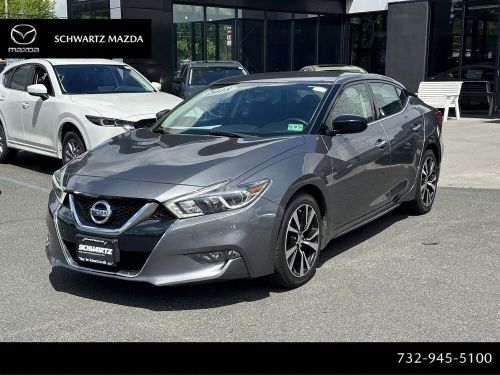

Engine:3.5 L

Fuel Type:Gasoline

Body Type:4dr Car

Transmission:Variable

For Sale By:Dealer

VIN (Vehicle Identification Number): 1N4AA6AP6JC383044

Mileage: 95497

Make: Nissan

Trim: S

Features: --

Power Options: --

Exterior Color: --

Interior Color: --

Warranty: Unspecified

Model: Maxima

Nissan Maxima for Sale

2023 nissan maxima platinum(US $35,700.00)

2023 nissan maxima platinum(US $35,700.00) 2018 nissan maxima(US $5,900.00)

2018 nissan maxima(US $5,900.00) 2004 nissan maxima se(US $3,799.00)

2004 nissan maxima se(US $3,799.00) 2021 nissan maxima platinum xtronic cvt(US $20,571.60)

2021 nissan maxima platinum xtronic cvt(US $20,571.60) 2014 nissan maxima s(US $10,500.00)

2014 nissan maxima s(US $10,500.00) 2011 nissan maxima s(US $1,300.00)

2011 nissan maxima s(US $1,300.00)

Auto blog

Nissan gets new NA boss, lowered forecasts in management shakeup

Sat, 02 Nov 2013José Muñoz, a Nissan and Infiniti sales and marketing vice president, will replace Colin Dodge as Nissan's new North America chief, come Jan. 1, as part of a wide-ranging management shuffle, Automotive News reports. Dodge will remain on Nissan's board, be assigned to special projects and report directly to CEO Carlos Ghosn.

Nissan is working on reorganizing its global operations into six regions, each with a new chief: North America (Muñoz' territory), Latin America, Japan-Southeast Asia, China, Europe and Africa-India-Middle East. Currently Nissan divides the globe into three regions, the Americas, Europe-Africa-India-Middle East and Asia-Pacific.

Nissan also lowered its sales forecast from 5.3-million vehicles to 5.2 million for the fiscal year ending on March 31, 2014. Last year, the company sold 4.914 million in the same period. In May, after Nissan's market share had fallen to 7.7 percent, Ghosn said he wants to double sales in the US by 2017 and increase its market share in the country to 10 percent.

Renault-Nissan has sold more EVs than its next two competitors combined

Fri, Sep 4 2015Nissan may not be doing so hot with sales of its Leaf electric vehicle in the US this year, but the Japanese automaker and its France-based partner Renault still remain the gold standard of electric-vehicle sellers. Thanks to numbers crunched by the good people over at EV Sales, we learn that the Renault-Nissan Alliance has moved more than 265,000 electric vehicles around the world. That accounts for more than a quarter of all the EVs sold worldwide and is more than Mitsubishi's 11 percent share and General Motors' 10 percent share combined. Nissan and Renault surpassed the quarter-million electric-vehicle mark in June. There are shifts afoot, though. Renault-Nissan's global EV market share is only 18 percent this year, and the Alliance is losing share to companies like Volkswagen, BYD, and, to a lesser extent, BMW. That shift can be seen in this year's US sales numbers, where the Nissan Leaf has pretty much plunged down. In fact, with VW and BMW broadening their inventory of plug-in models, Germany can claim the third-place spot in the list of countries with the most "electric" automakers, after China and Japan. The US is trailing, even if many people associate electric cars with California's Tesla. On that note, both Ford and General Motors have lost electric-vehicle market share this year, while Mitsubishi has essentially tread water. GM's numbers (and Nissan's, for that matter) need some context because Americans have been holding off on purchasing a first-gen Chevrolet Volt extended-range plug-in while the automaker readies a new and improved version. All told, Japanese companies have produced the most plug-in vehicles, accounting for 39 percent of the world's market so far, while the US is responsible for about one in four electric vehicles ever made. Sales '15 % Total Sales % Renault-Nissan 44,003 18 265,205 27 VW (VAG) 28,480 12 42,743 4 BYD 25,592 11 51,338 5 Tesla 24,867 10 83,587 9 Mitsubishi 24.117 10 108,883 11 BMW 15,469 6 31,822 3 Ford 11,548 5 65,696 7 GM 11,617 4 100,818 10 Featured Gallery 2015 Nissan Leaf View 12 Photos News Source: EV Sales Green Nissan Renault Electric ev sales renault-nissan

Ghosn says French ambassador told him: 'Nissan is turning against you'

Wed, Jan 15 2020BEIRUT ó Former Nissan chairman¬†Carlos Ghosn said on Tuesday that the French ambassador had warned him shortly after his arrest that his own company was plotting against him. "Frankly, I was shocked by the arrest, and the first thing I asked is make sure Nissan knows so they can send me a lawyer," Ghosn told Reuters in an interview in Beirut. "And the second day, 24 hours from this, I received a visit from the French ambassador who told me: 'Nissan is turning against you'. And this is where I realized that the whole thing was a plot." Former Nissan CEO Hiroto Saikawa, who was forced to resign last year after admitting that he had received improper compensation, told a news conference shortly after Ghosn's arrest that Ghosn had been using corporate money for personal purposes and under-reporting his income for years. The arrest of Ghosn, widely respected for rescuing the¬†carmaker from near-bankruptcy, has put Japan's criminal justice system under international scrutiny. Among the practices now under the spotlight are keeping suspects in detention for long periods and excluding defense lawyers from interrogations, which can last eight hours a day. "When he told me that 'two hours or three hours later, after your arrest, Saikawa went in a press conference and made his infamous statement where he said, you know, 'I am horrified, but what I'm learning...'' ¬ó so when he told me he made these statements, I said 'Oh my God this is a plot'." ¬† Related: Yamaha warns not to climb into instrument cases after Ghosn arrest ¬† Ghosn, 65, fled Japan last month while awaiting trial on charges of under-reporting earnings, breach of trust and misappropriation of company funds, all of which he denies. The one-time titan of the¬†car¬†industry said the alternative to fleeing would have been to spend the rest of his life languishing in Japan without a fair trial. Ghosn said he had escaped to his childhood home of Lebanon in order to clear his name. He noted that there were conflicting stories about his astonishing escape, but declined to say how he had managed to flee. Tokyo prosecutors said his allegations of a conspiracy were false and that he had failed to justify his acts. The 14-month saga has shaken the global auto industry and jeopardized the Renault-Nissan alliance, of which Ghosn was the mastermind. Japan's Ministry of Justice has said it will try to find a way to bring Ghosn back from Lebanon, even the countries have no extradition treaty.