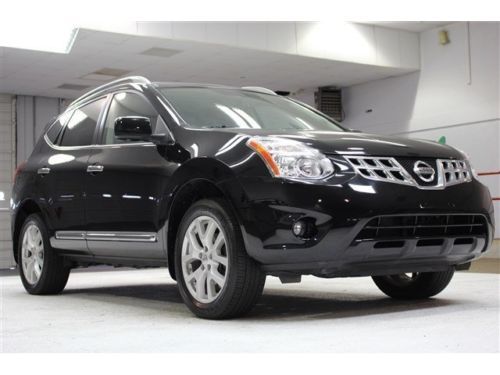

We Finance 11 Sv Awd Cd Audio Xm Bluetooth Fog Lamps Alloy Wheels Ipod Interface on 2040-cars

Cleveland, Ohio, United States

Body Type:SUV

Vehicle Title:Clear

Engine:4

Fuel Type:Gas

For Sale By:Dealer

Year: 2011

Make: Nissan

Model: Rogue

Mileage: 34,131

Sub Model: SV AWD w/1 OWNER/CLEAN CARFAX

Disability Equipped: No

Exterior Color: Gray

Doors: 4

Interior Color: Gray

Drivetrain: All Wheel Drive

Nissan Rogue for Sale

Suv 2.5l navigation cd all-wheel drive rear spoiler a/c(US $17,989.00)

Suv 2.5l navigation cd all-wheel drive rear spoiler a/c(US $17,989.00) S awd suv automatic cold a/c back up camera(US $8,988.00)

S awd suv automatic cold a/c back up camera(US $8,988.00) 2012 nissan rogue sl sport utility 4-door 2.5l flood salvage(US $11,500.00)

2012 nissan rogue sl sport utility 4-door 2.5l flood salvage(US $11,500.00) 2012 nissan rogue fwd 4dr sv(US $18,988.00)

2012 nissan rogue fwd 4dr sv(US $18,988.00) 2013 nissan rogue awd(US $21,994.00)

2013 nissan rogue awd(US $21,994.00) 2012 nissan rogue 2.5 sl navi cameras bluetooth all power --- free shipping(US $15,450.00)

2012 nissan rogue 2.5 sl navi cameras bluetooth all power --- free shipping(US $15,450.00)

Auto Services in Ohio

Zig`s Auto Service ★★★★★

Zeppetella Auto Service ★★★★★

Willis Automobile Service ★★★★★

Voss Collision Centre ★★★★★

Updated Automotive ★★★★★

Tri C Motors ★★★★★

Auto blog

Nissan, Renault reveal how they'll reshape alliance to cut costs, regain profit

Wed, May 27 2020TOKYO — The auto alliance of Nissan and Renault said Wednesday it will be sharing more vehicle parts, technology and models to save costs as the industry struggles to survive the coronavirus pandemic. Alliance Operating Board Chairman Jean-Dominique Senard said the group, which also includes smaller Japanese automaker Mitsubishi, will have each company focusing on geographic regions. “There is no plan for a merger of our companies,” the chairman said. “Our model today is a very distinctive model ... we donÂ’t need a merger to be efficient.” He stressed the alliance needs to adjust to the “unprecedented economic crisis,” to pursue efficiency and competitiveness, not sheer sales volumes. “Now is the time to rebuild,” Senard said, making clear he believed the alliance remained strong. All automakers are suffering from the pandemic, and scaling back or suspending production, but Nissan was reeling before the crisis struck from a scandal involving its former chairman, Carlos Ghosn. Yokohama-based Nissan is due to report its annual results on Thursday and has forecast it will slip into its first yearly loss in 11 years. Under the latest so-called leader-follower initiative, Nissan will focus on China, North America and Japan; Renault on Europe, Russia and South America and North Africa, and Mitsubishi on Southeast Asia and Oceania, for the benefit of the entire alliance. Nissan Chief Executive Makoto Uchida said the alliance planned to pursue fiscal strength together. “The synergy is huge,” he said. The number of vehicles sharing the same platform will double by 2024, saving 2 billion euros ($2.2 billion), according to Senard. The shared technology will also include electric cars and autonomous driving, platforms and car bodies, the executives said. Nissan is a leader in electric cars with its Leaf, but such technology will be available to the other alliance members, they said. The companies gave few details of how the revamp would deliver in the short term, as the car industry grapples with the fallout from the coronavirus pandemic and pressure to develop less polluting vehicles. They said in a joint statement that they aimed to produce nearly half of their vehicles under the new leader-follower approach by 2025 and hoped to cut investment per model in the scheme by up to 40%. The range of vehicles they produce is expected to fall by 20% by 2025 though the firms did not say how many jobs would go as they shift production.

2015 Nissan Murano and Juke priced, Color Studio to breed bad ideas

Thu, Nov 20 2014Nissan has released basic pricing information on its upcoming Murano, as well as detailed pricing on the refreshed Juke crossover at the 2014 LA Auto Show. The Japanese company also announced a new "color studio" for the Juke, which just reeks of bad ideas. First, let's talk money. The flashy, redesigned Murano crossover will kick off at $29,650, not including an $885 destination charge. While the new CUV will begin arriving in dealers on December 5, Nissan opted out of providing more detailed pricing data, including information about trim levels and other optional extras. It did no such thing with the Juke, though. The freshened 2015 model starts at $20,250 for a base Juke S, and climbs from there. The SV trim adds $1,050 to the price while the SL starts at $25,240. All-wheel drive adds $1,850 to the S and SV models and $1,700 to SL. If you're the sporting sort, the Juke Nismo starts at $24,830 while the Nismo RS rings up at $28,020. Adding an Xtronic continuously variable transmission and all-wheel-drive to the Nismo models increases the price by $2,400 and $2,000, respectively. And now, the Nissan Color Studio. We'll admit, there are some among the Autoblog staff that question this new feature, which gives customers an extreme degree of control when it comes to the styling of their Juke. For a price, Nissan will allow customers to choose individual colors for ten different parts of the Juke, including the rear spoiler, mirror caps, headlight surrounds, door sills and the wheels. While a fashionable mind might be able to create something rather cool, the potential for abuse here is extremely high. Check out the inset image to see what we mean. Scroll down for Nissan's announcement on Juke and Murano pricing, as well as details on the color studio.

Nissan 370Z Nismo freshening coming tomorrow

Thu, 15 May 2014Nissan is set to bring a special to the Fairlady faithful at the annual ZDAYZ fest. Based on the sole teaser and the event it's being unveiled at, it's pretty clear that Nissan is going to be issuing some kind of update to the Nismo version of its 370Z.

What that update is, though, is unclear. We can see a few small visual tweaks, like the horizontal LED running lights and their associated vertical vent. The grille looks reformed as well. Beyond that, though, it looks like we're stuck waiting for the full details until tomorrow afternoon. Until then, take a look below for the world's shortest press release.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.279 s, 7900 u