: Earnings/Financials Green Mitsubishi Nissan Renault Electric